CEO & Board of Directors

2026 CEO & Board Confidence Monitor

Year over year, confidence that an organization’s executive team will deliver on their strategic plan has increased among leaders at companies across markets, sectors, and ownership types. Given ongoing volatility, this rise is initially surprising and suggests that leaders are learning to operate effectively amid persistent disruption. That resilience is the main takeaway from our 2026 Confidence Monitor survey, which draws on responses from 1,921 CEOs and board members across industries, regions, and ownership structures.

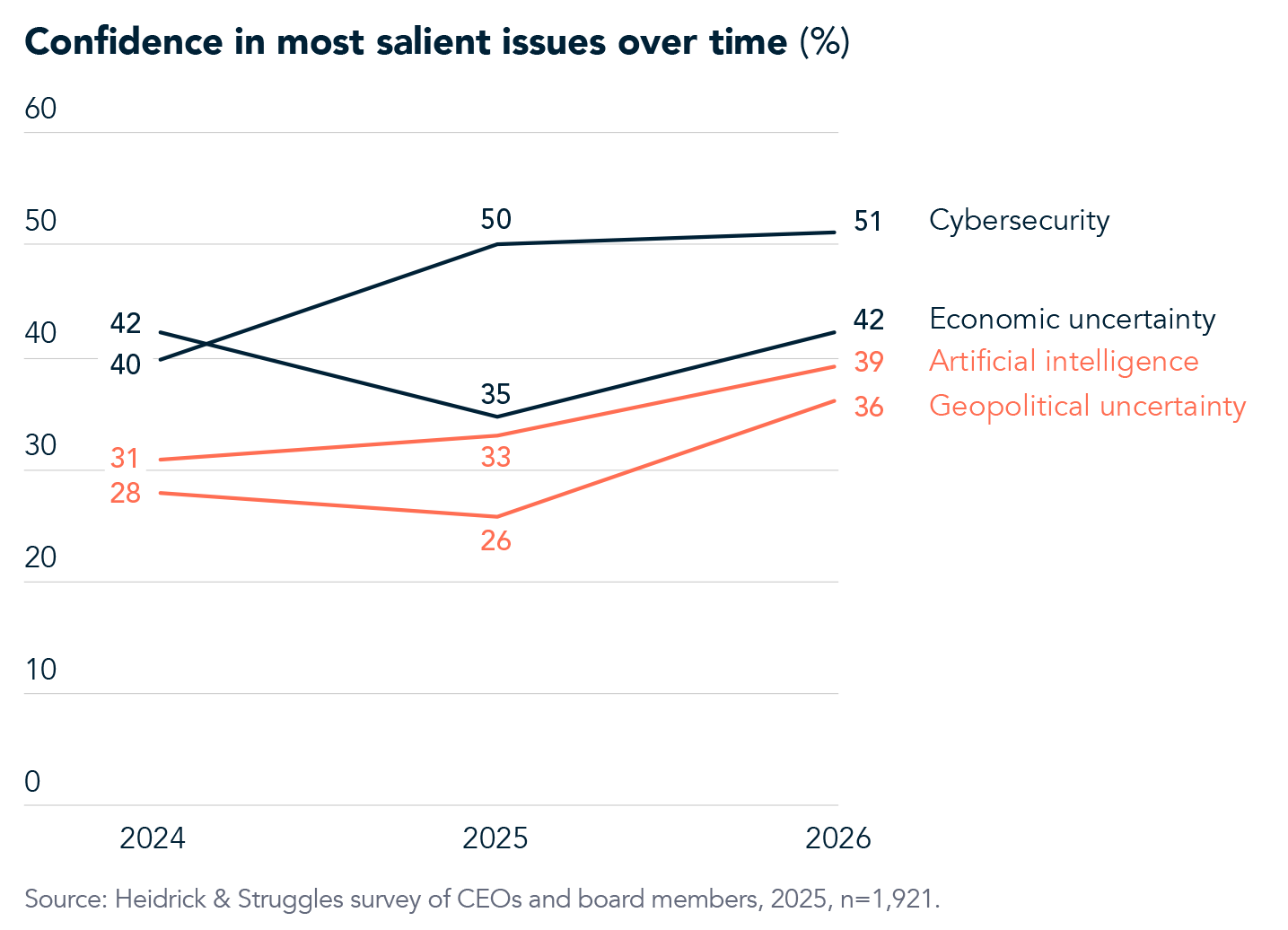

Executive teams’ confidence has also increased in terms of their organization’s ability to address four of the five most salient risks facing organizations today: economic uncertainty, artificial intelligence (AI), geopolitical volatility, and cybersecurity. This shift does not suggest a more stable external environment. Leaders remain focused on many of the same issues that have dominated their agendas for several years. Rather, the increase in confidence points to improved organizational capability. Investments in governance, foresight, and cross functional coordination appear to be strengthening leaders’ capacity to navigate uncertainty, even as many of the same risks remain firmly in view.

