Crypto & Digital Assets

The Future of Crypto and Blockchain: Why Financial Services Leaders Should Advance a Digital Assets Strategy

Cryptocurrency gets the most attention of any blockchain technology, particularly given recent market volatility. These technologies have been the foundation for many other use cases for more than a decade. And some opportunities, in crypto and elsewhere, are now maturing. Yet leaders of many traditional financial services firms have, on the whole, held back, unsure of how to seize the opportunities, given the volatility and opacity of many blockchain initiatives as well as regulatory uncertainty. Interviews conducted in Q2 2022—including during the periods of heightened volatility—with industry experts and experienced executives at traditional financial institutions and blockchain specialist firms have allowed us to gain an understanding of what opportunities are likely to develop and when, as well as how soon certain disruptors could present substantial challenges. The sharp decline in crypto prices and an increase in market risk factors will cause some leaders to reconsider their commitment to future investments. Instead, we believe this is a critical time for leaders to define a strategy that gives them optionality and ensures readiness for a future that will continue to transform toward a digital assets economy.

The near-term future of finance

As we write this, almost 15 years after Satoshi Nakamoto’s whitepaper on Bitcoin, there is active concern in the market regarding a crypto winter triggered by falling crypto prices, a sharp fall in trading activity, and the collapse of algorithmic stablecoins.

It is clear that the crypto market is not a price inflation hedge as many had expected, or a significant source of diversification given the correlation with the broader equity market. All this has intensified the need for oversight and a clear regulatory framework to govern crypto assets.

Nonetheless, blockchain technology does not directly depend on the pricing of current tokens. Therefore we expect to see continued investment into blockchain infrastructure for enterprise applications, independent of the volatility of crypto assets. In fact, the current pullback in crypto assets will lead to further consolidation of firms and tokens and could provide a unique opportunity to attract crypto-native talent to blockchain projects.

All that said, it is now also clear that institutional players, given their access to sophisticated tools for risk management and trading, are better suited to dealing with digital assets relative to retail investors. We expect that clients of traditional financial institutions will continue to push them to support digital assets.

A survey we conducted in spring 2022 suggests that three-quarters of financial services executives included said they expect their firms to increase their investments in this area; they are most keen on digital assets as an exchange of value.1

Centralized crypto finance companies and some early-adopting traditional firms including BNY, Fidelity, US Bank, Mastercard, PayPal, and JP Morgan, have been active on this front. Yet both traditional firms and big tech companies are losing talent to the new crypto players because these new players offer a culture of innovation, the opportunity to fundamentally change the landscape of finance, and the potential for personal wealth creation.

To experiment successfully, traditional firms will need to overcome their concerns about volatility, scalability, and regulatory uncertainty as they do so.

