Crypto & Digital Assets

From Financial Services to Blockchain and Crypto: How Executives Are Making the Switch

The idea of cryptography and digital money has been around since the 1970s, but it wasn’t until the publication of the Bitcoin whitepaper “Bitcoin: A peer-to-peer electronic cash system” in 2008 that digital assets started to gain traction.1 The first known purchase made with bitcoin was in 2010, and competitors began to emerge shortly thereafter. In the past months, the crypto market cap has hovered around $2 trillion and is expected to continue growing in the long term.2

Thus, blockchain and crypto companies are attracting considerable attention among both retail and institutional investors seeking financial gain. The sector is also attracting attention from executives in traditional financial services firms who are increasingly comfortable joining the new and often volatile industry. For example, Coinbase recently hired senior executives from Goldman Sachs, Barclays, and Bridgewater.3

Making the jump

To learn more about what is prompting seasoned financial services executives to join the blockchain, crypto, digital assets sector, the Global Blockchain Business Council and Heidrick & Struggles conducted an online survey of 46 professionals who recently made the move from investment banks, asset management firms, hedge funds, or other types of firms.4 The survey explored their reasons for moving and the reality of their new roles and businesses. At the time of the survey, all of the respondents were still working in blockchain and crypto, indicating that the moves have so far been a success.

Where are new blockchain and crypto executives coming from?

