The future of finance: A survey of European and South African CFOs

Executive summary

Chief financial officers (CFOs) have been central to every organization’s response to the COVID-19 pandemic and the ongoing reset that has followed. A recent survey of 450 CFOs in Europe and South Africa shows that CFOs themselves and their function have taken on new responsibilities and are spending more time working. That said, some of the changes that were most intense in the first six months after COVID-19 began affecting business operations have since shifted in intensity or focus. Most CFOs think the finance function has been situationally agile and that engagement, productivity, and quality of work have held steady or increased. Looking ahead, the data shows that leadership capabilities such as agility, communication, and adaptability will be central to success, as will digital skills. Some of these capabilities are already common; others are areas where CFOs will benefit from building their own and their teams’ abilities.

The CFOs who responded to the survey come from a broad range of industries, company sizes, and types of ownership. (See chart, “Survey respondents,” on page 4 of the full report.)

Responding to the pandemic

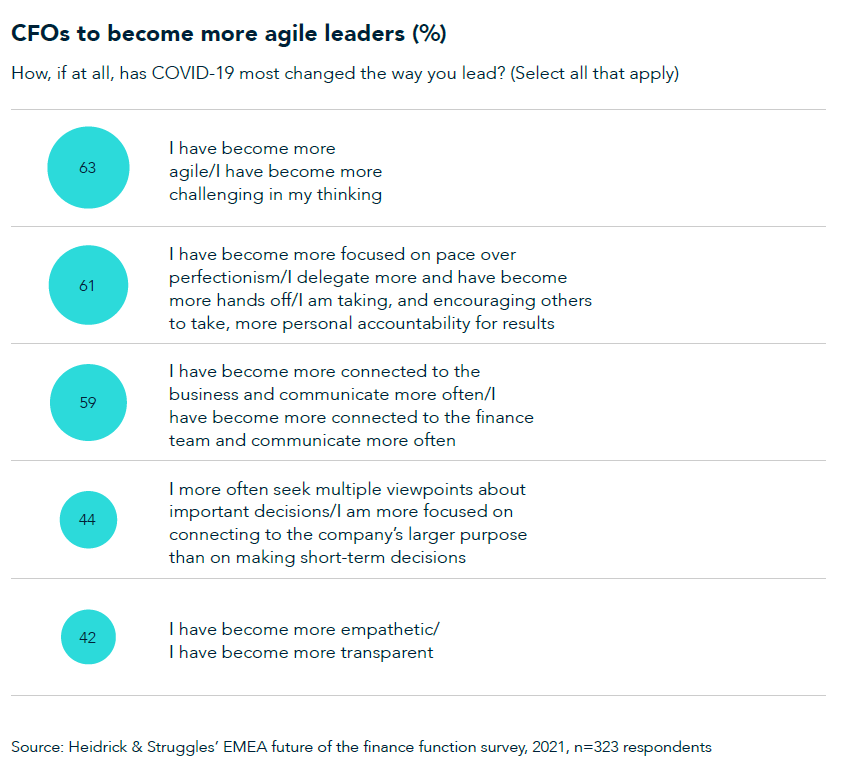

When asked how their approach to leadership had changed since the onset of COVID-19, we saw CFOs’ responses fall into five groups, shown in the chart below. Some CFOs are more agile and challenging in their thinking, some are more delegating; some have more communication and connection to the business while others have more focus on the company’s larger purpose.

New responsibilities

More than half of CFOs surveyed had taken on a new responsibility or significantly increased the importance or focus of an existing responsibility, which could account for the increase in time CFOs reported having to work during the pandemic. (See chart, “CFOs report adding new responsibilities or focus areas,” on page 6 of the full report.)

Finance leaders have an average of 10 functions reporting directly to them—as they did before the pandemic as well. However, 74% had a function reporting to them before COVID-19 that no longer does; 23% have a function reporting to them now that didn’t before.

