Boards & Governance

Board Monitor US 2024 | Navigating shifting sands: Six ways boards are reshaping their processes to thrive now

More and more, we have been helping our clients understand the expanding—and volatile—environment in which they are operating. How is the role of business in society changing? What are the implications for directors? What does the future hold?

The role of board member is continuously expanding to provide additional oversight on issues that impact their business in unprecedented ways. Issues include a rolling global pandemic, geopolitical uncertainty and conflict, emerging technologies, cybersecurity concerns, and a long list of social and environmental concerns—and the combined impact of these issues is something that even the most seasoned of directors had to tackle for the first time.

Six questions reshaping the boardroom

- Who is influencing the board agenda today—and are board members happy with that?

- Where does the board spend its time—and are those the right places?

- How are boards addressing the widening risk environment?

- Are boards more operationally involved?

- How should boards engage with the workforce?

- How are boards thinking about diversity today?

Who is influencing the board agenda — and are board members happy with that?

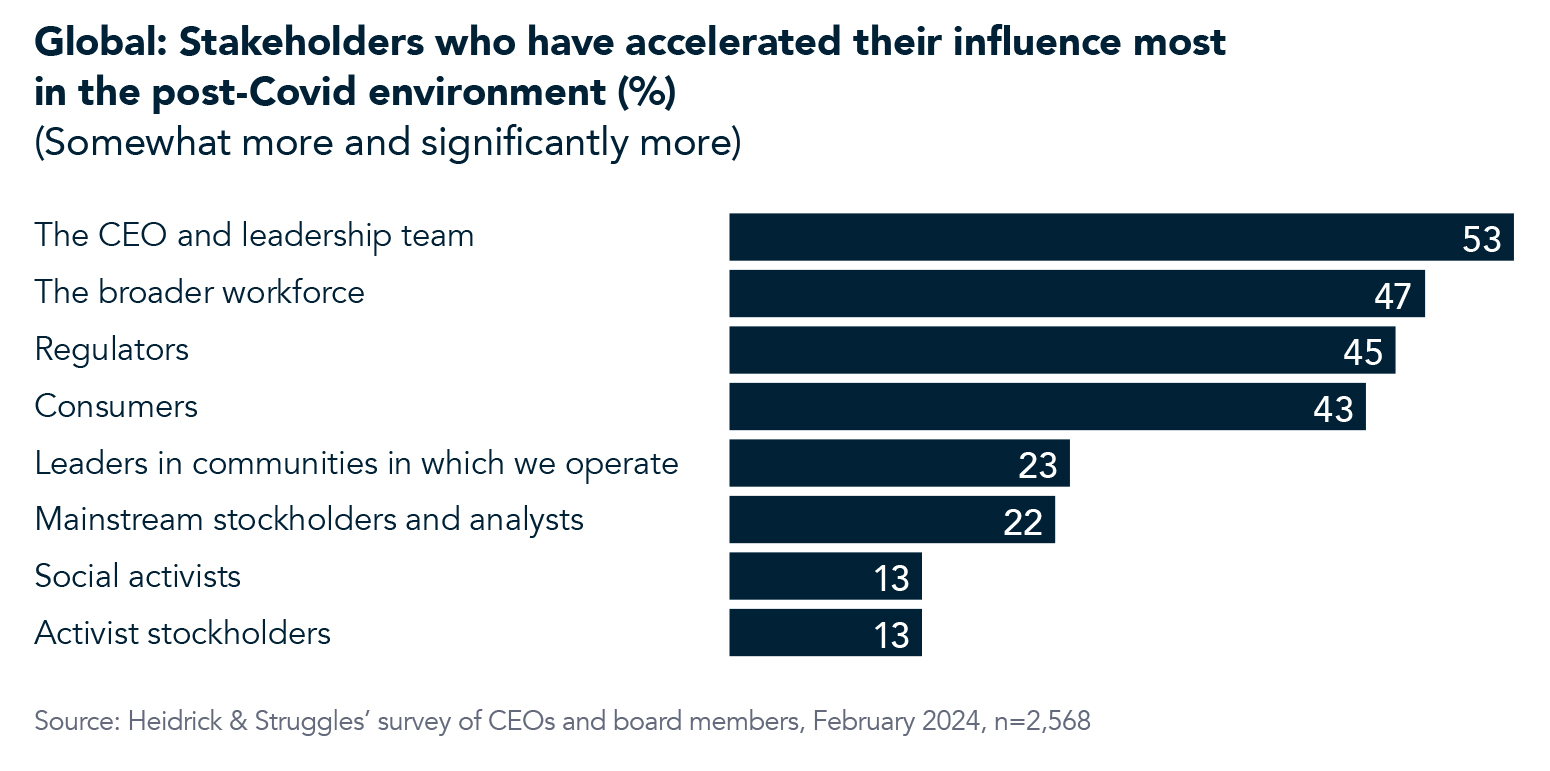

To better understand the relative influence of stakeholders today, we asked directors and CEOs to stipulate which stakeholders have accelerated their influence most in the post-Covid environment. Overall, they report that the CEO and leadership team, the broader workforce, regulators, and consumers and customers have increased their influence more than others.

The US in context

Given the direct fiduciary responsibility the board has to the company’s owners, and despite increased shareholder scrutiny and shareholder democratization policies in the asset management arena, a relatively low number of US respondents report increased influence from mainstream investors (19%) or from activist investors (9%). Globally, only 22% of respondents reported the increased influence of mainstream shareholders and 13% that of activist shareholders, only slightly higher.