That confidence is strongest when leaders assess near term execution of their strategic plan. More than two thirds of respondents report being very confident in their executive leadership team’s ability to deliver on the strategic plan, signaling broad faith in day to day leadership and operational performance. However, confidence declines sharply when leaders consider long term continuity, which highlights a persistent tension between confidence in managing today’s challenges versus preparedness for sustaining leadership and resilience over time.

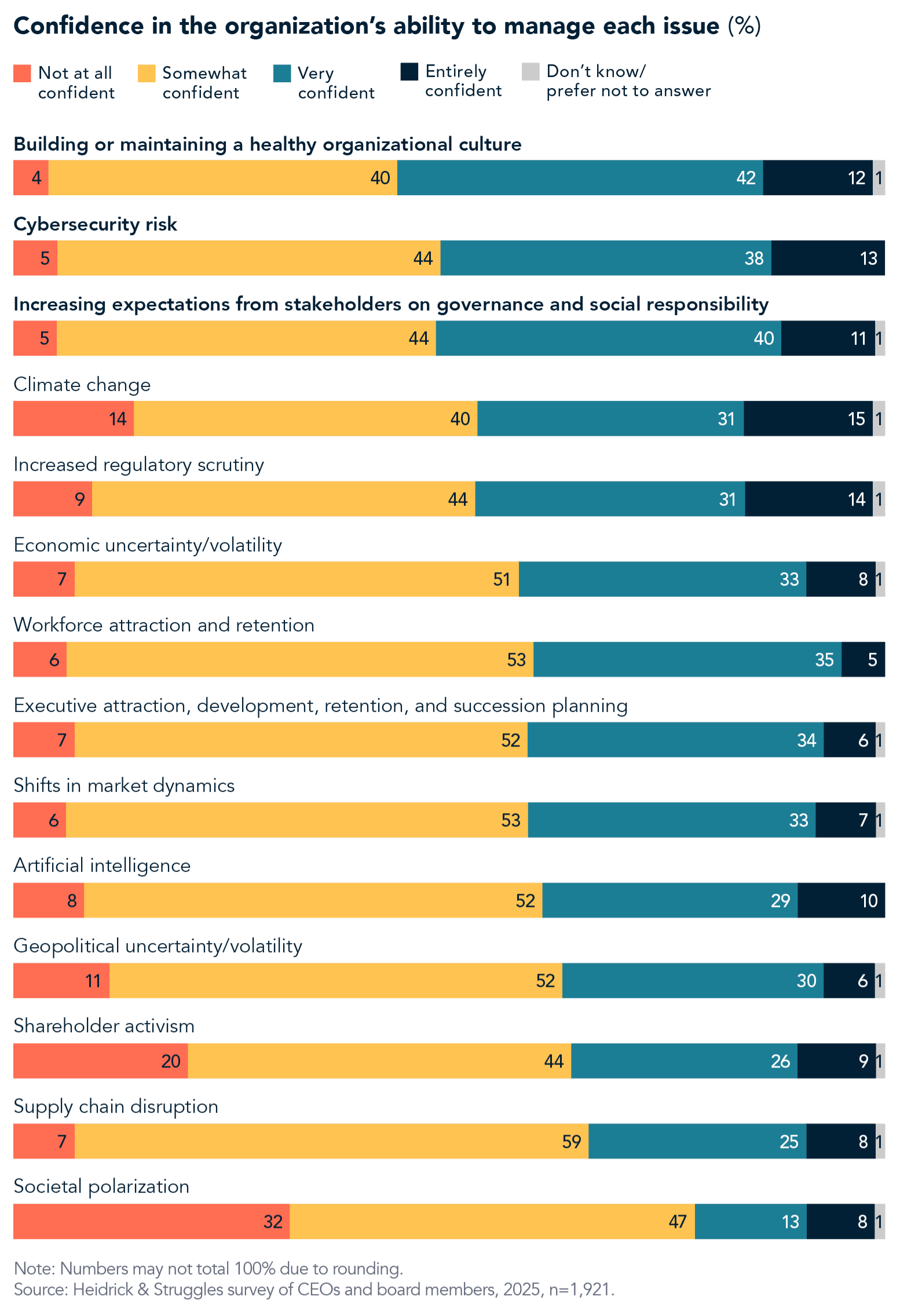

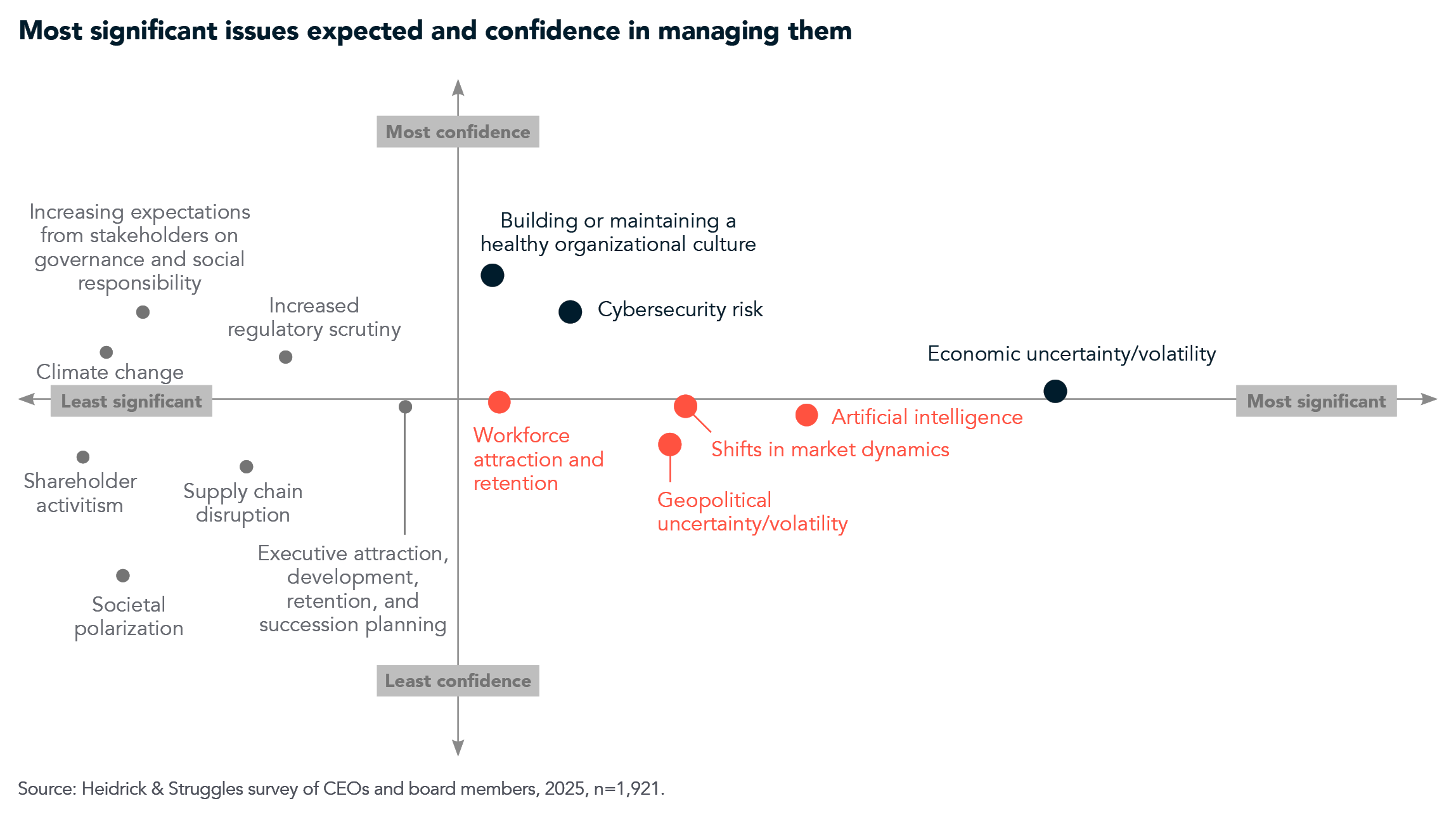

This near term confidence extends most clearly to specific areas of risk management. Overall, CEOs and directors report strong assurance in domains where capabilities have been built deliberately over time, such as their ability to build and sustain a healthy organizational culture, manage cybersecurity risk, and meet rising stakeholder expectations around governance and social responsibility.

