Chief Executive Officer

Route to the Top 2021

This year, we were curious to see if the sharp and immediate impact of the COVID-19 pandemic on CEO succession planning—in which we saw a markedly slower planning process and newly appointed CEOs who fit into a traditional comfort zone—continued, or if earlier trends toward greater diversity among new CEOs would be restored.

Indeed, we once again see a broader understanding of what makes a good CEO among the new appointments. We also explored how the profiles of these newly appointed CEOs differed from their direct predecessors in order to gain an understanding of how much CEO expectations have changed compared to the previous generation.

Our key findings include the following:

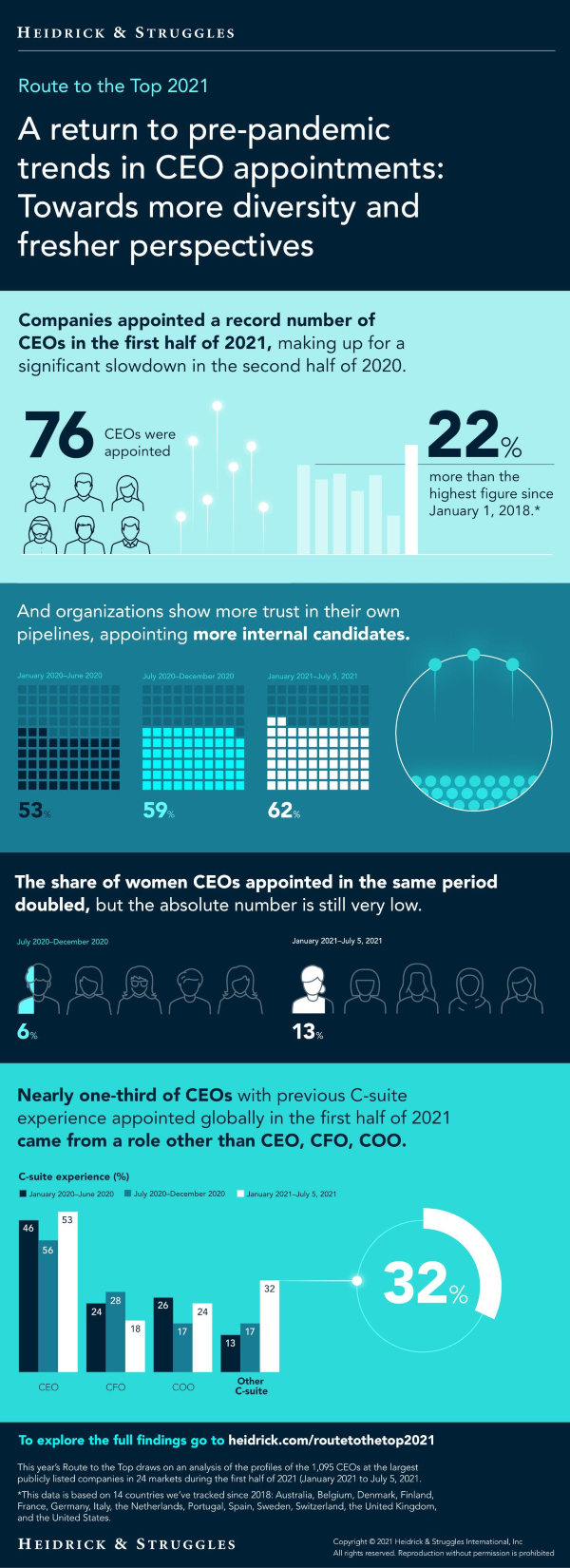

- The first half of 2021 shows a record number of CEO appointments, the highest since 2018.

- The share of women CEOs appointed in the same period doubled: 13% of all CEOs appointed in the first half of 2021 were women, compared to 6% in the previous six months—though absolute numbers are still very low.

- More new CEOs have C-suite experience beyond the traditional CFO and COO roles, including roles such as chief risk officer, chief strategy officer, and chief technology officer.

- After a period of increased external appointments early last year, the balance shifted toward internal appointments.

- Compared to their direct predecessors, new CEOs are more likely to be women, to be from countries other than where the company is headquartered, to have cross-border experience, and to have advanced degrees.

Our findings show us that companies are returning to a more expansive view of CEO succession. The steady increase of CEOs appointed internally—while ensuring those CEOs have various sources of fresh perspective—also highlights that many companies are strengthening their succession pipeline so they can tap into a larger number of leadership roles within the organization.