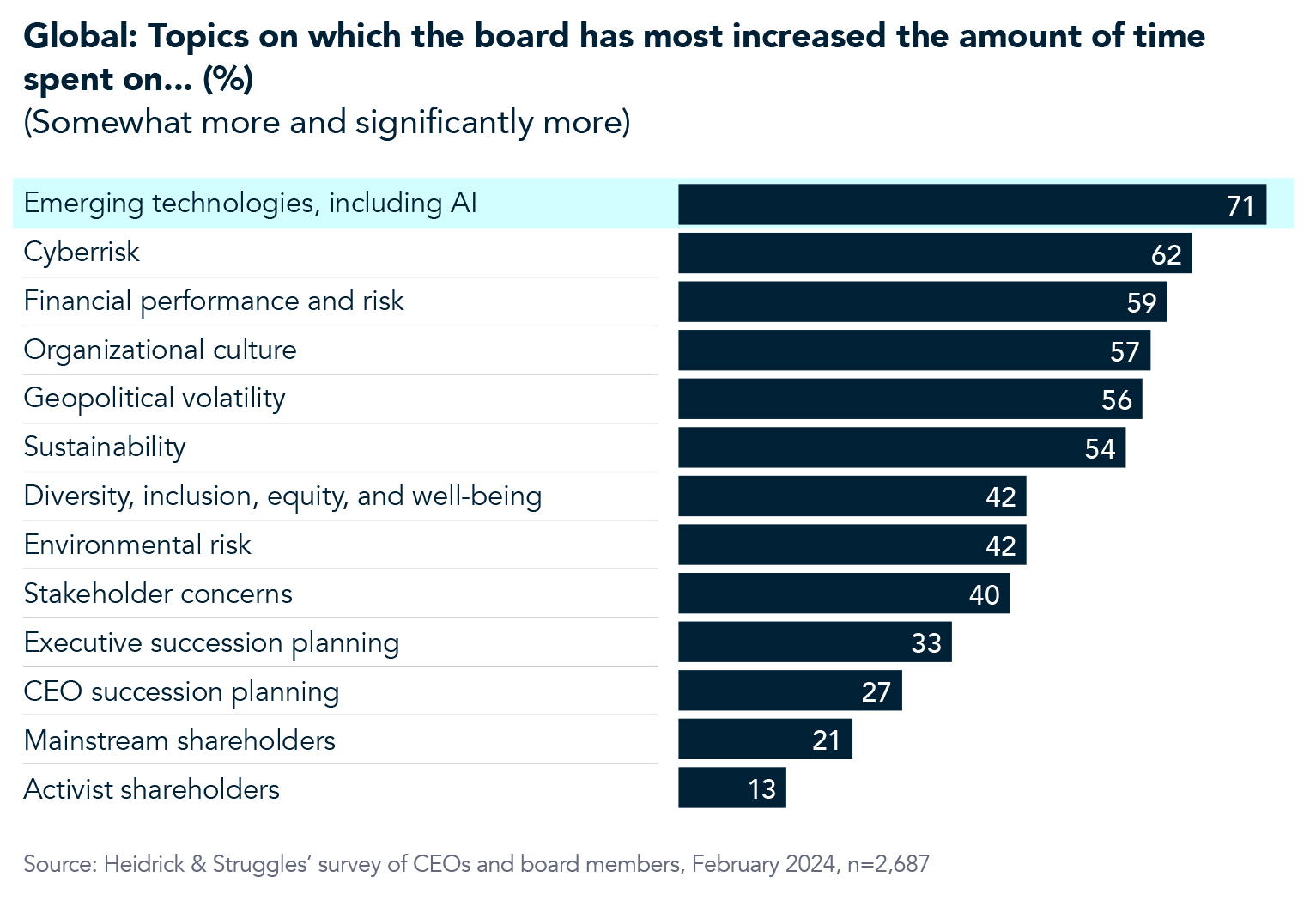

Where does the board spend its time—and are those the right places?

Technological disruption is top of mind for boards at the moment, as issues such as emerging technologies and cyberrisk are being given more attention than they were before the Covid-19 pandemic. On the other hand, boards say they focus to a lesser extent on mainstream and activist shareholder concerns.