More than half of respondents formally took on a new responsibility or significantly increased the importance or focus of an existing one. Of those who took on a new responsibility, nearly three-quarters added cost-cutting analysis, and more than half added new reporting requirements. When looking specifically at cost-cutting analysis, 89% of CFOs said that either themselves, the finance function as a whole, or both spent more time on this area in the first six months since the onset of COVID-19; 70% say they are still continuing to spend more time on this area now.

Business services finance leaders most often added a new responsibility or area of focus, and technology leaders did so the least often. (See chart, “New responsibilities or focus areas added, by industry,” on page 7 of the full report.)

More time working, but shifts in who and when

Eighty-three percent of CFOs said that they personally spent more time working in the first six months after COVID-19 began affecting business operations; that number dropped only slightly, to 79% currently. But CFOs see the opposite trend for the function as a whole: 59% said the function spent more time working in the first six months, while 64% say the function is working more now. This likely indicates that CFOs took personal leadership responsibility to figure out how the function could best support their organizations’ needs early on, and that the function as a whole is now engaging in those new ways of working. (See chart, “Changes to the amount of time working,” on page 8 of the full report.)

Employee engagement and finance function agility

In the first six months after the onset of COVID-19, keeping employees engaged, ensuring employee safety, and ensuring productivity and quality were maintained were CFOs’ top three challenges when it came to managing people. Currently, while keeping employees engaged still tops the list, developing strategies for a return to the office and acquiring new talent to support initiatives have substantially increased in importance. (See chart, “Challenges managing people: First six months of COVID-19 vs. now,” on page 9 of the full report.)

Both productivity and quality of work have remained relatively consistent in the first six months after COVID-19 compared to now; however, there was an increase in the proportion of respondents who said quality is higher now. (See chart “Changes in quality and productivity, first six months of COVID-19 vs. now” on page 10 of the full report.)

About half of CFOs believe employee engagement has remained unchanged; just under one-third say engagement is higher. (See chart “Employee engagement and finance function agility” on page 10 of the full report.)

A strong majority of finance leaders, 81%, think the finance function has been agile in response to the changes created by COVID-19, with 44% saying the function has been very agile. To make all that happen, CFOs most often focused on communication—both one-on-one and in groups, and across all kinds of formats. (See chart, “What CFOs did to maintain culture and morale,” on page 11 of the full report.)

Restructuring

Just under one-third of respondents said they restructured the finance function after the pandemic began affecting business operations. Of those who did, more than three-quarters said it was to improve overall efficiency and output; just under half said it was to cut costs; and 41% said it was to take advantage of business model changes and new business opportunities.

Just over a third of CFOs said that they added new talent to the finance team, with full-time employees being the most common. About a quarter said they reduced the size of the finance team; of those, a majority did so by reducing the number of full-time employees. Forty-two percent said they currently don’t have plans to rehire. (See charts, “Additions to the finance function” and “Reductions to the finance function,” on pages 12 and 13 of the full report.)

