Private Equity

Private equity focus: A new process for CEO succession planning in a new normal

CEO succession planning is a critical indicator of organizational foresight and future performance, widely regarded as one of the key responsibilities of boards. However, recent Heidrick & Struggles surveys of CEOs and board members around the world1 have found that leaders at private equity (PE)-backed companies place a lower priority on CEO succession planning than their peers at public companies—28% of board members we surveyed at these firms say that they consider CEO succession planning only on an emergency basis.

This tracks with PE firms’ traditional approach, but it has persisted through a fundamental change in the landscape for PE portfolio company leadership:2 longer exit timelines mean that PE investors are now having to think more like operators, which means creating value through operations and, often, experiencing more leadership changes than they have been used to. Indeed, today over 70% of CEOs at PE-backed companies are replaced during an average hold period of five and a half to six years. Our own experience and conversations with private equity leaders show that a more established and robust succession planning process— one integrated into an overall talent strategy— will best-position PE firms for success.

Drawing on data gathered from Heidrick & Struggles surveys conducted in 2024 and 2025 of CEOs and board members around the world, this report explores current approaches to succession planning at PE-backed companies and what these leaders can do to best position their organizations for the future in the current environment.

Top succession planning priority today

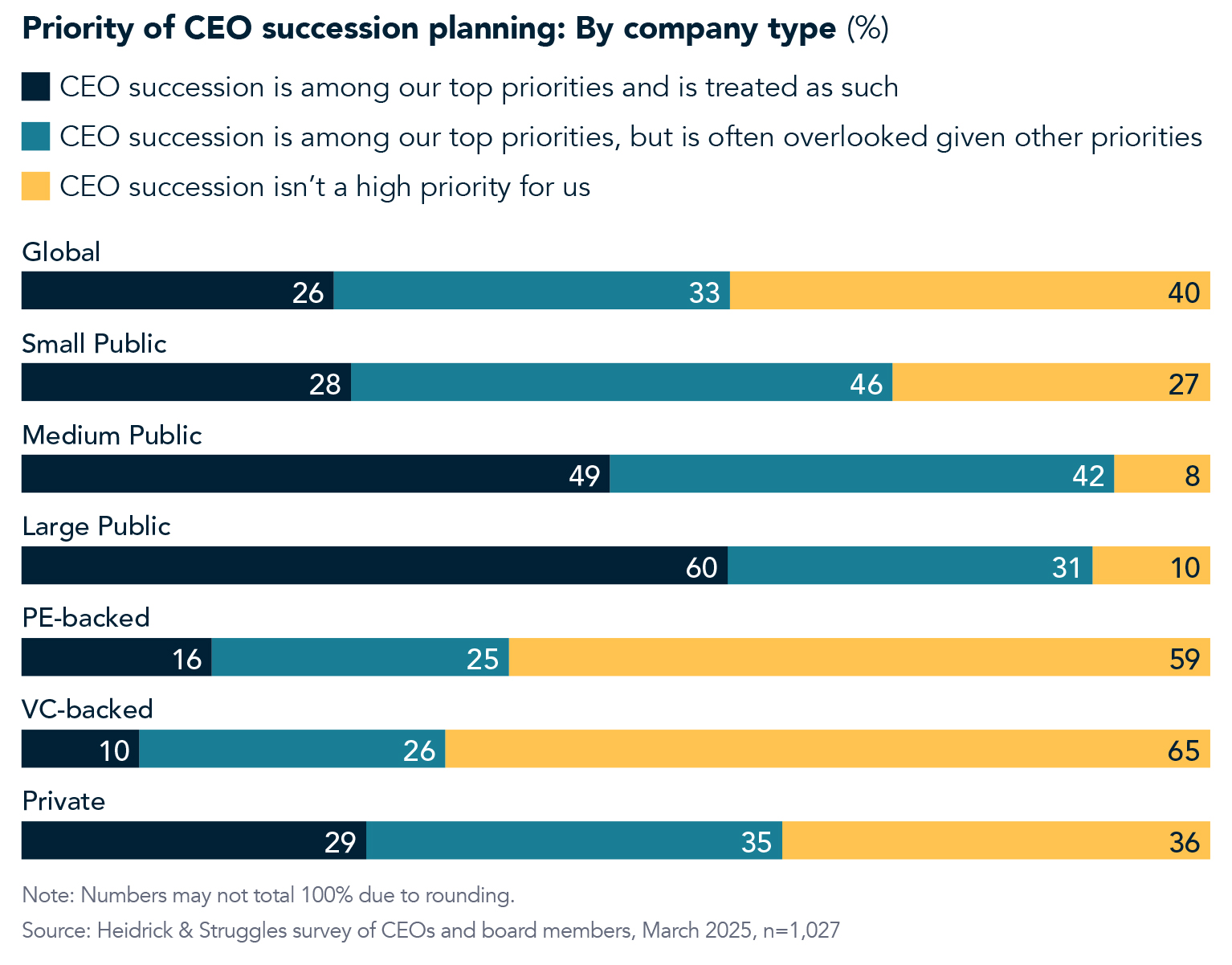

Globally, across all ownership structures, 26% of CEOs and board members say that CEO succession is among their top priorities and is treated as such. However, only 16% of respondents from PE-backed companies say the same.

Looking ahead: Borrowing from corporate to benefit PE

Regardless of where PE leaders choose to start, clarity regarding the succession planning process, the responsibilities of each person, and agreement on the importance of succession planning to overall value creation and strategy is of the utmost importance.

We have seen that the private equity firms that do this well have centralized talent functions and treat talent strategy and management as core drivers of value creation. We have three key recommendations for PE firms looking to improve their CEO succession strategies.

Assume and plan for at least one CEO succession per portfolio hold period

The likelihood of the CEO at the beginning of the investment being retained throughout the hold period has been less than 20% for more than a decade now. Additionally, multiple studies have shown that replacing a CEO typically extends the hold period by an average of six to 12 months, and these transitions can incur substantial costs for PE firms in delayed and unmet value creation. Given this business reality, it is prudent for PE boards plan for at least one CEO replacement throughout the hold period.

Implement portfolio-level, fit-for-purpose CEO succession planning to avoid conflicts of interest