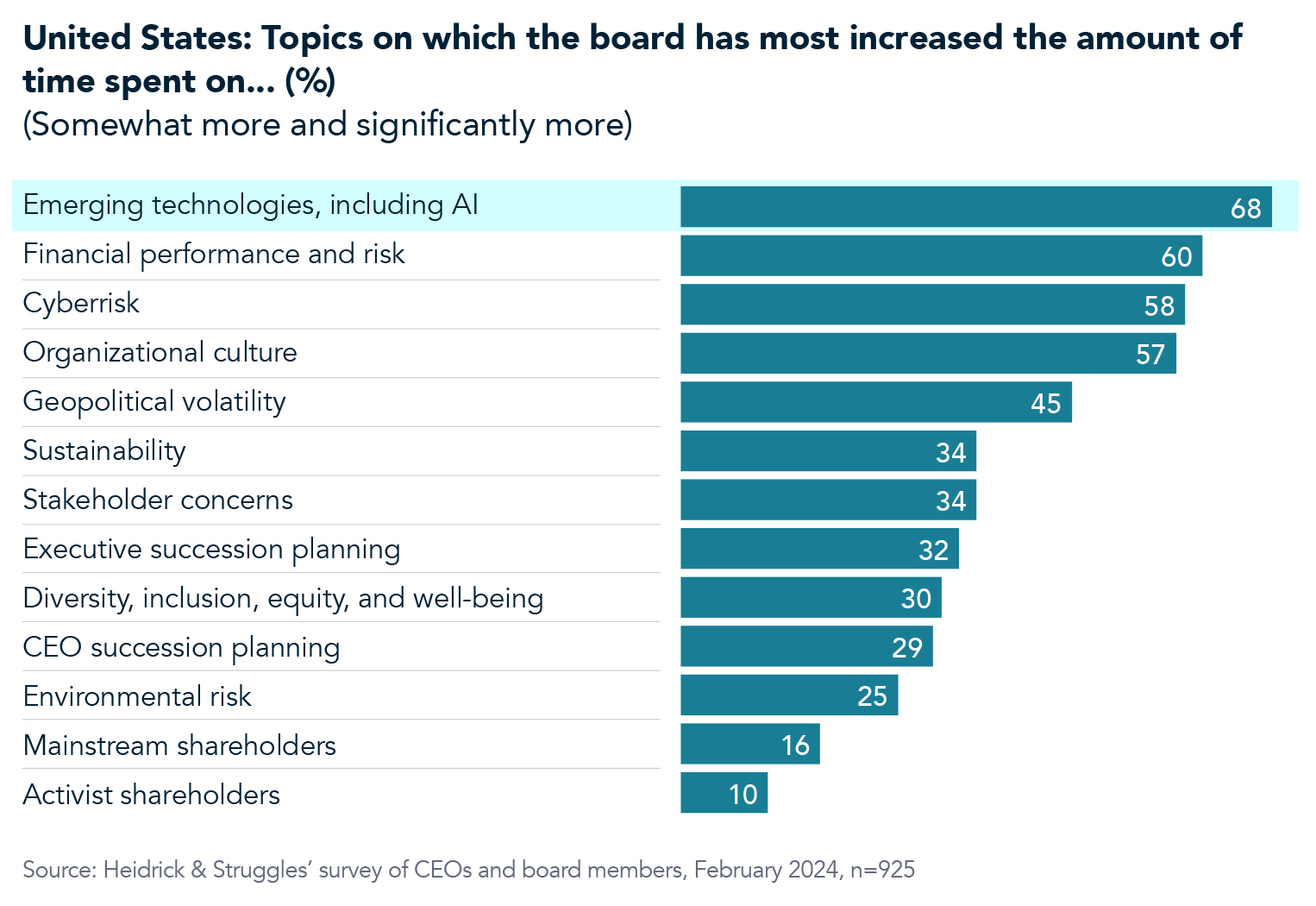

The US in context

More respondents in the United States report an increase in time spent on emerging technology and AI concerns than any other area, consistent with the average global response. Financial performance and risk, cyberrisk, and organizational culture round out the top concerns. While geopolitical volatility remains a top concern for US boards, particularly considering 2024 global elections super-cycle and the 2024 US election specifically, US directors report a lower increase in the amount of time spent on this issue compared with those in several other markets, particularly those closest in proximity to global conflict zones.

We also saw a lower share of US respondents than in any other country say they are spending more time addressing sustainability (34%) and environmental risk (25%), compared to global averages of 54% and 42%, respectively. Not surprisingly, though, respondents at industrial companies in the United States far more often report a higher focus, 42% and 31%, respectively (followed closely by those in the consumer sector.)

How are boards addressing the widening risk environment?