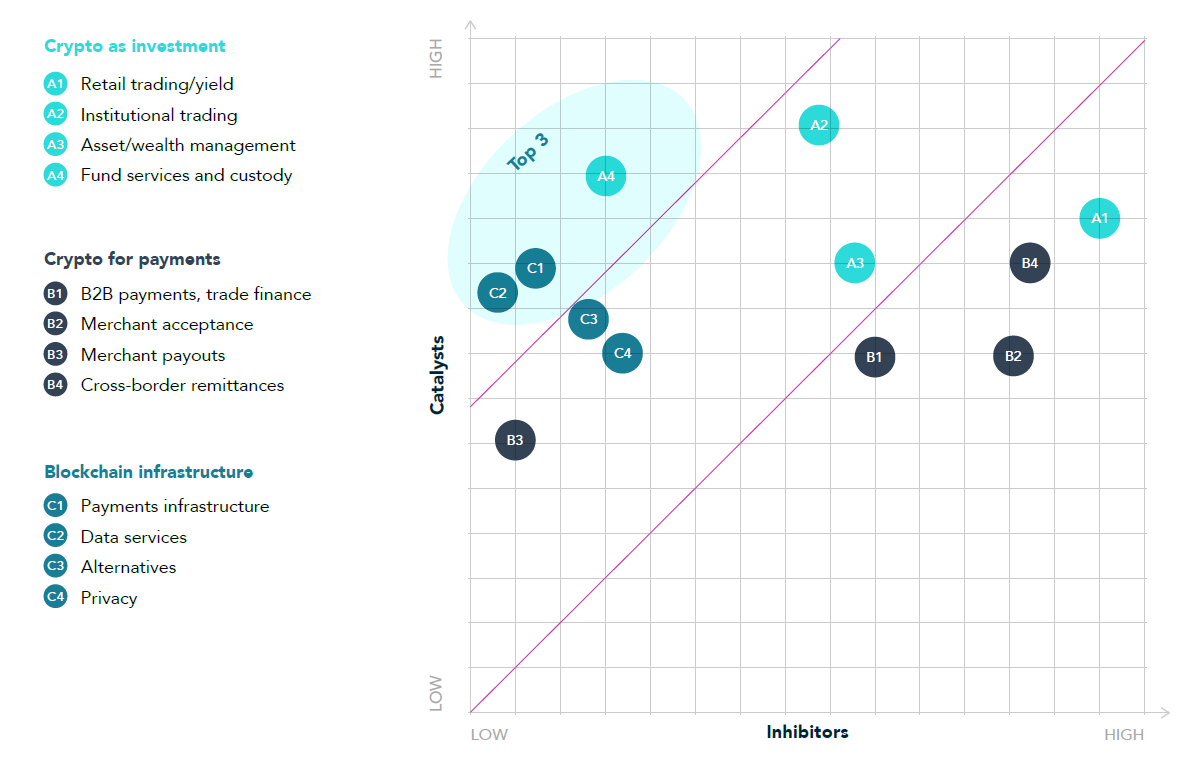

We see three major catalysts to growth:

- Market demand: Customer interest and adoption is a critical indicator for future investments. In addition, the speed at which central banks become comfortable with digital currencies will play an important role in shaping the market.

- Path to profits: Ultimately, incumbents need to see clear incremental business cases for new crypto applications. While this should not prevent experimentation, banks will need to consider unit economics over time, as spreads tighten.

- Supply readiness: Given the need for unique expertise and IP, incumbents need to watch the evolution of the ecosystem of providers in this market as well as build and attract their own blockchain talent.

In addition to market volatility, we see four other major inhibitors to growth:

- Threat to existing business: Some crypto use cases are designed to remove friction and transaction costs from today’s financial system. Banks need to tread carefully and consider the near- and long-term impact of disrupting an existing business model.

- Cyber-specific risk: Cryptocurrency-based crime hit a new all-time high in 2021, with illicit addresses receiving $14 billion over the course of the year, up from $7.8 billion in 2020.2 And $3.2 billion in cryptocurrency was stolen in the same year, of which 72% was stolen from DeFi protocols, according to Chainalysis.3

- Scalability and sustainability: Despite huge growth, digital assets represent only about 1% of overall global financial wealth. Further, the speed and throughput of various chains remain abysmally low relative to current payments networks. In some cases, transaction costs (for instance, gas fees for Ethereum) remain high, especially when the networks are congested. Finally, retail interest may ebb as returns from crypto investments are expected to moderate over time.

- Regulatory uncertainty: The most material challenge to future investments is the lack of a clear regulatory framework. Several questions remain regarding the legality of digital assets and the jurisdictional authority across the different regulators. In this environment, many incumbents are unwilling to push the boundaries of regulation, especially when some business cases remain dubious in their value creation potential.

We scored the 12 use cases described below (see sidebar, "Crypto and blockchain: 12 use cases") based on our view of the relevant catalysts and inhibitors for each of them. “High” indicates significant client demand and contribution to profitability; “low” indicates that client demand exists but infrastructure and/or regulatory hurdles need to be overcome. In the following chart, the most near-term attractive use cases are in the upper left:

Against this backdrop, incumbent financial firms would do well to make some no-regret moves—learning about the space through participation in discussion forums, for example, and keeping tabs on technology players emerging in their space. Over time, it will be critical for senior leaders to engage directly on strategy, investment, and talent needs. They can start to develop their next moves—and the leaders they will need to make them—by addressing a few questions:

- Path to play:

- Given your strategy, customer base, and current talent, where can you play today on the spectrum of wait-and-watch to experimentation to active participation? To maintain or improve your competitive position, where do you need to be playing in three years?