In most cases, the replacement CEO in a portfolio company will be an external hire, brought in to improve performance—often due to a lack of confidence in the existing leadership. This means asking the sitting CEO or chief people officer to manage this process creates an obvious conflict of interest (unlike longer term planned successions seen at other types of companies). In addition, PE firms that centralize CEO succession planning with targeted, periodic market mapping of “ready now” talent are often best suited to minimize business disruption.

Conduct CEO succession planning proactively and continuously

Most public boards discuss CEO succession planning annually if not more frequently. Most PE-backed organizations, however, do so only on an as-needed basis. Periodically scanning the available talent market, combined with robust CEO performance management, ensures that PE firms have a more extensive set of options when they want to make a change.

Although CEO succession planning is a lower priority for PE-backed companies than public companies, the higher rate of CEO turnover in PE today, combined with the shifting talent landscape and volatile market conditions, means that a stronger focus on longer-term leadership assurance will better prepare these organizations for a present and future in which more is at stake, more is uncertain, and more is expected of the CEO than ever before. We believe that an ongoing approach to succession planning, with a broader set of selection, evaluation, development, and replacement activities for both the CEO and board, will best position companies for the future, whether private or public.4

About the authors

Gustavo Alba (galba@heidrick.com) is a partner in Heidrick & Struggles’ Miami and New York City offices and a co-global managing partner of the Private Equity Practice.

Jason Henderson (jhenderson@heidrick.com) is a partner in Heidrick & Struggles’ New York office and leads the Private Equity Practice for Heidrick Consulting.

Stephen Schwanhausser (sschwanhausser@heidrick.com) is a partner in Heidrick & Struggles’ Stamford office and a co-global managing partner of the Private Equity Practice.

References

1 An online survey of CEOs and board members conducted in June and July 2024 garnered 1,702 respondents across sectors and markets around the world. Another online survey of CEOs and board members conducted in spring of 2025 garnered 522 respondents across sectors and markets around the world.

2 For more on assessing CEO candidates, see Jason Henderson and Amanda Worthington, “The landscape for hiring a PE operating company CEO is changing fast—hire for “how” to navigate it successfully,” Heidrick & Struggles, https://www.heidrick.com/en/pages/private-equity/the-landscape-for-hiring-a-pe-operating-company-ceo-is-changing-fast.

3 “Route to the Top | Today’s CEO: The growing importance of character, learning, and leading in a contested world,” Heidrick & Struggles, February 28, 2024, heidrick.com

4 “Route to the Top | Today’s CEO: The growing importance of character, learning, and leading in a contested world,” Heidrick & Struggles, February 28, 2024, heidrick.com.