Compensation Trends

2021 North American Alternative Asset Management Marketing and Investor Relations Professional Compensation Survey

Welcome to our second annual North American Alternative Asset Management Marketing and Investor Relations Professional Compensation Survey.

Together with our surveys of private equity investment and operating professionals, this report provides a comprehensive picture of the compensation that North American executives in the hedge fund, real estate, and private equity industries currently receive.

For this report, Heidrick & Struggles compiled compensation data from a survey of 366 alternative asset management marketing and investor relations professionals in North America who are employed in private equity, hedge funds, or real estate.

Alternative asset management market context

This year’s survey of compensation of marketing and investor relations professionals in the hedge fund, real estate investment, and private equity industries is set in the context of a reacceleration of these sectors after a pause early in the COVID-19 pandemic. In addition, requirements to work remotely for most executives have altered some dynamics, particularly in fundraising.

We have seen that larger, better-known firms have, on the whole, had an edge in fundraising across all three sectors. This reflects a greater comfort level with name firms during uncertainty, as well as the economy-wide trend of connecting with fewer new people during the pandemic.1 Digital assets (including bitcoin) have also been strong performers. It’s notable, however, that 14% of respondents to the survey indicated their firm had not raised new money in 2020.

The fundraising edge of larger firms means that they have also been more able to innovate and introduce new products, while smaller firms tended to bring fewer new products to market over the past year. That said, 70% of all respondents indicated their firm’s performance had improved in 2020 compared with 2019, and 11% said performance was up 20% or more.

In terms of hiring trends, last year we noted a competitive market—and it has only become more so. This is true for all candidates and particularly for candidates diverse in terms of gender or race and ethnicity. Firms have become very focused on adding diverse executives and are willing to offer significant rises in base and bonus to attract them. Here too, just as larger firms have been more able to innovate their products, they have, in our experience, been more able to increase the diversity of their leadership teams. The demographics of our survey respondents highlight this point: the lowest share of white respondents, 58%, and the highest share of Latinx respondents, 5%, were at companies with more than $30 billion in assets under management. The highest share of white respondents, 81%, was at firms with $5 billion to $10 billion in assets under management; the highest share of male respondents, 67%, is at firms with under $1 billion in assets under management.

As for executives, after seeing some hesitance to change firms during the height of the uncertainty, we have seen an increasing willingness to move, particularly to the larger firms. Given that it can be harder to break into new markets or products while remote work continues, some smaller firms may be able to compete by seeking out people who want to leave their current firm but stay in the same field.