A turn back toward pre-pandemic trends

New CEO appointments rose dramatically in 2021. After a significant slowdown in appointments in the second half of 2020, companies made a record number of CEO appointments in the first half of 2021, which signals confidence in both their company’s prospects and their ability to find the right leader.

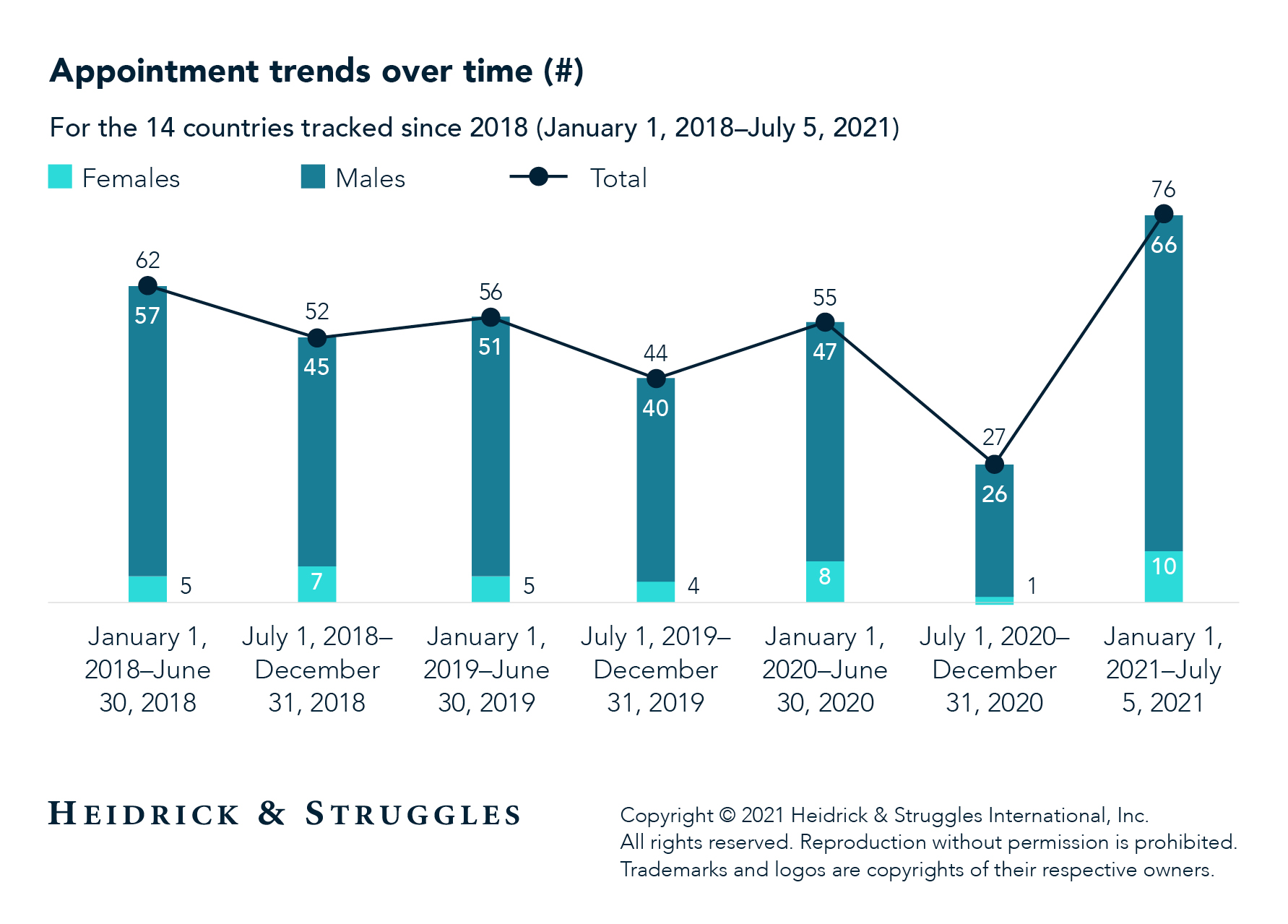

Looking at the 14 countries1 we’ve tracked since 2018, the first six months of 2021 had significantly more appointments than any similar period, outstripping the next highest half-year period by 14 placements, or 22.6%, and was very close to the overall number of appointments in 2020 in these 14 countries: 82. (See also chart “CEO appointments by market” on page 6 of the full report.)