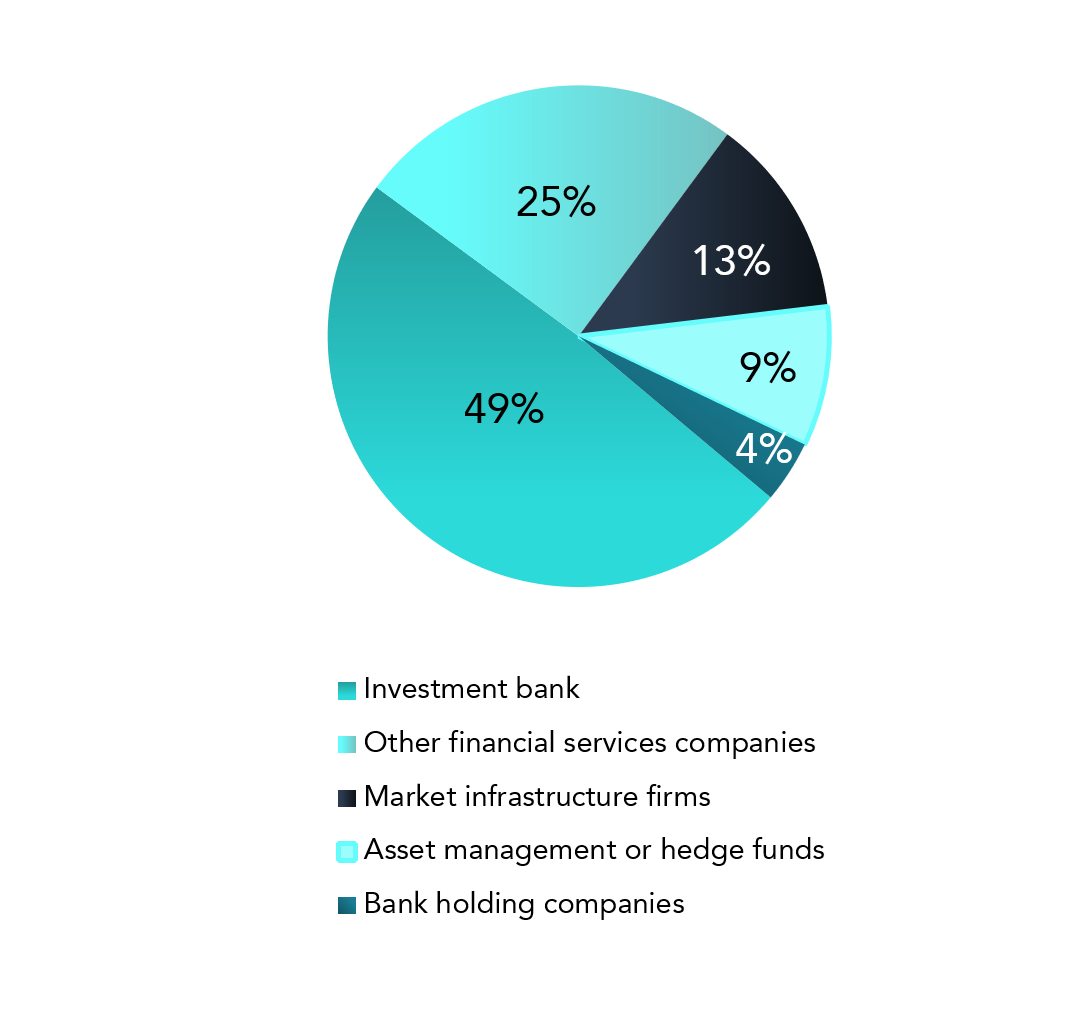

Nearly half of survey respondents (49 percent) joined the blockchain and crypto industry from roles in investment banking. The other half came from market infrastructure organizations, asset management companies, hedge funds, and other types of financial institutions, from securities and venture capital to bank holding companies.

Previous experience: What types of financial institutions executives come from (%)

