Leadership Succession Planning

Leadership teams in the top 50 Middle East companies: The path to the C-suite

Our first study of key leadership roles at leading Middle East companies shows that in 2023 companies relied more often on internal promotions; when hiring externally they showed a more marked preference for executives who came from the same sector and had previous C-suite experience; and fewer newcomers were women than in previous years.

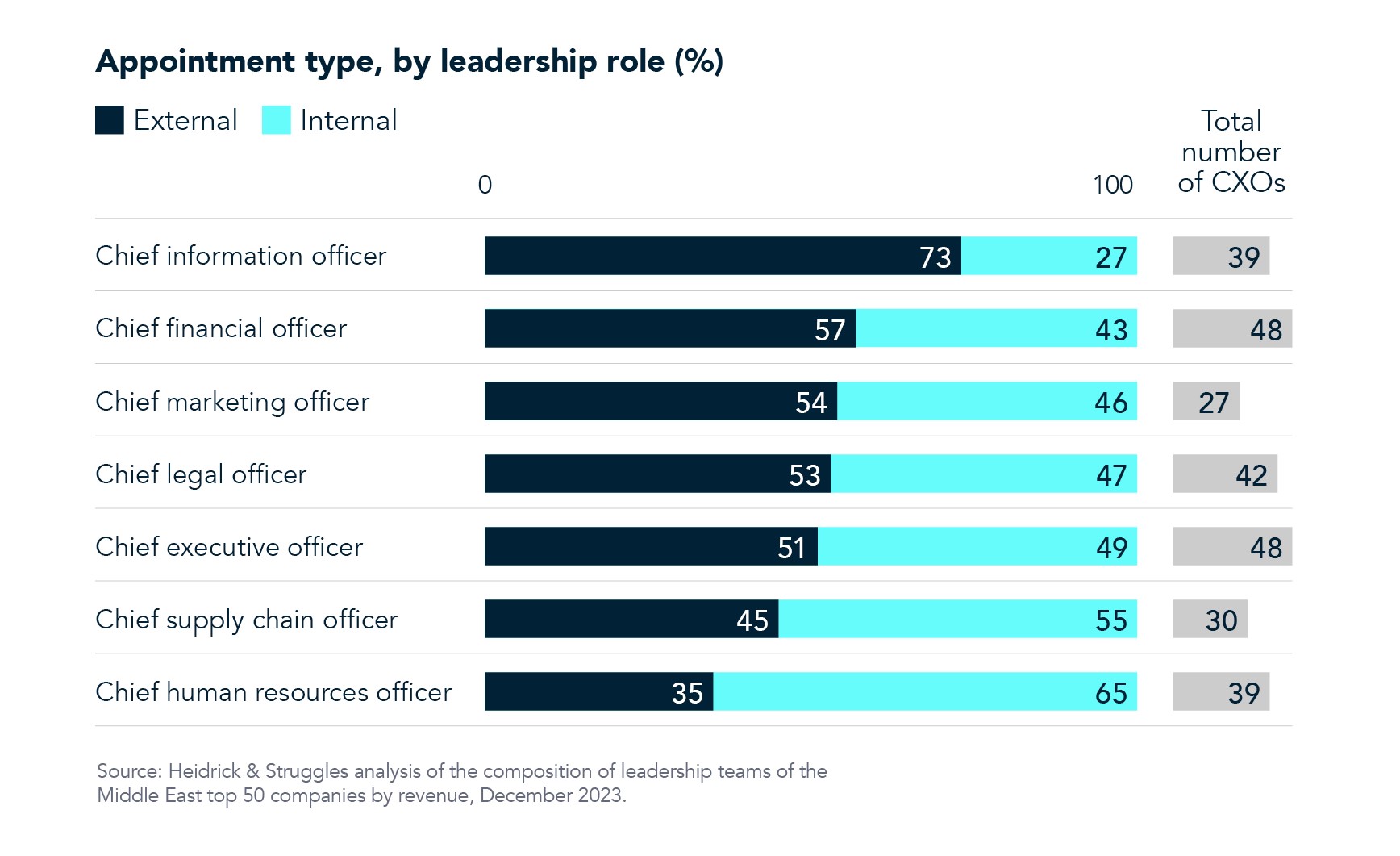

An increase in internal appointments. Overall, 53% of current executive team members were hired externally. This ratio is relatively persistent among most roles. However, there are two outliers: 73% of CIOs were hired externally, while only 35% of CHROs came from outside the organization. The heavy reliance on external talent for technology leadership roles is particularly notable because the rapidly increasing demand for executives with AI expertise will likely exacerbate competition for these leaders even further.