Governing in a complex environment with an increasing accelerated rate of change requires new and practical approaches to ensuring expertise and managing risk. When we asked what steps boards have taken since Covid began to better manage uncertainty and risk, their responses leaned toward an internal focus on risk management, primarily through interactions among the board itself or between the board and management. However, we also see a growing willingness to draw in the contributions of external experts.

The US in context

Similarly to their counterparts around the world, the most significant increased investments are internal in nature: 68% of US directors report spending more time discussing risk with management; 50% report spending more time discussing risk among the board; and 49% report expecting more investment from management in understanding risk. They also report increased reliance on external advisory sources: 33% of US directors report an increased use of external experts; 30% report the addition of specialized experts to the board itself; 19% report establishing advisory committees; and 15% have hired independent experts separate from those advising management.

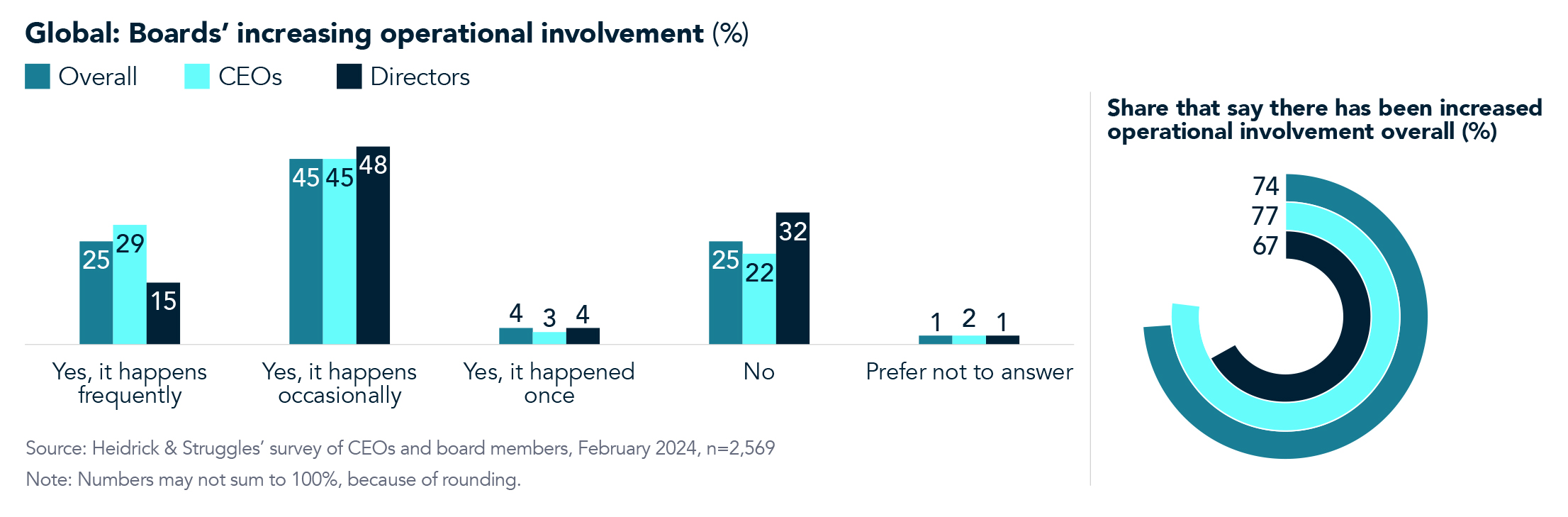

Are boards more operationally involved?