Source: GBBC and Heidrick & Struggles blockchain survey, 2021, n = 45

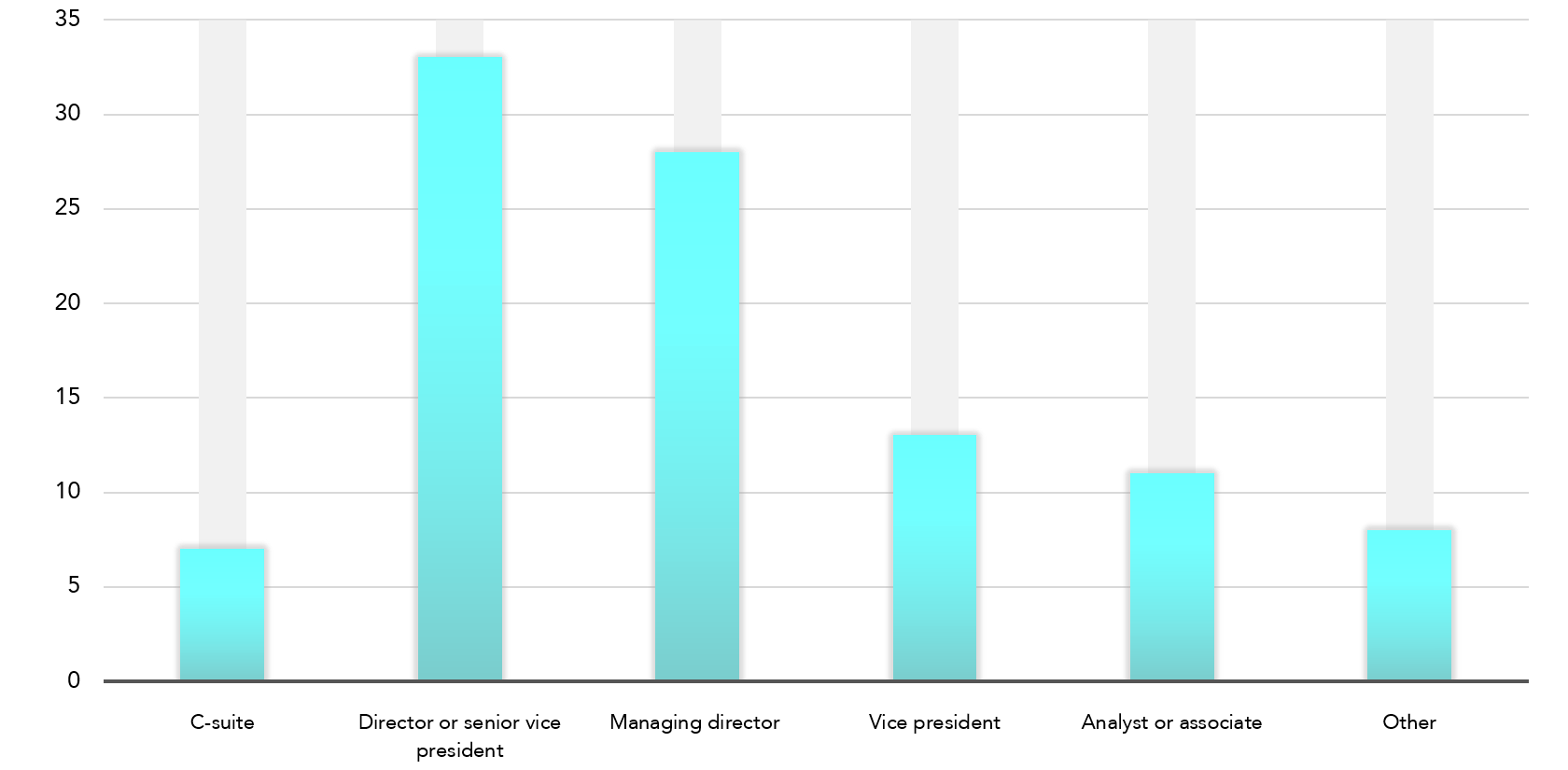

Most respondents held high-level positions at their previous institutions. One-third came from roles as directors or senior vice presidents, and 28 percent had previously served as managing directors. We have seen that an increasing number of senior executives from traditional financial services companies are more open to joining crypto companies as it becomes clearer that cryptocurrencies and blockchain are a driving force for the future of financial services.

What roles executives had before joining a blockchain or crypto company (%)

Source: GBBC and Heidrick & Struggles blockchain survey, 2021, n = 46

What’s prompting them to make the switch?

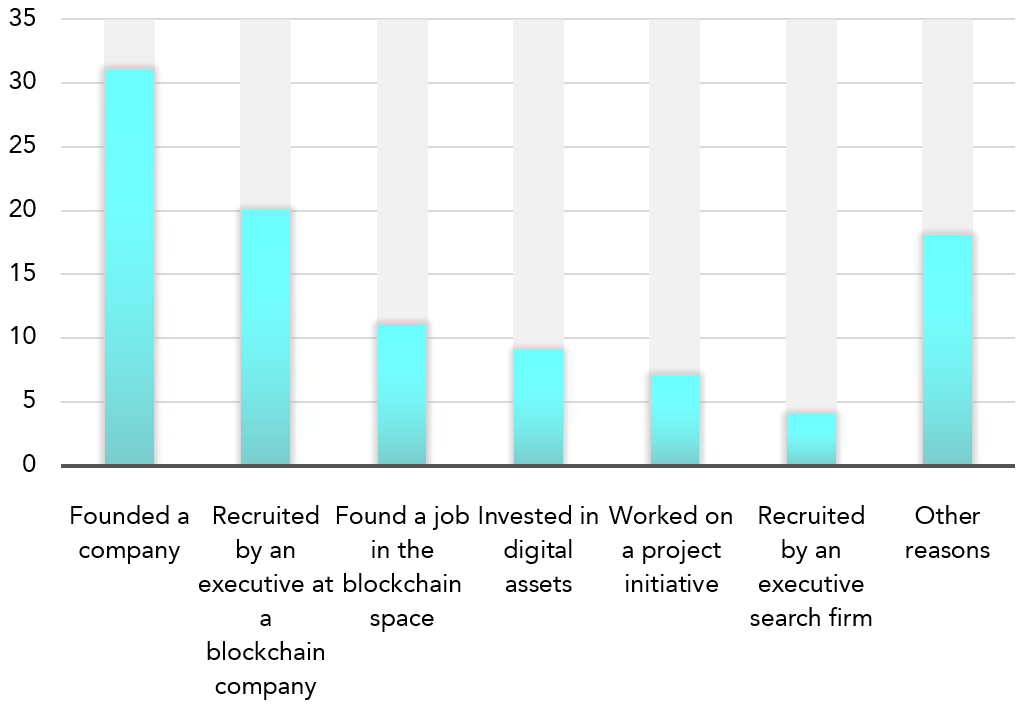

Nearly a third of respondents said they left their previous role to start a company. The fact that so many executives are willing to take a risk on a new venture underscores blockchain’s role in the broader financial industry. An additional 20 percent said they left their previous role because they were recruited by an executive at a blockchain or crypto company, highlighting the importance of networks and connections in the digital assets space; executives are more likely to join a blockchain or crypto company when they know and trust the people working there.

How executives made the switch to a blockchain or crypto role (%)

Source: GBBC and Heidrick & Struggles blockchain survey, 2021, n = 45

What kind of companies are they joining?