That confidence, however, is uneven. Societal polarization stands out as a notable area of concern, with 79% of respondents reporting that they are only somewhat confident or not at all confident in their ability to manage it effectively. For more information on how business leaders are managing this issue, see our recent article on leading across boundaries.

For four of the five most salient issues—economic uncertainty, AI, geopolitical volatility, and cybersecurity—confidence has improved over time:

In other words, even as these risks remain prominent or grow in complexity, leaders in 2026 increasingly believe their organizations are equipped to respond. While meaningful gaps persist, the overall trajectory points to a maturing risk management posture. This shift likely indicates that organizations are developing stronger tools to navigate uncertainty in a world where disruption is now a constant. Investments in strategic planning, such as governance structures, foresight capabilities, and cross functional coordination, are translating into measurable confidence gains.

The central role of leadership

This evolution in risk management helps explain why leadership quality is so important. Leaders consistently express higher confidence where they believe they can directly shape outcomes. Even in an environment defined by external volatility, confidence in future success is strengthened when organizations demonstrate the ability to resolve the issues that are within their control. Notably, confidence has increased year over year across every organizational leadership category we asked about, signaling growing optimism despite ongoing uncertainty. Although more than two thirds of respondents are very confident in their executive leadership team’s ability to deliver on the strategic plan, that confidence drops sharply when leaders consider long term continuity. Only four in ten respondents expressed confidence that their CEO succession planning positions the organization well for the future. This gap is most pronounced among North American and European respondents, who tend to express lower confidence overall than their counterparts in Latin America (LATAM), Asia-Pacific (APAC), or the Middle East.

Ownership structure further shapes confidence. Respondents at small private equity-backed organizations are significantly less confident across the board than their peers at companies with other ownership types, which reflects the added pressure of leaner leadership teams, longer hold times, and uncertain exits. The findings suggest that while many organizations feel well led today, fewer are confident in the leadership pipelines required to sustain performance through prolonged uncertainty.1