As the role of the board is expanding, boundaries are also changing, with undetermined consequences for the dynamics between boards and executive teams. We have observed a trend of boards becoming more operationally involved and wanted to understand how widespread of a trend this was. A majority of the respondents to our survey report that board members are indeed more operationally involved: 25% say it happens frequently; 45% occasionally; and 4% that it has happened once. Only a quarter report that they have not crossed that line. Notably, CEOs more often than directors report operational involvement from the board.

The US in context

US respondents least often say that increased operational involvement is frequent. And, they most often say that it doesn’t happen at all, relative to most of their counterparts in other regions. Even so, a majority of those in the United States (70%) still report increased involvement overall. The most common reason for increased involvement cited by US respondents is the need to learn more about the operational nature of the business than normal reporting allows.

How are boards engaging with the workforce?

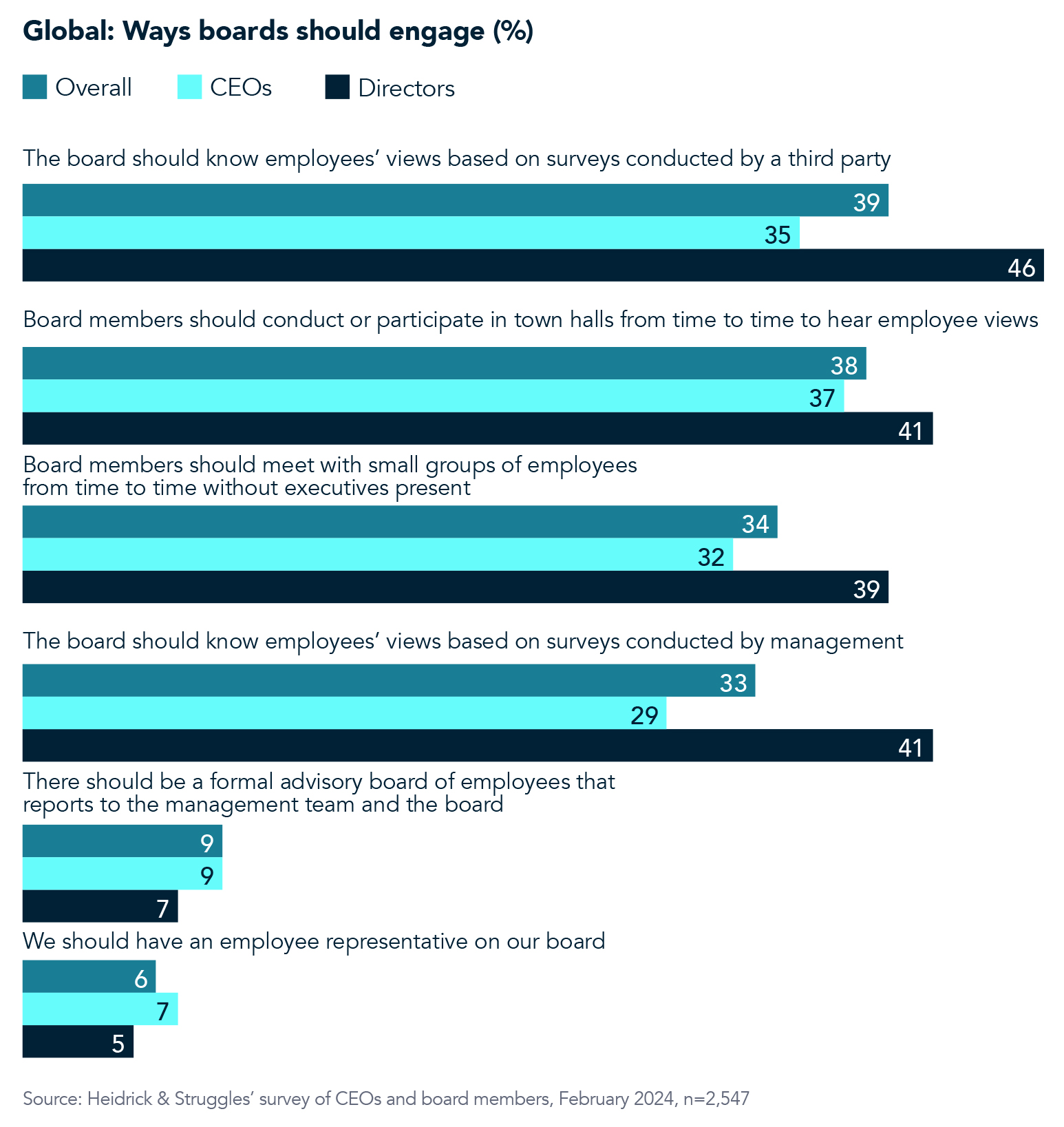

We increasingly see workers influencing the board agenda globally, and 86% of our respondents (and 93% of directors) see the case for a deeper engagement with the wider workforce. On a global basis, respondents most often preferred to engage with the workforce through the use of surveys, town halls, and direct engagement with small groups of employees without management present. Here, too, there are some differences between how directors and CEOs think boards should seek engagement.

The US in context

Eighty-one percent of US respondents are in favor of directors engaging with the workforce beyond those in senior management, slightly lower than the 86% global share. Meanwhile, 17% of US respondents say directors should not interact with employees at all—one the highest contingent to choose this option. US respondents less often advocated for formal or structural methods of workforce engagement than the global average: only 6% of US respondents favor the use of formal advisory boards, for example, compared with 9% globally.

How are boards thinking about diversity today?