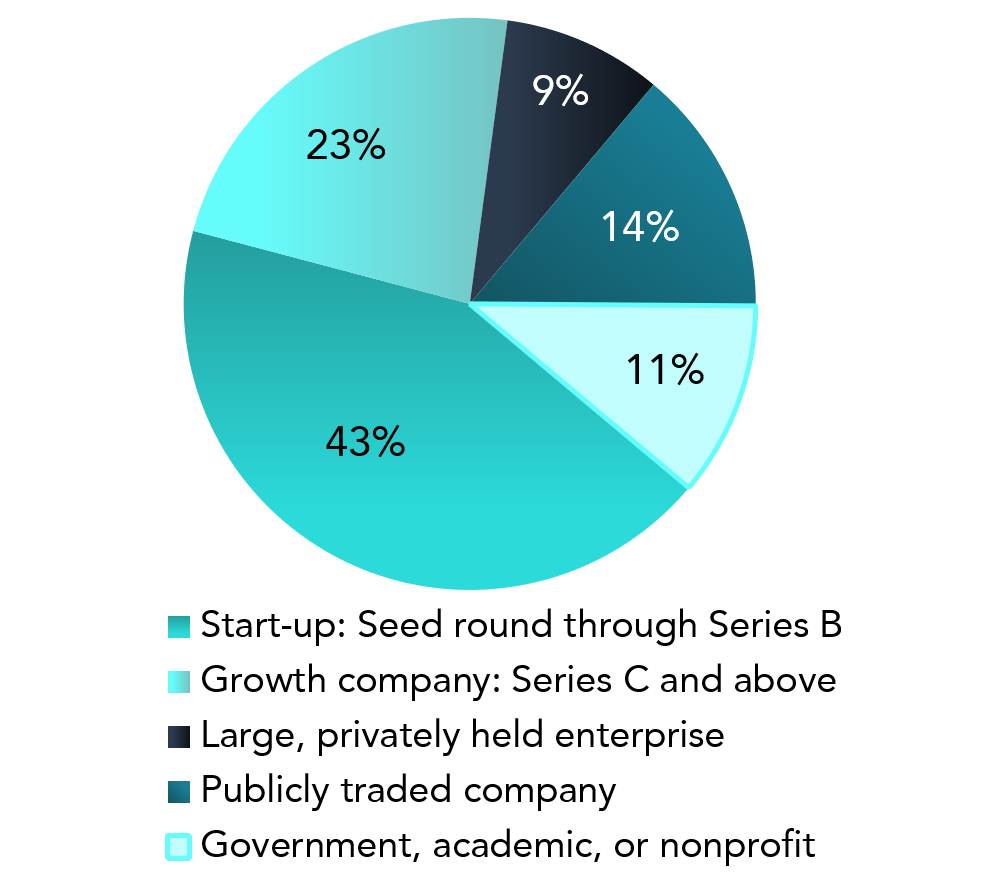

A large proportion of the executives we surveyed joined companies that are starting small and scaling fast. Forty-three percent of respondents said their companies are in the start-up phase, and a further 23 percent are in growth-stage organizations. Only 9 percent said they work for large, privately-held enterprises. Similarly, the vast majority reported working in companies with fewer than 300 employees. This trend reflects the way the sector is evolving, with many companies starting small and growing fast.

Current stage of the companies where executives joined (%)

