Board of Directors

Board Monitor Mexico 2025 | The quiet power of continuous board refreshment: A shift toward strategy

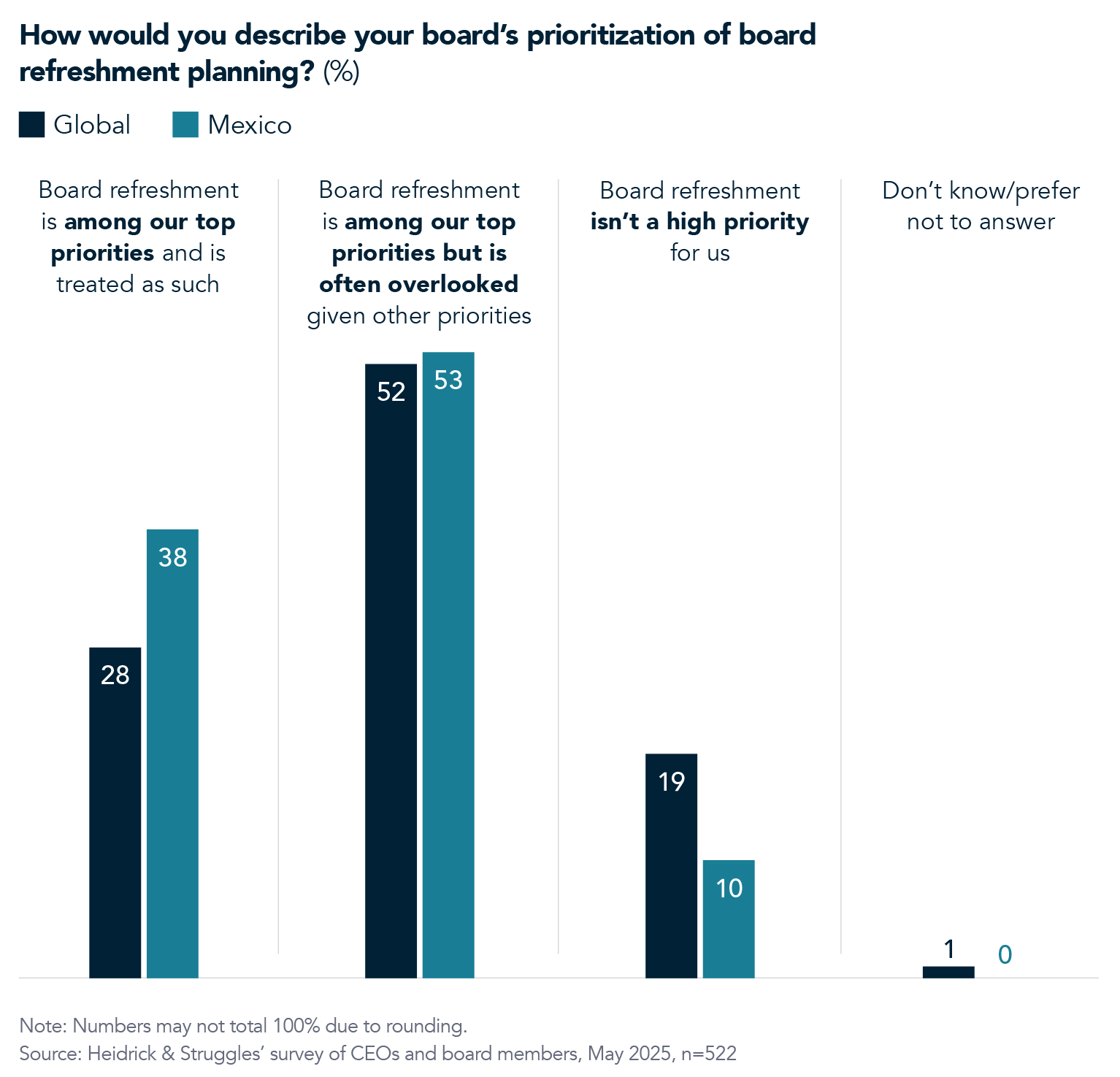

In Mexico, 38% of CEOs and board members report that they treat board refreshment as a top priority—a full 10 percentage points above the global average. This prioritization translates to confidence: 58% of Mexican CEOs and board members believe that their board’s approach to refreshment planning positions the organization well for the future, compared to 51% globally. These figures, drawn from Heidrick & Struggles’ 2025 Board Monitor survey, reflect a marked difference in governance mindset at Mexican companies and indicate that Mexican boards are at the forefront of board renewal practices internationally.