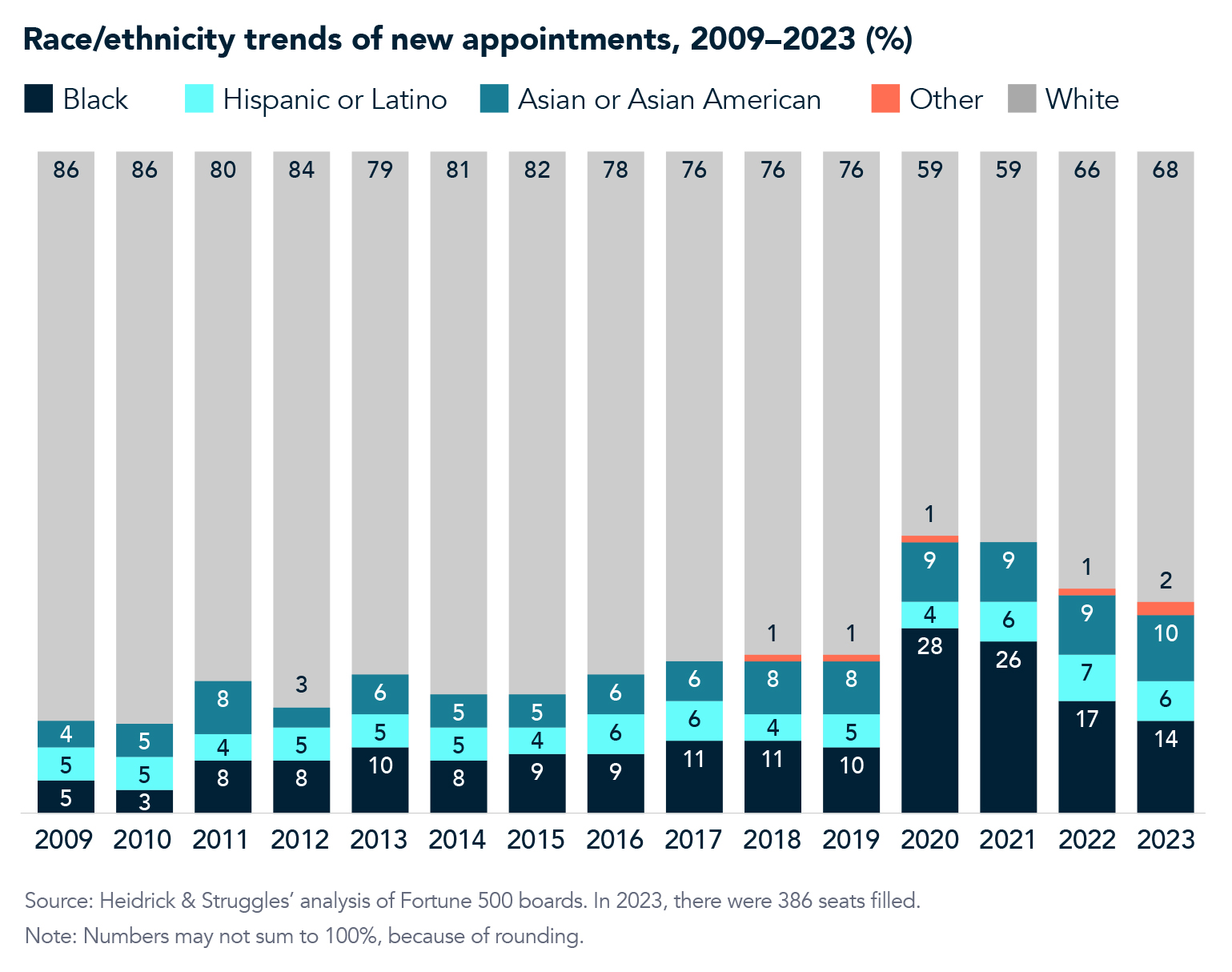

Governing and leading across abiding cultural divisions could be one of the most important contributions business has to offer society. This contribution can take singular forms in different markets. For instance, some of the most substantial changes in the US governance environment are reflected in the changes we see in board diversity, which translates to a focus on gender and ethnicity trends. However, the conversation has widened to consider the impact of geopolitical differences—at home and abroad, and the importance of other stakeholders, whose influence we covered earlier.