Source: GBBC and Heidrick & Struggles blockchain survey, 2021, n = 44

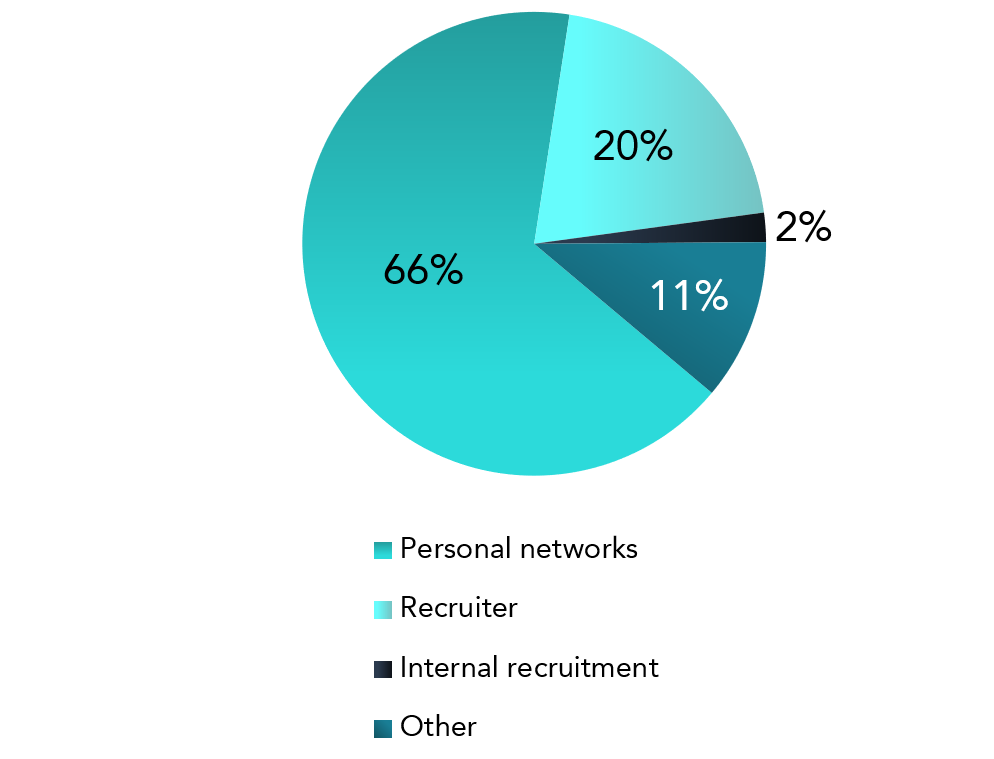

How are companies recruiting for senior roles in blockchain and crypto organizations?

Personal networks play an outsize role in recruiting, as we noted previously. Indeed, approximately two-thirds of respondents said their company would recruit through personal networks if they were hiring an executive to focus on blockchain or crypto. As the sector is establishing itself, more and more executives are ready to make the jump, particularly if they see colleagues who made the switch earlier succeeding. A large proportion of the executives said they would rely on recruiting firms to fill a position; this again resonates with our experience that executive search firms are not generally known for working in the sector unless blockchain and crypto companies have a clearly defined need for a senior executive role. Only 2 percent said they would first promote from within the company, likely because executive ranks are still thin at these small firms.

Where would blockchain and crypto companies hire from? (%)

Note: Numbers may not sum to 100% because of rounding.

Source: GBBC and Heidrick & Struggles blockchain survey, 2021, n = 46

How are blockchain and crypto roles different from roles in the financial sector?

The vast majority of participants work on smaller teams with smaller budgets in their new roles compared to their previous roles: 78 percent said their new team is smaller than the one they came from, and 76 percent said they have a smaller budget.

When we asked executives about what’s most different in their current roles compared to previous ones, flexibility was high on the list, as well as a sense of being able to have an impact. For many, culture also plays an important role, as many are looking for an environment with a faster pace of change and one in which they can learn quickly and experiment, with a less layered decision-making process.

- Project timelines are shorter and decision-making is faster. In keeping with crypto’s scrappy, agile reputation, nearly 75 percent of respondents said they have shorter timelines, and nearly 84 percent said that decisions are made faster.

- Hierarchies and organizational processes are loose. Also highlighting agility, 78 percent of respondents agreed that hierarchy was less strict in their new roles, while 62 percent said the same about processes.

- Processes and roles are less clearly defined. Only 15 percent of respondents reported having “clear responsibilities,” while 63 percent said their roles were less defined.