- What are your underlying beliefs about the future of crypto and client demand, and what are some no-regret decisions you can make now?

- Capabilities needed:

- What are relevant start-up firms to track, invest in or partner with?

- Do you have an updated view of how your client needs will evolve?

- How can you keep abreast of relevant developments in this space?

- How can you best find the leaders you need?

How to be relevant in that future

This emerging landscape requires traditional finance firms to develop a new playbook to participate and win. Over the next two or three years, we see a different path for larger and smaller incumbent players:

- Large incumbent financial firms: The onus of supporting and championing crypto will fall on large banks and other financial institutions. But each large player’s chosen approach will depend on its beliefs, risk appetite, risk of disruption, and client needs. Most will actively experiment with select use cases, as some have already started doing. They may act by themselves or in partnership with other financial or technology players. A select few are already willingly embracing crypto by building infrastructure and products, while staking out their position as first movers.

- Focused banks and financial institutions: These firms will likely play to their existing strengths and wait to see what works for the larger players. Community banks, for example, might steer clear of the allure of the new world but a focused, digital-first player like WebBank will embrace crypto by enabling new economy players as their preferred banking partner.

Beyond senior engagement and commitment, we see three critical enablers for success.

1. Partnerships

Being clear about the respective value proposition that traditional finance and centralized crypto firms each bring to partnerships will be important. We have seen two models. In the first, traditional firms bring relationships with institutional clients, while centralized crypto firms bring unique IP to solve crypto-specific challenges. As an example, BNY Mellon is building a custody solution for clients with collaborators. In the second, the two types of firms form virtuous ecosystems, so institutional clients get access to an end-to-end solution. For instance, Coinbase is a primary investor in Circle; BNY Mellon is serving as the primary custodian for the Reserves of Circle’s USD Coin; BlackRock invested in Circle with an eye to likely manage Circle’s assets; and Stripe announced support for Circle’s stablecoin, USDC, to enable payments for Twitter content creators.

Such partnerships are attractive to technology and crypto firms because of traditional players’ large client bases and brand reputation, as well as the likelihood of investment from the incumbents. These may be mega players like Coinbase or smaller firms like Fireblocks, NYDIG, Chainalysis, or Lukka.

2. Organization

Firms that are early in their journey rely on an enterprise strategy function to define the business case and near-term road map, and then prototype early solutions. Firms that have a stronger commitment to digital assets are building business units with a dedicated executive leader to grow and scale their propositions. Sometimes these lie within an existing line of business—for instance, BNY Mellon stood up a digital custody business within its broader custody business—or they can be independent business units, such as Fidelity Digital Assets, which are unencumbered by the traditional operating model and equipped with dedicated talent, investments, and technology.

3. Talent

Succeeding with crypto initiatives also requires a proactive approach to managing talent, given fierce competition to attract the right leaders.

Skill sets that are critical to success include product, engineering, risk/compliance/legal, and strategy. A model where the crypto business sits in an existing line of business will also require leaders with capabilities related to transformation such as creating new ways of working and collaborating across boundaries. In addition, other Heidrick & Struggles work has identified four leadership capabilities that will be critical for new leaders: leading through influence, driving execution, creating possibilities from new thinking, and having an ownership mindset. When taken together, these allow leaders to build strong, trusting, and inclusive relationships across their firms, which helps new ideas get heard and supports resilience on their teams. (For more, see “Transformation in financial services: Succeeding with new leadership roles to thrive in the new normal” and “Future-ready leaders: Finding effective leaders who can grow with your company.”)