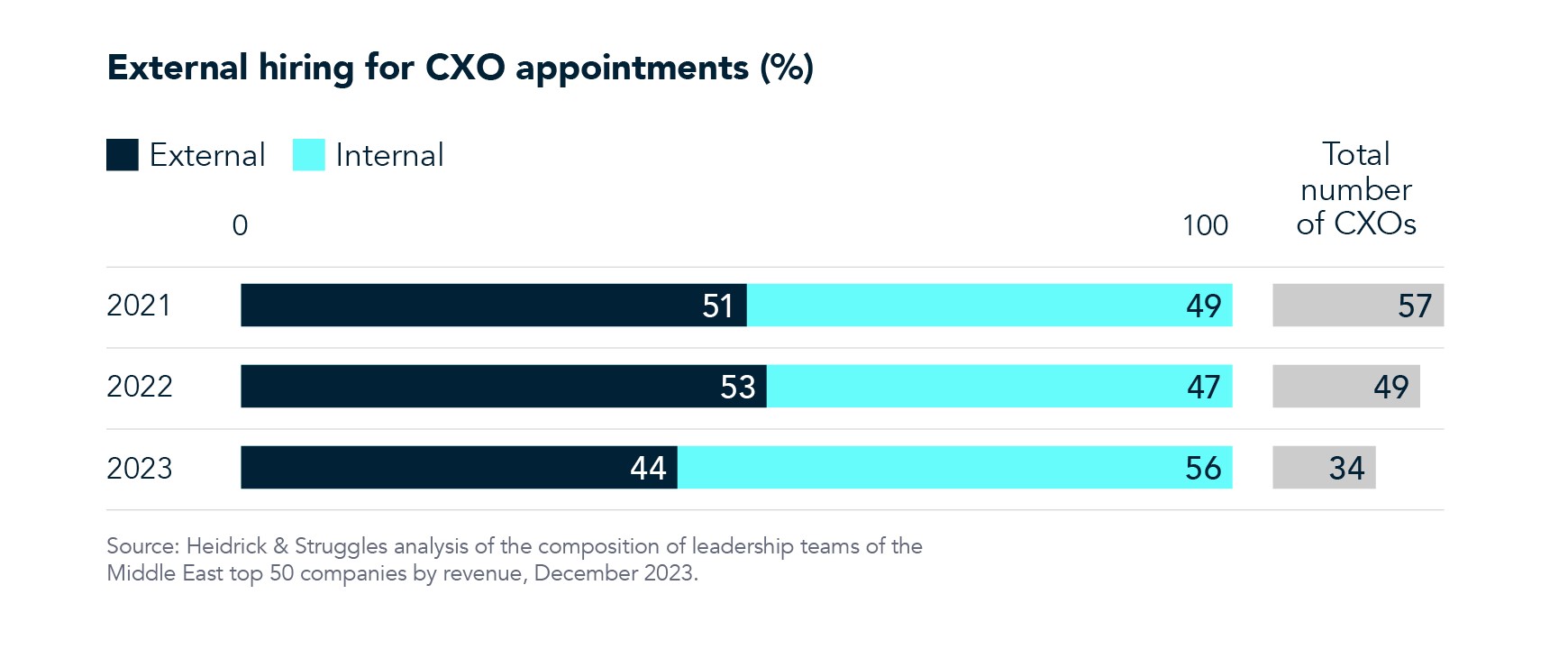

However, in 2023, more than half of new hires were internal promotions: 56%, a marked rise from earlier years. This suggests that companies have been able to improve their internal leadership development pipelines overall.