Key risks: Significance and trends

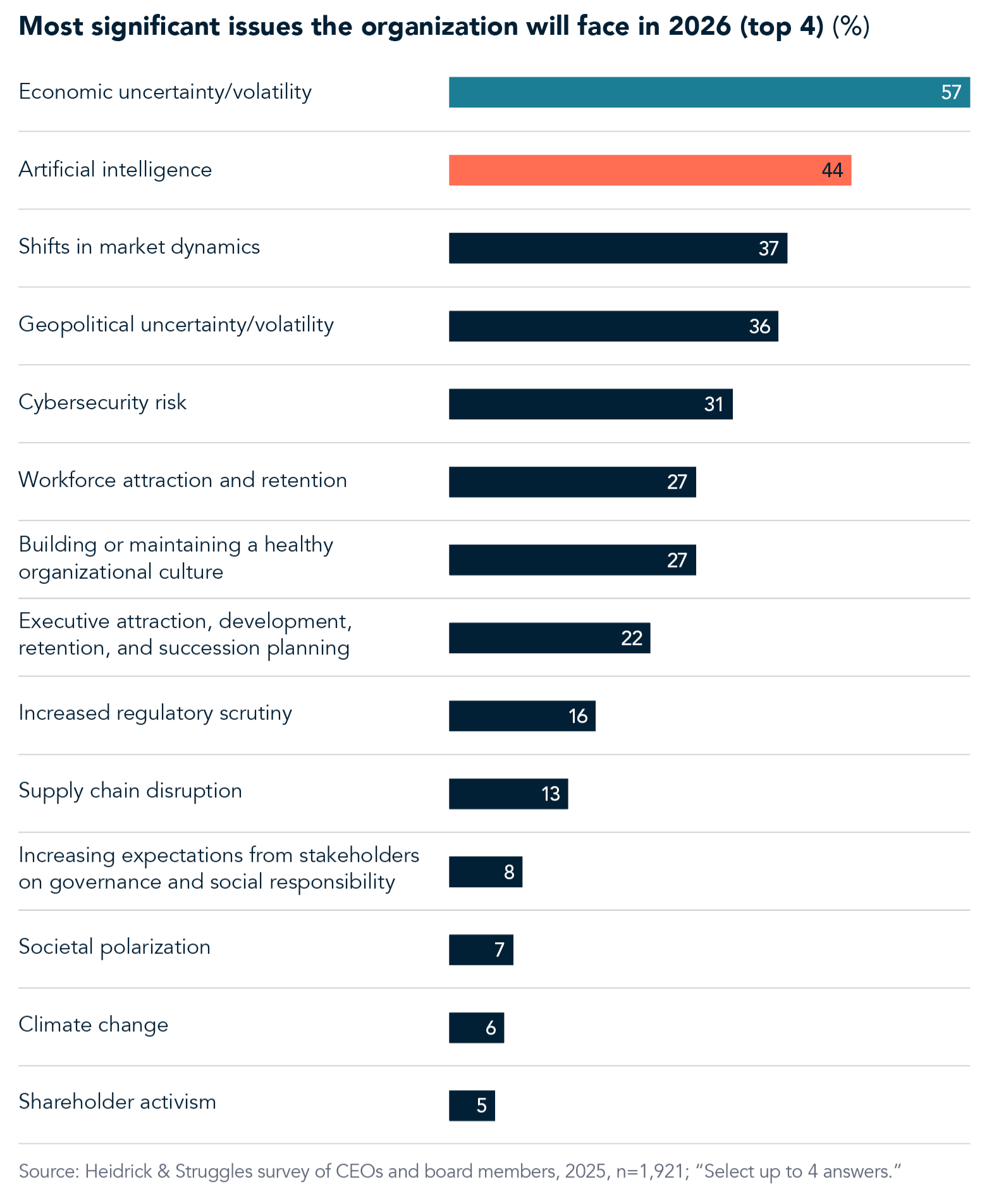

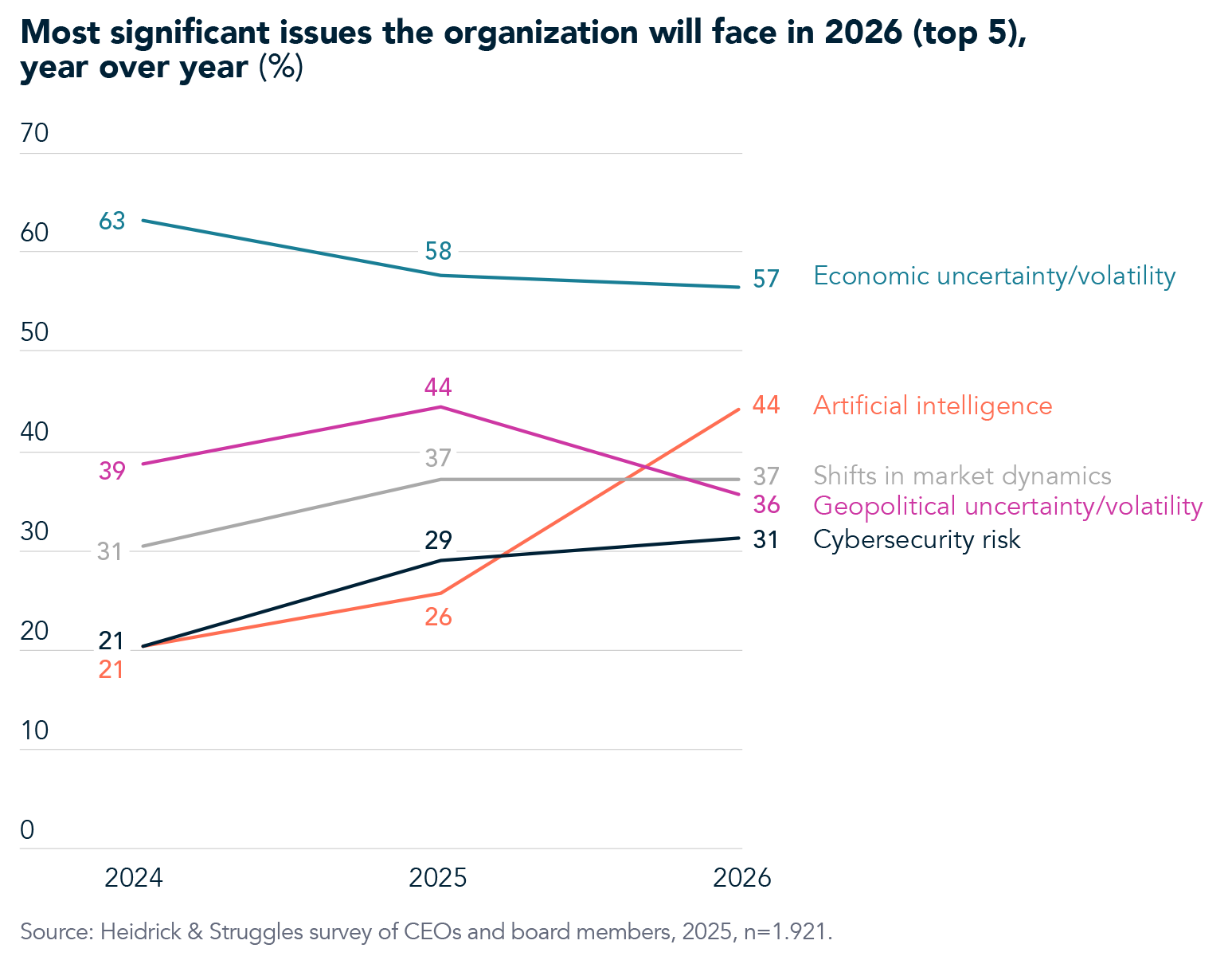

Confidence, however, is not shaped by leadership alone. It is continually tested by the nature of the risks organizations expect to face. As they have for the past three years, CEOs and directors identify economic uncertainty and volatility as the most significant issue they expect to face in 2026. However, AI has emerged as the fastest growing area of concern, increasing 18 points since last year’s survey. This shift underscores AI’s accelerating effect on strategy, operations, and risk management as organizations seek new ways to embed it successfully in their day to day work.

Importantly, many of these issues cannot be viewed in isolation. There is growing overlap between risk categories such as AI and cybersecurity: in a recent Heidrick & Struggles survey of chief information security officers, 57% identified AI, machine learning, and data analytics as the most important area of expertise for them over the next three to five years.2

Respondents’ concerns vary by the ownership structure, region, and industry of the companies they lead. Across ownership structures, leaders of larger organizations are more likely than those at smaller companies to identify geopolitical uncertainty as a key issue, likely because larger companies are more often global in scope, making geopolitical developments more salient to their operations. Consistent with this pattern, leaders at public companies—typically larger than privately owned organizations—are more likely to cite geopolitical volatility as a top concern.

Regional differences are similarly pronounced. Executives in North America and Europe tend to focus more on macro level risks, such as economic uncertainty and shifts in market dynamics, while executives in the APAC and Middle East regions prioritize cybersecurity, AI, and increasing expectations around governance and social responsibility.