Succeeding in finance in today’s environment

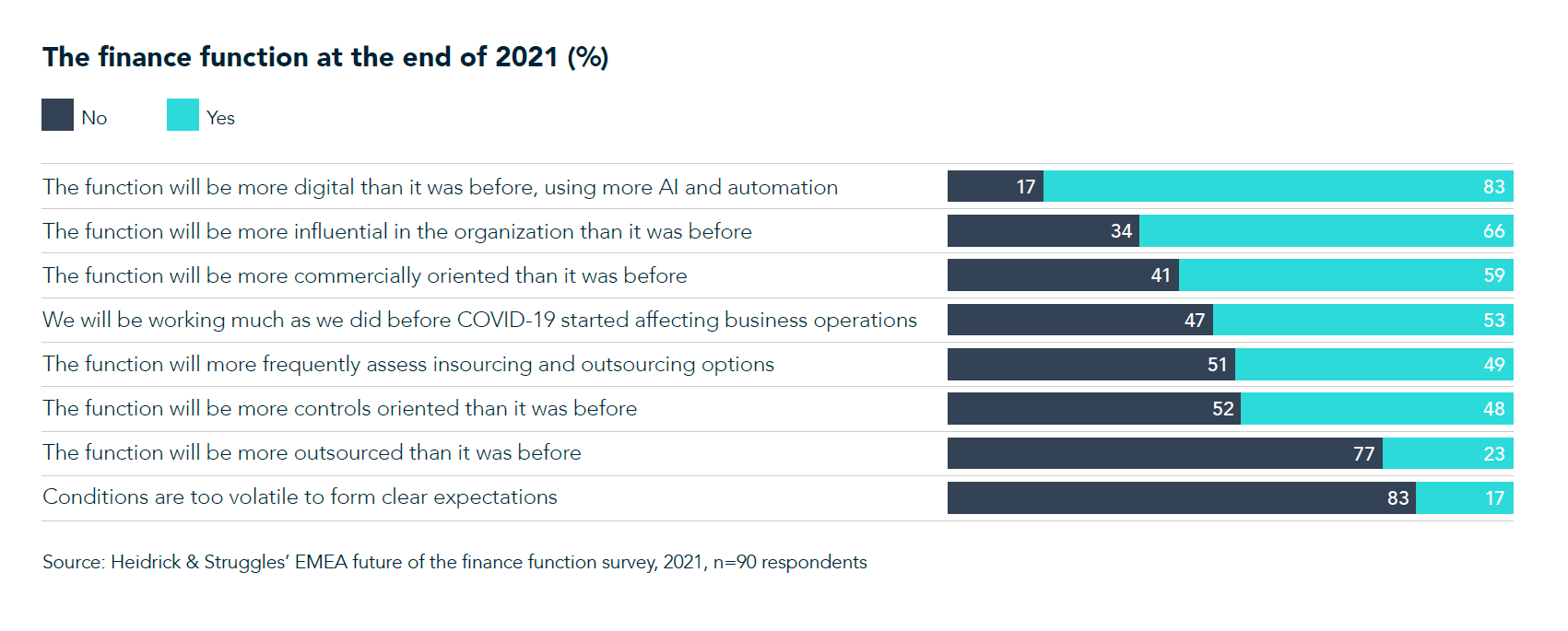

Looking at which of these changes CFOs expect to stick and how they expect the function will work in the future, a strong majority, 83%, believe the finance function will be more digital than it was before; two-thirds believe the function will be more influential to the organization than it was previously.

Succeeding in that environment, this and other Heidrick & Struggles work suggests, will require many CFOs and finance leaders to develop additional capabilities.

In terms of digital capabilities specifically, Heidrick & Struggles analysis shows that CFOs fall toward the low end in almost every one of the characteristics that we have identified as being important to digital dexterity. The finance role is traditionally operational, so it is little surprise that today’s leaders are strong problem solvers, influencers, and prioritizers. But digitally dexterous leaders are better equipped to manage the pace, pressure, and amount of new learning and innovation that successful digital transformations bring. Finance leaders may therefore look to become more curious and open-minded, experimental, and able to communicate and collaborate across boundaries.