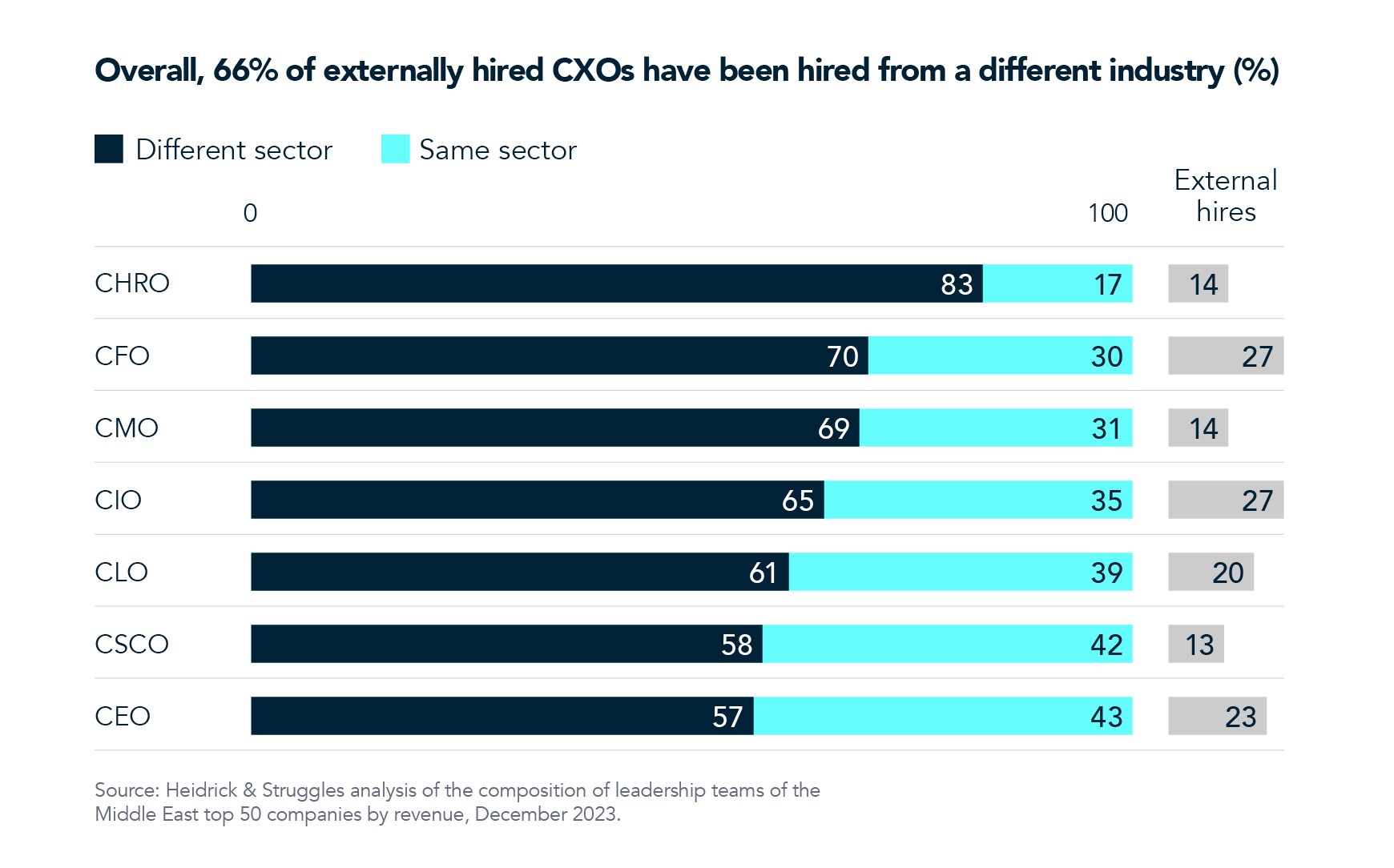

Sector experience. Among executives who were external hires, 66% came from a different industry. Roles such as CHRO and CFO saw a larger infusion of talent from other sectors, while CEO and chief supply chain officer positions have more often been filled by people with sector-specific experience.

However, the trend is shifting here as well: over the past two years, and in 2023 in particular, companies showed an increased preference for hiring executives from the same sector: 40% of external hires came from the same sector in 2023, up from 18% in 2021.