External drivers of confidence gaps

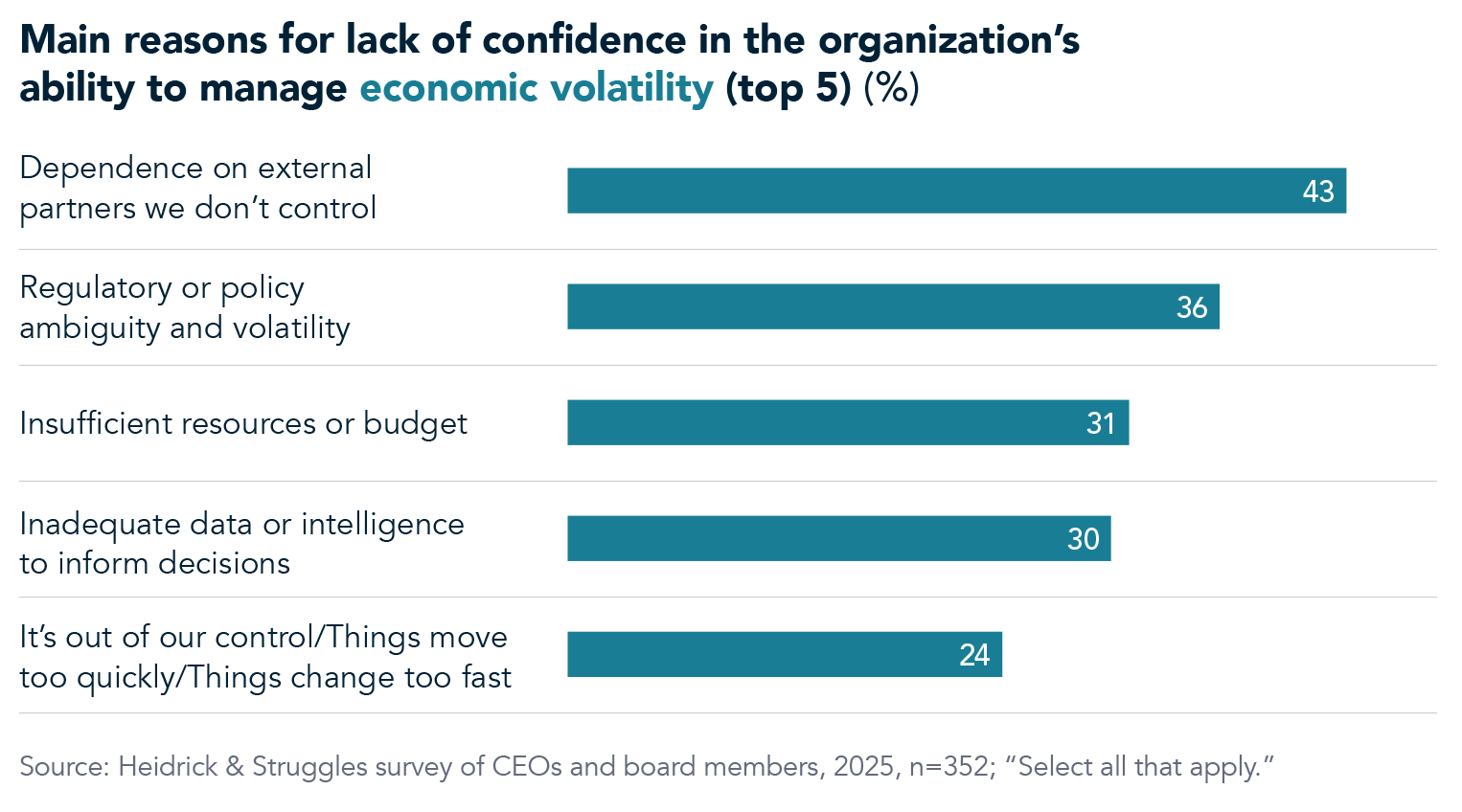

Even the best governance and foresight seem harder to translate into confidence for risks that sit largely outside organizational control, such as economic and geopolitical uncertainty. Across both issues, the most frequently cited reasons for low confidence cluster around dependence on external parties, regulatory and policy ambiguity, insufficient resources, inadequate data or intelligence, and the sense that events are moving too fast to manage.

Dependence on external networks is particularly notable, and concerns about it spike among family-owned businesses as well as organizations in APAC and the Middle East regions. These companies often rely more on concentrated networks of suppliers, customers, financiers, or government regulators than other types of companies, which amplifies the sense that crucial risk levers are held outside the enterprise. Regulatory and policy ambiguity plays a similarly powerful role, especially in industrial and healthcare sectors, where complex, shifting rules and state decisions can rapidly affect the economics of long cycle investments or highly regulated products.

For public companies, which must balance long term resilience investments against near term earnings expectations, concerns related to insufficient resources or budget and inadequate data or intelligence stand out. The result is a layered confidence gap: organizations are navigating external risks they cannot control, while simultaneously building the internal data, resourcing, and agility needed to respond at the speed the environment now demands.

Normalized volatility and the role of optimism

Finally, it is worth reflecting on the broader context in which leaders assess risk and confidence. One possible explanation for moderated concern about economic and geopolitical volatility is normalization. Organizations have navigated repeated disruptions over the past five years, starting with Covid 19 and including supply chain shocks, policy shifts, and tariffs. Leaders may now view these challenges as simply part of the new baseline. This does not diminish the importance of vigilance, but it does suggest that repeated exposure can build resilience and shape how leaders prioritize and interpret risk.

Optimism is both natural and valuable. Leaders’ confidence and hopefulness are not signs of complacency; they are human responses that enable leaders and organizations to act decisively under uncertainty. Optimism fuels strategic investment, talent development, and innovation, and it complements rigorous risk management. In other words, believing in the organization’s ability to navigate the future is itself a lever of resilience.

About the author

Jeremy Hanson (jhanson@heidrick.com) is a partner in the global CEO & Board of Directors Practice; he is based in the Chicago office.

References

1 For related analysis on strengthening leadership pipelines through attraction, retention, development, and succession planning, see our work on leadership assurance.

2 Heidrick & Struggles survey of chief information security officers, December 2025, n=371.