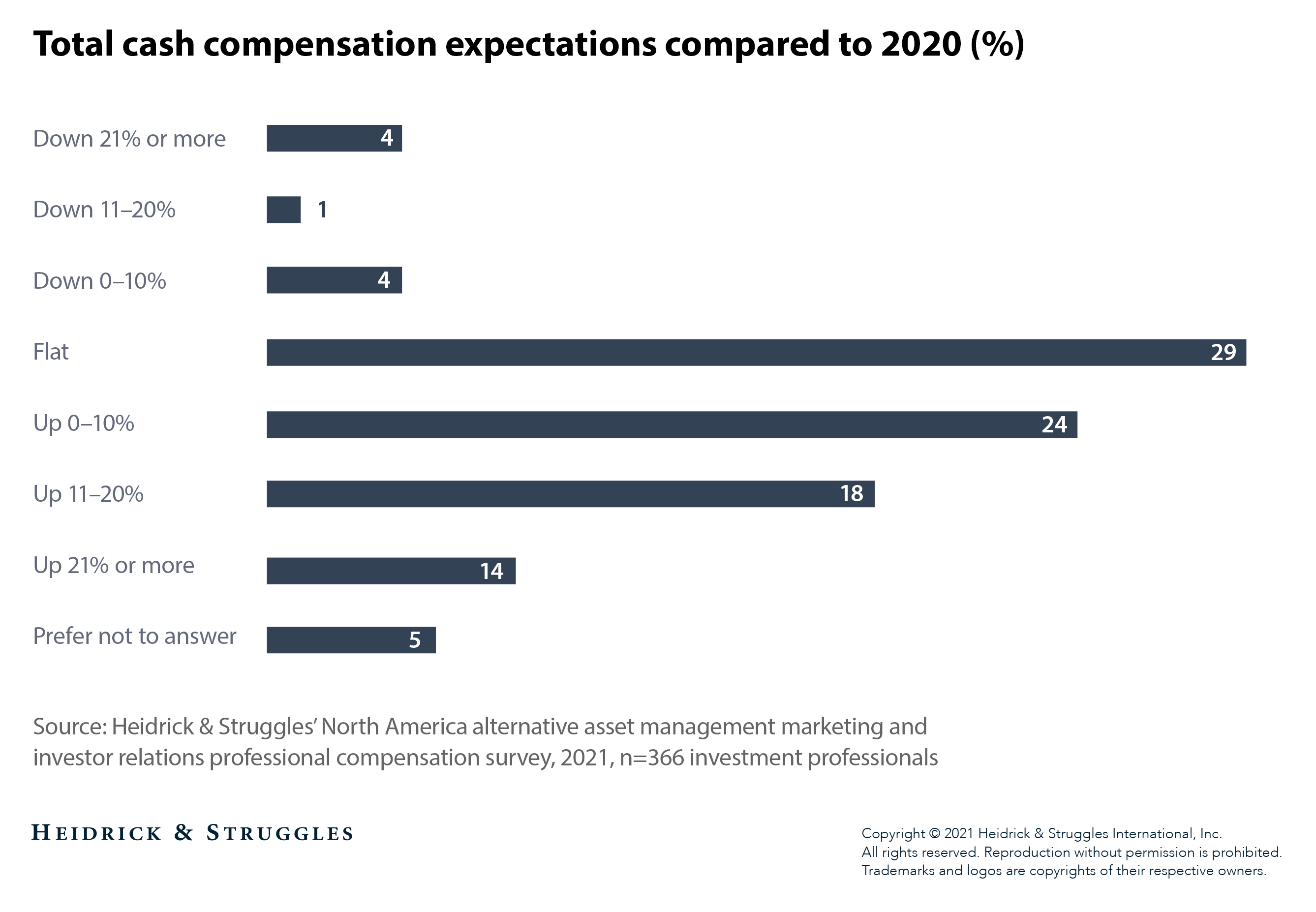

A strong majority of respondents, 71%, said there had been no change in performance expectations last year after COVID-19 began affecting business operations, and a slim majority expect cash compensation this year to rise over last year.

Looking ahead, we expect demand for diverse executives to continue to rise, and we see increasing interest from many firms in finding executives with experience in ESG investing, both of which should lead to higher compensation for executives who meet those criteria.

Demographics

Nearly half of the respondents to this survey had more than 20 years of work experience, and nearly two-thirds had more than 10 years’ experience in alternative asset fundraising. In terms of their firms, a third of respondents belonged to firms with more than $30 billion under management. Just over a third of respondents were in sales and investor relations, covering a wide range of products and investments. Just over half of respondents were male, and the majority were white. (For more, see charts on pages 6–7 of the full report.)

Base and bonus compensation trends, 2018–2020

Overall

Compensation for alternative asset marketing and investor relations professionals in all three sectors on the whole rises with seniority and size of firm, though there is some variation. Viewed by industry sector for 2020, professionals in hedge funds surpassed the other two sectors in median total cash compensation.2 (See pages 8–10 of the full report.)

Over the three years from 2018 to 2020, we saw some change—mostly increases—year over year, but a bit less than might have been expected. This is probably because the pause in early 2020 flattened the trajectory. Most respondents, 85%, said their bonuses were discretionary, and just over half, 57%, said that none of their 2020 bonus had been deferred. (See pages 11–13 of the full report.)

Gender, racial, and ethnic diversity

The survey shows that white or Asian male executives across sectors report higher median cash compensation than female executives or those who are Black, Hispanic, or Latinx. The overall difference in reported cash compensation is consistently greater for women than racially or ethnically diverse executives. This may be related to the fact that firms are paying a particular premium for racially or ethnically diverse executives because of the very low numbers of them in the industry. (See page 14 of the full report.)

Carry

Forty-five percent of respondents said they receive carry. The average vesting time is four years, and 69% of respondents say it starts vesting after the first year. Looking across all funds, median carry is highest at hedge funds, but PE firms edge them out at the 75th percentile. (See pages 15–16 of the full report.)

About the authors

Graham Beatty (gbeatty@heidrick.com) is a partner in Heidrick & Struggles’ New York office and the Americas Sector Leader of the Real Estate Practice.

Paul Charles (pcharles@heidrick.com) is a partner in the San Francisco office and a member of the Financial Services and Technology practices.

John Hindley (jhindley@heidrick.com) is a partner in the New York office and a member of the Financial Services Practice.

References

1 “The next great disruption is hybrid work—are we ready?” 2020 Work Trend Index Annual Report, Microsoft, March 22, 2021.

2 Median total cash compensation figures are not always the total of median base and median bonus figures, because not all respondents received a bonus.

Acknowledgments

The authors wish to thank Mohd Arsalan and Daria Sklyarova for their contributions to this report.