Companies that did make a change early in the pandemic on the whole reverted to their comfort zone of appointing executives with prior CEO experience and a successful leadership track record, who were often men. (See Route to the Top 2020.) Across the 24 markets in our study, we saw that progress toward gender equity surged forward in 2021 after last year’s pause: the share of women appointed to CEO roles had dipped to 6% in the second half of 2020 but rose to 13% in the first half of 2021. This is likely the result of the combined impact of regulatory requirements for gender balance in corporate ranks implemented by many countries in our study, stakeholder pressure, and a conscious decision to gain fresh perspectives through a fairer gender balance.

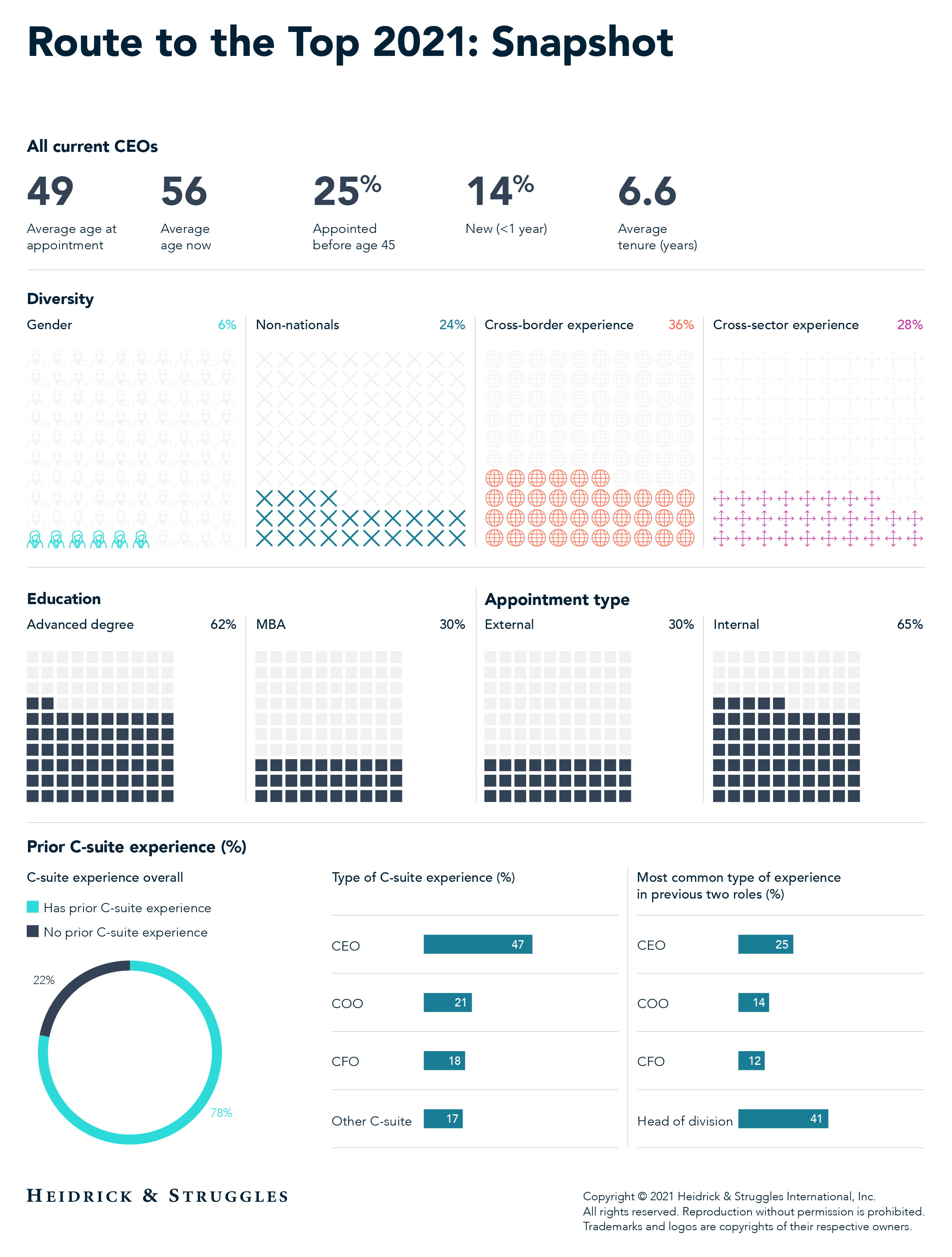

Other sources of diversity and fresh perspectives, such as having a nationality different from the home country of the company’s headquarters, cross-border experience, and cross-industry experience, have held steady through the past 18 months. We have, however, seen an increase in the share of new CEOs with MBAs or other advanced degrees over the past 12 months. (See charts, “Fresh perspectives also return in CEO profiles in the first half of 2021,” on page 7 of the full report.)