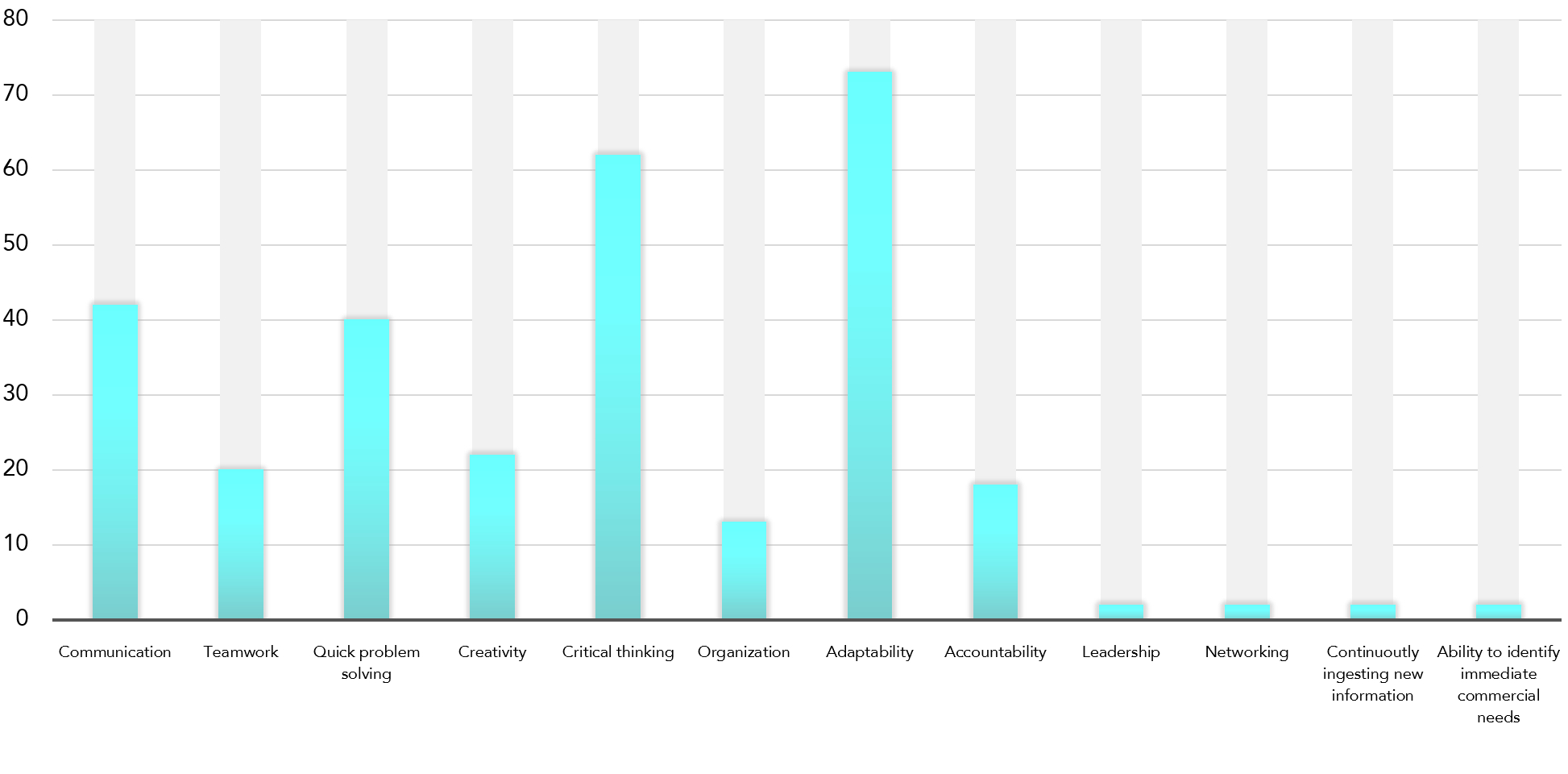

What skills are important for executives in blockchain and crypto?

To succeed in the blockchain and crypto space, executives need to be able to adapt, think critically, and communicate well. One executive said, “The pace of change in blockchain vastly exceeds that in traditional finance. Executives must process information quickly and be comfortable making decisions in ambiguity.” Nearly three-quarters of respondents cited adaptability as one of the three most important soft skills for a blockchain executive, and 62 percent listed critical thinking. Surprisingly, leadership and networking skills were at the bottom, but that could be a consequence of the fact that respondents had to deal with significant cultural change when they joined a start-up and learning the ropes might have taken priority over leading. It is likely the prioritization of these skill sets will change as the companies, and sector, mature.

Most sought-after soft skills for blockchain and crypto executives (%)

Source: GBBC and Heidrick & Struggles blockchain survey, 2021, n = 45

When it comes to hard skills, product management and development topped the list, with 72 percent of respondents listing it among the top three. The other highly rated skills were also focused on building the business, which makes sense for early-stage companies.

Looking at the success differentiators, respondents cited flexibility, curiosity, grit, resilience, creativity, interdisciplinary thinking, and “comfort with discomfort.” As one respondent summed it up, “Blockchain is constantly evolving and requires skills for adaptability, curiosity, genuine interest, and a strong conviction that we are doing the right thing.”