The US in context

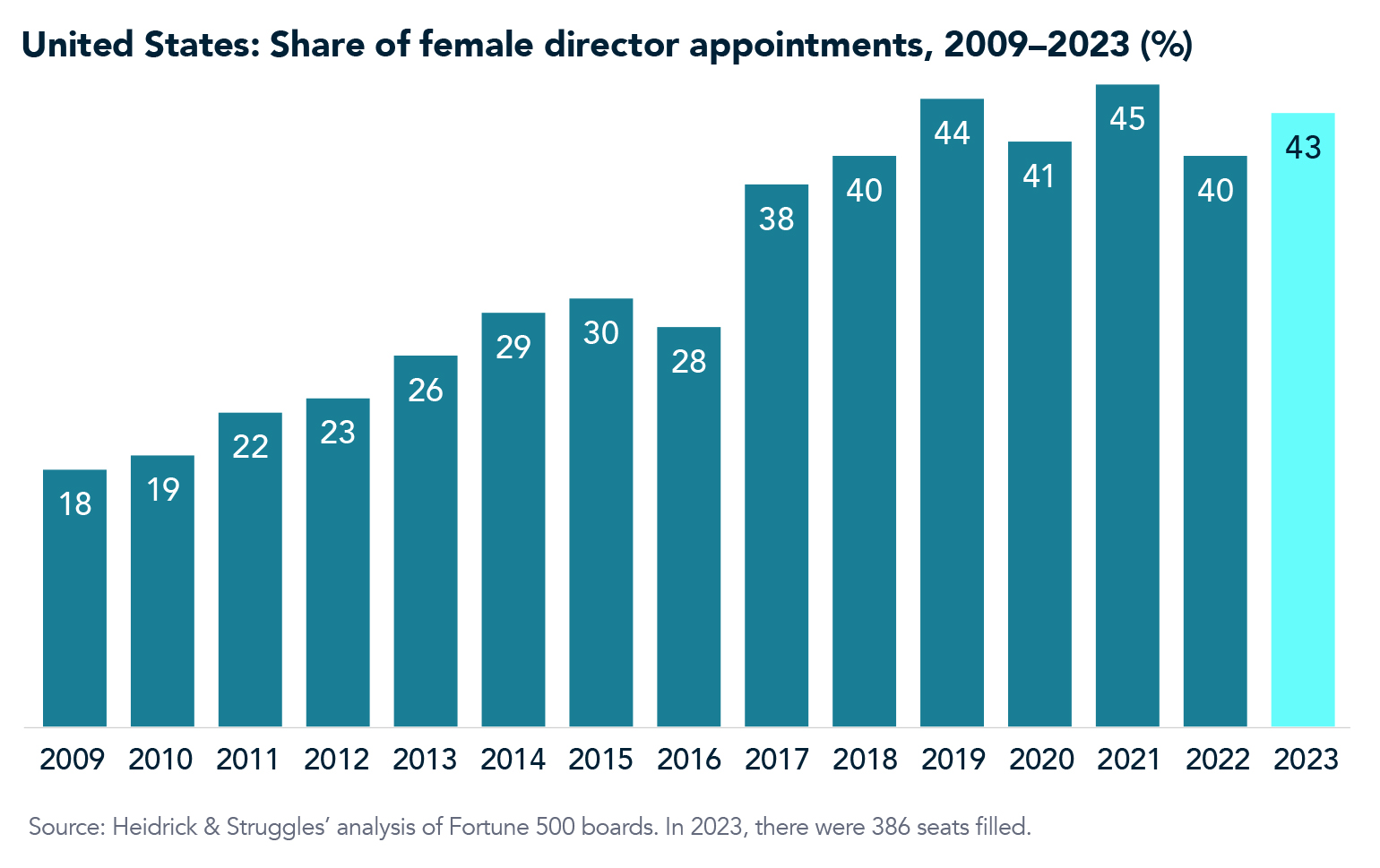

For the full year of 2023, we saw a continued retreat from peak ethnicity and gender placements in 2020 and 2021. Our analysis of the newest class of directors added to Fortune 500 boards, and historical trends in the backgrounds of people being added to boards, is available here.

The number of seats going to women on US boards has advanced substantially over the past 15 years but fell slightly last year, and the total share of women directors remains short of parity. The percentage of seats going to women on public Fortune 500 company boards in the United States since 2009 on a percentage basis has more than doubled, but appointments have leveled off in the last five years.

Recommendations

- Increase stakeholder engagement. A majority of US directors are increasing engagement with stakeholders of many kinds. Engagement with the workforce varies widely by region, and from company to company. In the United States, most directors are increasing their commitment to ensure the voice of non-management employees are heard in the boardroom, while stopping short of the more formal voting mechanisms required in some countries.

- Cultivate a learning culture on the board. Directors are accustomed to being hired for their expertise—for being experts. This won’t change, but the scope of expertise required is expanding beyond the capacity of a traditional board. In this environment, “learning to learn” and business judgment have never been more important. Effective chairs set the tone for learning.

- Expand sources of expertise. Still, a growing number of boards are also using mechanisms such as advisory committees, external advisors, and on-demand talent platforms to surround the board with the range of rapidly changing skills needed to create capacity and govern in this expanding environment.