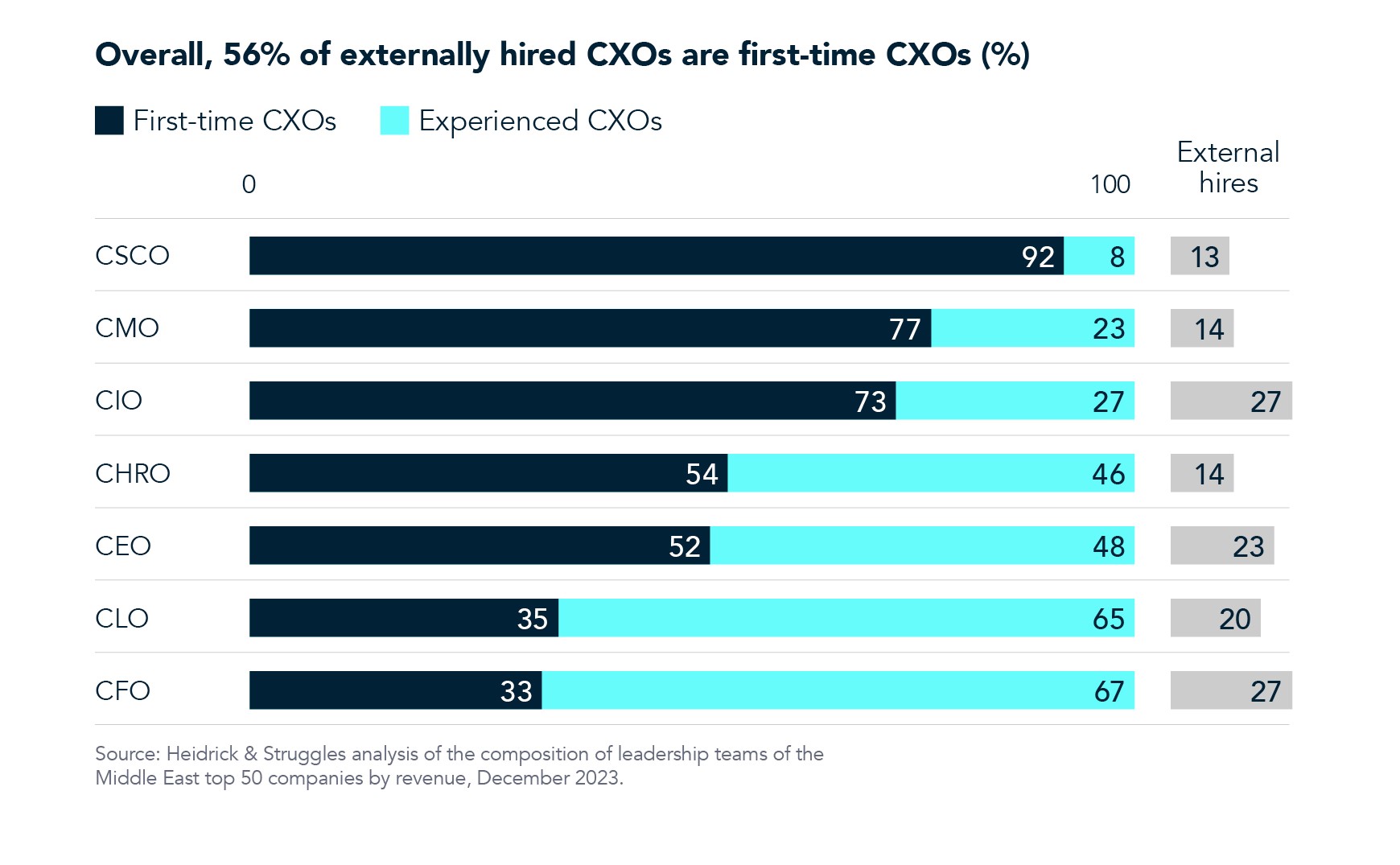

First-time leaders. It’s also notable that 56% of externally hired CXOs came into their current roles without any prior C-suite experience. This is most often the case with chief supply chain officers, chief marketing officers, and chief information officers.

But there has been a shift in preferences here as well: in 2023, 53% of external hires had prior C-suite experience, compared to 35% in 2022 and 46% in 2021.