Most sought-after hard skills for blockchain and crypto executives (%)

Source: GBBC and Heidrick & Struggles blockchain survey, 2021, n = 46

How does compensation compare?

When comparing total compensation for executives in blockchain overall with those in traditional banking, nearly half of executives said they would expect compensation to be the same or lower for executives in blockchain and crypto, while more than 30 percent expected blockchain and crypto executives to earn more, and 17 percent—a notably high share—said they didn’t know. We have seen that professionals entering the blockchain and crypto space are often willing to accept a lower base rate of compensation. They know they are taking a risk in entering the field, but they also know the potential rewards in terms of equity are significant because the volume of investment keeps growing: global venture-capital funding into cryptocurrency and blockchain reached a record of $6.5 billion in the third quarter of 2021, up from $5.2 billion in the second quarter.5

Five considerations when contemplating joining a blockchain and crypto company

The survey results reflect closely what we’re seeing in our work in the digital assets sector. As more and more executives make the leap from financial services to blockchain and crypto, five key themes emerge:

- Blockchain and crypto companies offer exceptional room for individual growth. Because the field is young and growing fast, functions and responsibilities are less clearly defined than in other industries and therefore less rigid. Blockchain and crypto companies are more willing to hire professionals with less experience in a particular role and are ready to promote them and expand their responsibilities on an accelerated timeline.

- Flexibility means leaders can shape the way their companies operate. Flexibility is a key incentive for executives making the switch, and as hierarchies, processes, and roles are less defined, traditional factors such as time spent in the office have faded in terms of relevance as the COVID-19 pandemic progressed and working from home became a common occurrence. Some organizations do not have traditional headquarters, and those that do are increasingly open to remote work arrangements. It remains to be seen if this trend will stick, or if companies might return to an approach that prioritizes office presence.

- Companies are prioritizing culture impact over role-specific experience. Blockchain and crypto companies are looking for professionals with enough industry experience to fill gaps required by their specific context, but needs change with the evolution of the company. For instance, early-stage blockchain and crypto companies are more likely to require engineers or product development specialists and, later, sales or more senior executives. As potential regulatory requirements are looming, many blockchain and crypto companies are now looking for legal and compliance specialists. But whatever hard skills they’re looking for, blockchain and crypto companies undoubtedly need people who have the passion to be adaptable, creative, and comfortable in uncertainty.

- The blockchain and crypto industry requires different leadership capabilities than traditional financial services. To keep up with the demands of a fast-moving field, successful candidates need grit, resilience, and the willingness to go all in. Executives looking to join the blockchain and crypto sector need to have a high-risk tolerance and the ability to operate at a considerably more accelerated pace than more traditional sectors.

- Culture is critical. In a new industry, founders play a significant role in shaping company culture, for better or worse. Candidates would do well to ensure they understand the culture of the organization they are considering joining. The fact that so many are hired through networking offers an advantage.

About the authors

Sofia Arend (sofia.arend@gbbcouncil.org) is the director of communications at the Global Blockchain Business Council.

Riyad Carey (riyad.carey@gbbcouncil.org) is a senior policy analyst at the Global Blockchain Business Council.

Adrianna Huehnergarth (ahuehnergarth@heidrick.com) is an engagement manager in Heidrick & Struggles’ New York office and a member of the Financial Services and Crypto & Digital Assets practices.

David Richardson (drichardson@heidrick.com) is a partner in Heidrick & Struggles’ New York office and a member of the Financial Services Practice. He also leads the global Market Infrastructure & Data Services sector and the Crypto & Digital Assets sector.

Sandra Ro (info@gbbcouncil.org) is the CEO of the Global Blockchain Business Council.

References

1 Satoshi Nakamoto, “Bitcoin: A peer-to-peer electronic cash system,” Bitcoin.org, October 31, 2008.

2 “Cryptocurrency prices by market cap,” accessed December 21, 2021, coingecko.com.

3 Joshua Oliver, Laurence Fletcher, Eva Szalay, and Philip Stafford, “‘It’s wild out there’: Crypto firms lure top bankers in price boom,” Financial Times, May 26, 2021.

4 The survey was conducted from July 2021 to October 2021.

5 Michael Bellusci, “VCs invested record $6.5B in crypto, blockchain in Q3: CB Insights,” CoinDesk, November 2, 2021.