- Govern across boundaries. Polarization has reached severe levels in a growing number of countries, most notably the United States. The new face of diversity includes and goes well beyond traditional definitions and boundaries. The implications for business are far-reaching. Make certain that director candidates have the experience, wisdom, empathy, and proven reputation of working across societal and inter-company boundaries.

- Increase investment in succession planning. In this widening risk environment, and with rising investor pressure on directors, effective boards are adopting an ongoing approach to succession planning—for both the CEO and board itself. Reactive recruitment projects are a thing of the past. Still, our research shows concern among many directors that succession is being pushed down the priority stack and not actively addressed.

- Leverage others. As the scope of board responsibility expands, lean on the corporate secretary for help. Challenge service providers and outside experts to take on more, collaborate with each other, and rethink their business models (standards, pricing, conflicts). Lean on the executive team, and on peer companies, to develop collaborative insights and drive change.

Acknowledgments

Heidrick & Struggles wishes to thank the following executives for sharing their insights. Their view are personal and do not necessarily represent those of the companies they are affiliated with: Mark Cutifani, chairman, Vale Base Metals; board member, Total Energies; former CEO, Anglo American Total, Anglo American; David Karp, partner, Corporate Practice, Wachtell, Lipton, Rosen & Katz; and Donna James, chair, Victoria’s Secret & Company; board member, American Electric Power and The Hartford Financial Services Group.

Heidrick & Struggles also wishes to thank the following colleagues for their contributions to this article: Gustavo Alba, Ryan Bulkoski, Bonnie W. Gwin, Jeremy Hanson, Lee Hanson, Liz Langel, Jeff Sanders, Stephen Schwanhausser, Lyndon Taylor, and Sachi Vora.