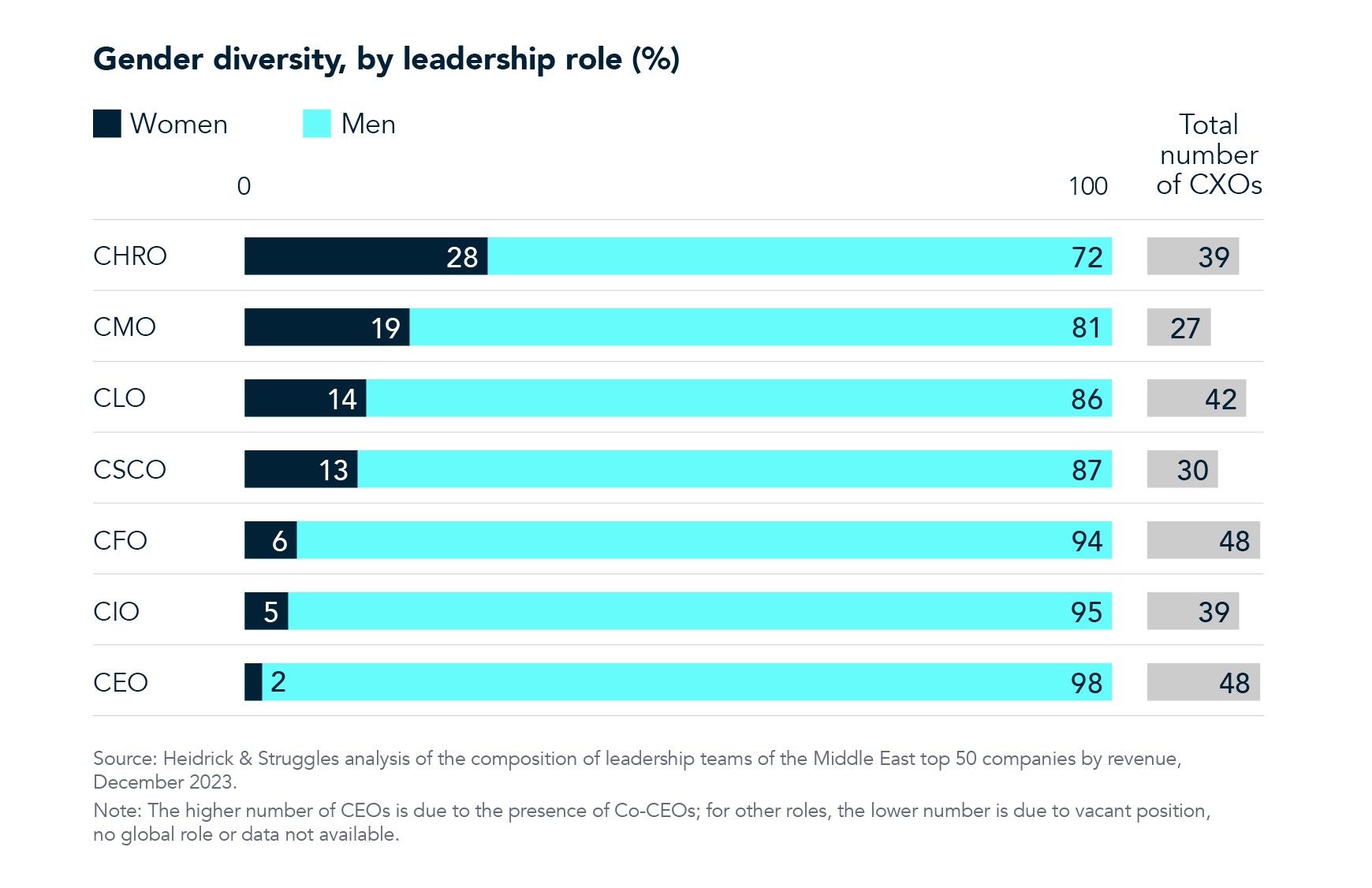

Gender balance. Twelve percent of the CXOs are women; they are most often CHROs, at 28%, and least often CEOs, 2%. Forty-four percent of women were hired from outside their current companies, compared to 53% of men. Here, too, 2023 saw a change of trend, with a decrease in the share of appointments that went to women: from 14% in 2021 and 16% in 2022 to 11% in 2023.

Three considerations

- Succession planning: While the increased share of internal appointments indicates good progress in the development of internal pipelines, Middle East companies could do more, particularly since they seem comfortable with appointing first-timers even to fill critical roles. Building their bench deeper into the organization and across all leadership roles should help ensure they have viable candidates across many timeframes and scenarios.

- Gender balance: Our analysis suggests that companies can double down on increasing gender balance across their talent pools, with a focus on P&L roles, which globally more often lead to CEO or board positions. In our experience, companies that are successful in developing and retaining more women in leadership positions take an intentional approach throughout the leadership pipeline, from attraction through senior leadership succession planning.

- Onboarding practices: Fifty-two percent of the leaders in roles were appointed since January 2021, and many came with no previous C-suite or sector experience. The step-change to an executive role in itself comes with significant pressure, and being new to the sector and the company—and perhaps, for many executives, to the region as well—adds additional layers of complexity. This makes a hyper-tailored onboarding critical: boards, CEOs, and HR teams should work together to shape onboarding, mentoring, and development programs based on the information they gleaned through the recruitment process for each incoming leader. Companies should pay particular attention to the impact leaders hired externally could have on the organizational culture, making sure there is a healthy balance between maintaining and bolstering the existing culture and having potential to reshape it for future needs.

About the authors

Richard Guest (rguest@heidrick.com) is the partner in charge of Heidrick & Struggles’ Middle East and North Africa, based in the Dubai office, and the regional managing partner of the global Technology & Services Practice for Asia Pacific and the Middle East.

Maliha Jilani (mjilani@heidrick.com) is the leader of the Social Impact practice and co-leader of the Board practice in the Middle East and North Africa region; she is based in the Dubai office.

Shaloo Kakkar Kulkarni (skulkarni@heidrick.com) is a partner in the London and Middle East offices and a member of Heidrick Consulting.

Markus Wiesner (mwiesner@heidrick.com) is a partner in the Dubai and Singapore offices and the regional managing partner of Heidrick Consulting for Asia Pacific, Middle East, and Emerging Markets.