Partnering with start-ups that have complementary solutions will give incumbents a chance to connect with high-end talent who might otherwise hesitate to work in large banks—and it may prevent some traditional-firm executives from jumping ship. Investing in these start-ups will also help incumbents get their business cases prioritized.

Financial services executives who responded to our Spring survey indicated their companies are spreading the net wide to find talent, most often hiring from tech companies, developing their own emerging leaders, and establishing partnerships or hiring consultants.4 And they are implementing these tactics in collaborative ways that develop other internal talent as well. As an example, BNY Mellon has invested in attracting crypto talent with experience in security and ledgers, and has them working with existing leaders with experience in building platforms.

Over time, successful incumbents will bring together the best of both worlds: the stability, resilience, and regulatory compliance associated with banks, with the innovation, creativity, and intuitiveness of technology start-ups. Understanding the landscape now—and making right bets on strategy and talent—will best position firms for success.

About the authors

David Richardson (drichardson@heidrick.com) is a partner in the Financial Services Practice and leads the global Market Infrastructure & Data Services sector and co-leads the Crypto & Data Assets sector in the Americas; he is based in Heidrick & Struggles’ New York office.

John Rolander (johnsrolander@gmail.com) is an expert in financial services who has advised global financial institutions in Europe, Asia, and the United States.

Todd Taylor (ttaylor@heidrick.com) is a partner in Heidrick & Struggles' New York office and the global managing partner of the Financial Services Practice.

Kunal Vaed (kunal.vaed@gmail.com) is an independent advisor and a former financial services executive, who led digital wealth businesses at JP Morgan and E*TRADE.

Srini Venkateswaran (srini.venkateswaran@gmail.com) is a strategic advisor to financial services firms and start-ups, and is based in New York.

Adrianna Huehnergarth (ahuehnergarth@heidrick.com) is an engagement manager in the New York office.

Acknowledgments

The authors wish to thank the following executives for sharing their insights: Mark Casady, General Partner, Vestigo Ventures; Nikhil Chandhok, Chief Product Officer, Circle; Mike Demissie, Head of Digital Assets and Advanced Solutions, BNY Mellon; Seth Goodman, Chief Revenue Officer, WebBank; Gunjan Kedia, Vice Chair of Wealth Management and Investment Services, U.S. Bank; Phil Kelly, Head of Business Development, O(1) Labs; Cyril Mathew, Global Head of Business Development and Partnerships for Crypto/Web3, Stripe; Dan O’Prey, Chief Product Officer, Bakkt; Sarthak Pattanaik, Chief Information Officer, Digital Assets, Treasury Services, Clearance and Collateral Management, BNY Mellon; David Puth, CEO, Centre Consortium; Brian Quintenz, Advisory Partner, a16z; Roman Regelman, CEO of Securities Services and Digital, BNY Mellon; Sandra Ro, CEO, Global Blockchain Business Council; Christine Sandler, General Partner, Walden Bridge Capital; Raj Seshadri, President, Data and Services, Mastercard; Kristin Smith, Executive Director, Blockchain Association; Hadley Stern, Global Head of Digital Asset Custody, BNY Mellon; and Kevin Werbach, Professor of Legal Studies and Business Ethics, The Wharton School, University of Pennsylvania. Their views are personal and do not necessarily represent those of the companies they are affiliated with.

References

1 Proprietary survey conducted by Heidrick & Struggles in May 2022.

2 Mengqi Sun and David Smagalla, “Cryptocurrency-Based Crime Hit a Record $14 Billion in 2021,” Wall Street Journal, January 6, 2022.

3 The 2022 Crypto Crime Report, Chainalysis, February 2022.

4 Proprietary survey conducted by Heidrick & Struggles in May 2022.

5 “Total stablecoin supply,” The Block, accessed May 31, 2022.

6 Casey Wagner, “Large Institutional Transactions Push Total Value Locked in DeFi to $239B,” Blockworks, April 20, 2022.

7 Mengqi Sun and David Smagalla, “Cryptocurrency-Based Crime Hit a Record $14 Billion in 2021,” Wall Street Journal, January 6, 2022, wsj.com.