An increasing share of new CEOs have held other roles in the C-suite, signaling that companies are increasingly reaching beyond the traditional ranks of CFOs and COOs. In fact, the proportion of new CEOs who had held other C-suite roles more than doubled from January 2021 to June 2021 compared to the same period in 2020. The number of former CFOs took a notable dip, particularly compared to the previous six months. C-suite roles that are moving up in paving the way to CEO include chief risk officer, chief strategy officer, and chief technology officer. (See charts, “More new CEOs have previous C-suite experience,” on page 8 of the full report.)

In addition, head of division roles have become increasingly common stepping-stones to the top job: 41% of the new CEOs this year had held such roles. Indeed, many companies have elevated the heads of their main divisions to their executive teams in recognition of the roles’ importance and to ensure that those leaders take part in key decisions. Such practices also give division heads firsthand experience with executive committees and make them stronger contenders for CEO roles.

Data from the past 18 months also show increasing shares of internal appointments from January 2020 to July 5, 2021. This suggests that improvements many companies have made to their internal leadership development and succession planning processes, such as broadening the experience of heads of divisions, are now working. These internally appointed CEOs are more often women than are their externally appointed peers and have more often held less traditional C-suite roles. It’s also little surprise that they less often have cross-sector experience. (See charts, “More CEOs are appointed internally,” on page 9 of the full report.)

The changing of the guard: New CEOs compared to their predecessors

It is perhaps no surprise that CEOs appointed over the past year differ significantly from the CEOs they replaced. After all, the departing CEOs’ average tenure was seven years, and in those years the world has changed markedly. The new CEOs in this year’s report are more likely than their predecessors to be women, to be non-nationals, to have cross-border experience, and to have advanced degrees. (See charts, “New CEOs versus their predecessors,” on page 11 of the full report.)

Newly appointed CEOs also have more diversified areas of prior C-suite experience than their predecessors do. This difference could reflect the increased importance of functions such as technology, risk, or strategy. But this broadening of scope also reflects the fact that the CEO role itself is expanding far beyond its historical day-to-day running of the business. CEOs today need to champion (both internally and externally) issues such as sustainability, social justice, DE&I, and cybersecurity, along with other issues specific to their business or geography. CEOs are in the spotlight more than ever, their actions are scrutinized by a larger number of stakeholders, and they have to be much closer to and transparent with their own employees. In this context, leadership capabilities such as agility, empathy, role modeling the organizational purpose, and fostering inclusion matter just as much as specific areas of expertise. (See charts “Newly appointed CEOs have more diversified C-suite experience than their predecessors,” “Fresh perspectives: Sector view,” “Fresh perspectives: Market view” on pages 13–15 of the full report.)

Looking ahead

Looking ahead, as the role of the corporation is reimagined in the wake of COVID-19 and growing societal expectations surrounding climate, equity, cyber concerns, and other external realities, boards are reconsidering the CEO succession planning process itself. We expect to see even more investment in the development of internal candidates and a more continuous review of both internal and external candidates against the backdrop of rapidly evolving geopolitical scenarios and across multiple time horizons. As part of that effort, companies should be preparing for potential emergency CEO succession needs; these emergency plans require much closer scrutiny to make sure boards have in sight the right candidates for the context they would need to step into. (For more, see “Considerations for emergency CEO successions.”)

All this means that we expect companies to broaden their search for fresh perspectives even further. In addition, we expect increased focus on leadership capabilities rather than specific skill sets. Though there will always be differences in emphasis based on sectors, markets, and individual companies’ scale and business models, other recent research by Heidrick & Struggles has found that there are four capabilities in which future-ready leaders consistently excel: leading through influence, driving execution, creating new thinking, and having an ownership mindset. (For more, see “Future-ready leaders: Finding effective leaders who can grow with your company.”)

Finally, considering the ever-expanding role of the CEO, companies will benefit by putting more weight than ever before on such capabilities—both when they assess current CEOs and as they look for future ones.

Acknowledgments

Thanks to the following Heidrick & Struggles’ colleagues for their contributions to this report: Bonnie Gwin, Jeremy Hanson, David Hui, Jeffrey Sanders, Claire Skinner, and Lyndon Taylor.

References

1 We have tracked 14 countries since 2018: Australia, Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, Portugal, Spain, Sweden, Switzerland, the United Kingdom, and the United States.