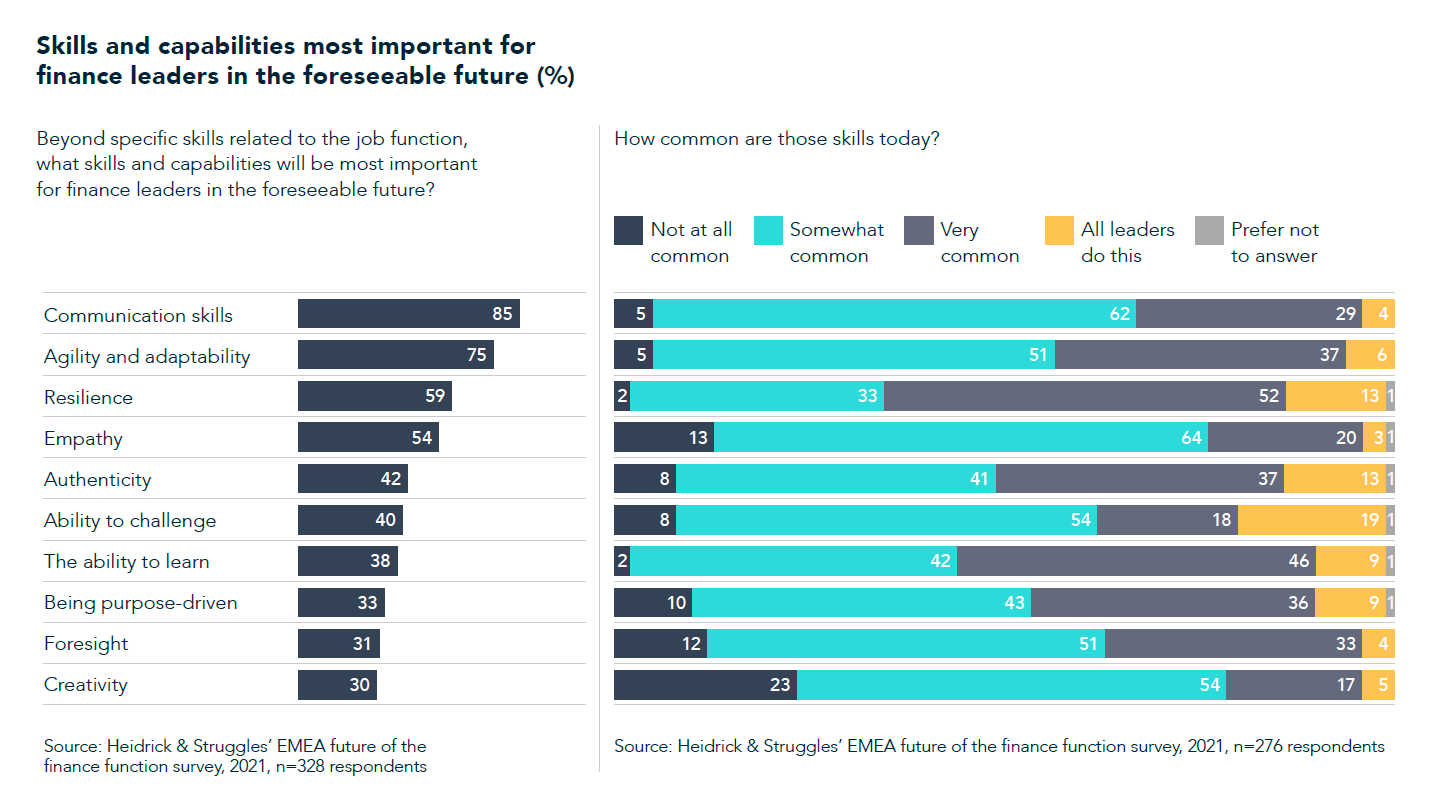

Communication has been an integral part of maintaining culture and morale in the finance function and, unsurprisingly, communication skills and agility and adaptability were the top two skills CFOs identified as being important for finance leaders for the foreseeable future. Among the important skills, some are more common than others today; empathy, creativity, and foresight were seen as the least common in the finance function today.

The point on foresight is particularly notable because other Heidrick & Struggles work has shown that agility requires four skills: adaptability, resilience, learning, and foresight. And though CFOs are clear that the first three are common among leaders today, it appears that most would benefit from a focus on developing foresight. Other analysis we have done shows that leadership styles among finance leaders have shifted to include more empathy over the past several years, which will likely benefit the function going forward. (For more on why each agility trait matters and how CFOs are increasing their own and their organizations’, agility, see “CFO agility in the spotlight: Balancing current risk and future viability.”)

Looking ahead

It is clear that the role of a CFO, as it pertains to an organization’s success, has never been more critical. The breadth of enterprise-wide thinking and leadership that now fall directly within a CFO’s remit are more extensive than we have ever seen. In short, this is a great time to be a CFO, for those prepared to build and maintain an ever-growing commercial, strategic, operational, and agile approach to developing your leadership skills for the benefit of your organization.

About the author

Susie Clements (sclements@heidrick.com) is a partner in Heidrick & Struggles’ London office and regional managing partner of the Corporate Officers Practice in Europe and Africa.