The Board Monitor survey, conducted in late spring 2025, asked CEOs and board members in markets around the world about their board refreshment strategies. The survey results delivered a clear message: boards that approach refreshment as a strategic, ongoing discipline are significantly more likely to report that they are well-positioned for the future—and that their companies are positioned to outperform peers over time. A clear pattern emerged from these leaders’ responses, enabling us to group respondents into three categories based on their approach to board refreshment:

- Strategic refreshers, who actively prioritize board renewal

- Traditional refreshers, who acknowledge the importance of board refreshment but don’t consistently act on it

- Reactive refreshers, who do not see board refreshment as a priority

What makes Mexico stand out is not only the higher share of strategic refreshers but also the substantially smaller group of reactive ones—just 10% in Mexico versus 19% globally. This suggests that board leaders in Mexico are taking a more proactive approach to board composition and oversight than their global peers.

What’s driving Mexico’s strategic focus?

Among Mexican organizations that prioritize board refreshment, CEOs and boards most often say that they do so to meet stakeholder expectations. Two-thirds of strategic refreshers say it is important that the board includes directors with a range of backgrounds that reflect the organization’s stakeholders—suggesting a strong focus on relevance and representation in board composition. Mexican organizations are following through; our analysis found that the share of women appointed to open board seats increased from 33% in 2023 to 46% in 2024. More detailed information about the demographic data of the incoming class of board members is available in this infographic.

Interestingly, Mexican strategic refreshers less often than their global counterparts point to fast-changing strategic priorities as a reason for refreshment (40% in Mexico versus 54% globally). This implies that in the Mexican context, board refreshment is more often motivated by internal alignment and long-term planning than by rapid market or industry shifts. However, regulatory pressure is more prominent: 33% of strategic refreshers in Mexico identify this as a key reason for prioritizing refreshment, compared to 21% across Latin America. These findings suggest that proximity to regulators and government, as well as compliance and evolving governance standards, are shaping board practices more directly in Mexico than in some neighboring markets.

One industry expert explained, “Boards, particularly in highly regulated industries, are increasingly prioritizing the appointment of directors who can strengthen organizational relationships with regulators and government entities. These directors provide valuable insights into regulatory agendas, enhancing the organization’s influence in policy discussions.”

The largest group of respondents in Mexico, as in markets around the world take a traditional approach to board refreshment. Yet within this group, the data suggests more movement toward strategic board refreshment than in many other markets. A far smaller share, for example, say they aren’t being more active about board refreshment because their board doesn’t have age or term limits—only 10% compared with the 23% global average. Similarly, just 19% report that their boards avoid difficult conversations about individual or full board contributions, compared to 28% of respondents globally.

All this suggests that CEOs and board members in Mexico may face fewer structural or cultural barriers to strategic board refreshment. Instead, the issue may come down to execution: the recognition of the importance of board refreshment is there, but processes or leadership attention may still be lacking. The contrast between this group and the more proactive strategic refreshers points to an opportunity: many boards appear well-positioned to move toward more deliberate and structured refreshment practices, if enabled with the right tools and support.

Considerations for next steps

CEOs’ and directors’ responses to our survey indicate that Mexico is ahead of the global curve in making board refreshment a strategic priority. Boards are more likely to act, more open to accountability, and more focused on aligning their composition with organizational needs.

Respondents indicate the challenge now is consistency. Today, they are grappling with a constant stream of high-stakes, time-sensitive issues—from global tariffs and shifting trade dynamics to the rapid evolution of AI, cybersecurity threats, and regulatory uncertainty. These priorities demand attention, but they shouldn’t displace the structural work of board refreshment.

To remain effective, boards must treat refreshment not as a reactive fix but as a continuous, forward-looking practice—one that is grounded in process, embedded in governance routines, and aligned with long-term strategy. The most resilient boards will be those that make room for both: addressing urgent risks while sustaining the board’s long-term relevance and capability.

As you consider your approach to board refreshment, we suggest starting with these questions:

- How would you characterize your organization’s approach? Strategic? Traditional? Reactive?

- How well does your approach position your organization for the future?

Then, considering these recommendations can help you make progress where you most want to:

- Treat board refreshment as an ongoing discipline, not a discrete project. Scheduled maintenance drives better outcomes and is the best defense against costly and time-consuming emergencies or attacks.

- Establish well-defined practices for removing poor-performing contributors. Regularly evaluate board member performance within and outside of election cycles and reconsider term and age limits.

- Link board refreshment (and CEO succession planning) to your strategy and risk-planning cycles. At a minimum, review the board matrix at each turn in the planning process.

- Leverage others. Strategic board refreshers engage the chief people officer and corporate secretary and get the most out of outside providers. This leverage, alongside steady maintenance, will remove distractions and keep you focused on your strategic agenda.

- Improve transparency. Adequately disclose your practices in your financial filings or on your website, in private contexts, and to your limited partners or owners. Disclosure of effective practices, done well, improves investor and owner confidence and peace of mind.

Acknowledgements

Heidrick & Struggles wishes to thank the following colleagues for their contributions to this article: Lydia Peraza and Carlos Vasquez