Deepening the CPO and board relationship

The answer to this misalignment isn’t just adding more time for CPOs to engage with board members. The question is time with whom, and on what topics? From our work and ongoing discussions with CPOs and board members, we’ve identified four key areas where greater time investment from CPOs can most effectively support the board’s agenda and enhance the relationship.

Navigating the natural path to the boardroom table

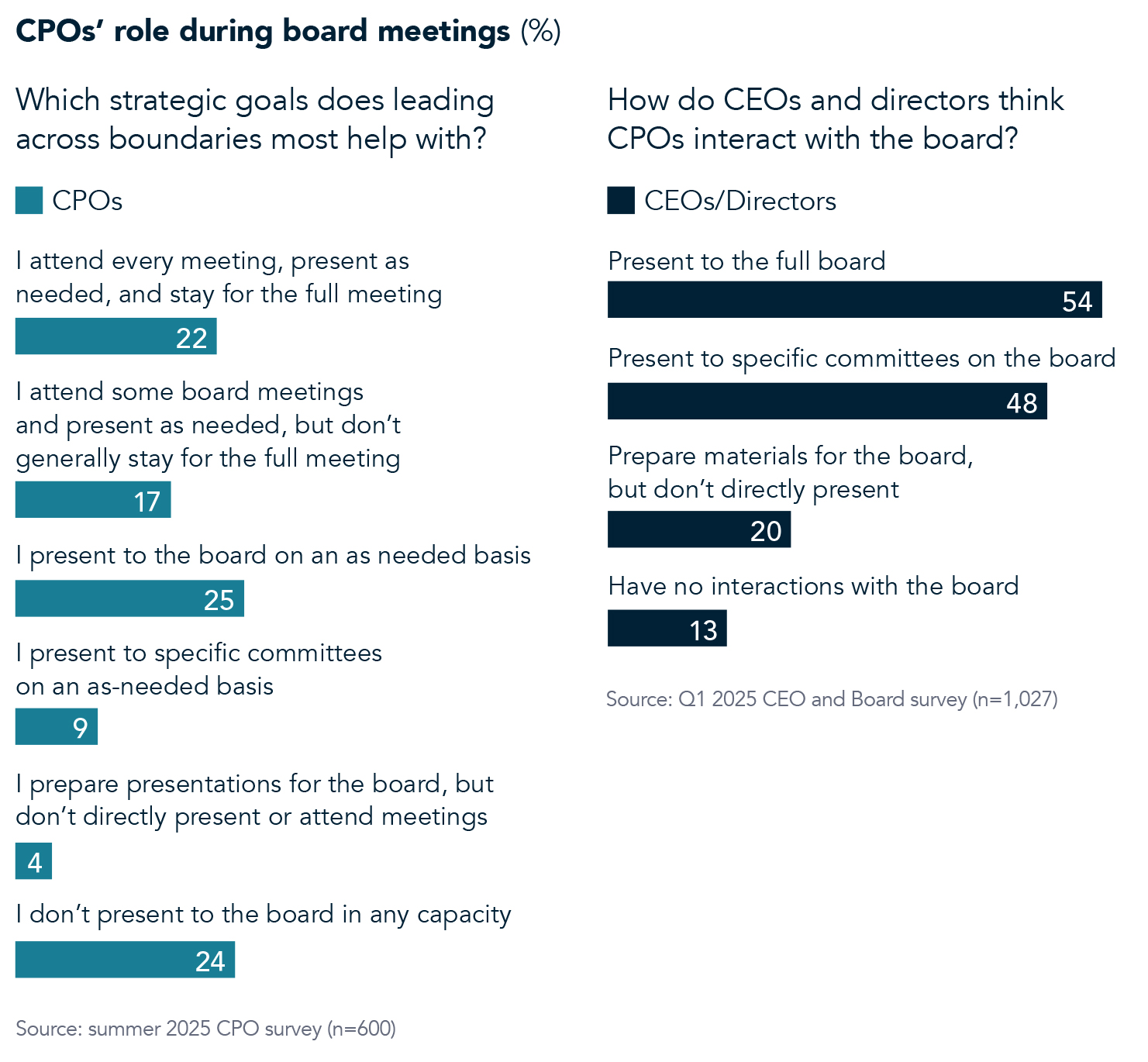

CPOs need to be confident that what they bring to the boardroom table is unique, insights that can’t be replicated or represented by other executive team members. CPOs’ top-down understanding of people and culture contributes to a holistic perspective on issues affecting the workforce at all levels that is vital to informing board decisions about talent, which is, as we have noted, a topic increasingly important to boards since they see it as increasingly important to valuation.

With that confidence, a natural path for CPOs to highlight for the board their deep understanding of the organization is through the compensation and nominating & governance committees. A key part of succession planning is the readiness of internal candidates, so CPOs can use discussions with these committees to get to know the board and their interests better. Being able to offer current information on compensation trends for existing and emerging roles is often an important way for CPOs to ensure they’re giving board members information they need. This means being able to anticipate business needs. For example, when companies rushed to hire executives with AI expertise, CPOs who understood how tech firms were compensating people in those roles early on could give their organizations an edge. Similarly, being able to offer committee members insights on leadership skills, capabilities, and availability gathered from peers in the company’s sector and outside can highlight CPOs’ broader business acumen and foresight.

CPOs note that part of navigating this path successfully is striking a balance between having a strong, aligned relationship with the CEO and being a “truth teller” to the board. This may sometimes be uncomfortable, but CPOs who identify problems that can influence strategy implementation early on—such as a faltering culture or unaddressed skills gaps—and start open, honest conversations about them can help find solutions that benefit the entire company.

Executive succession planning

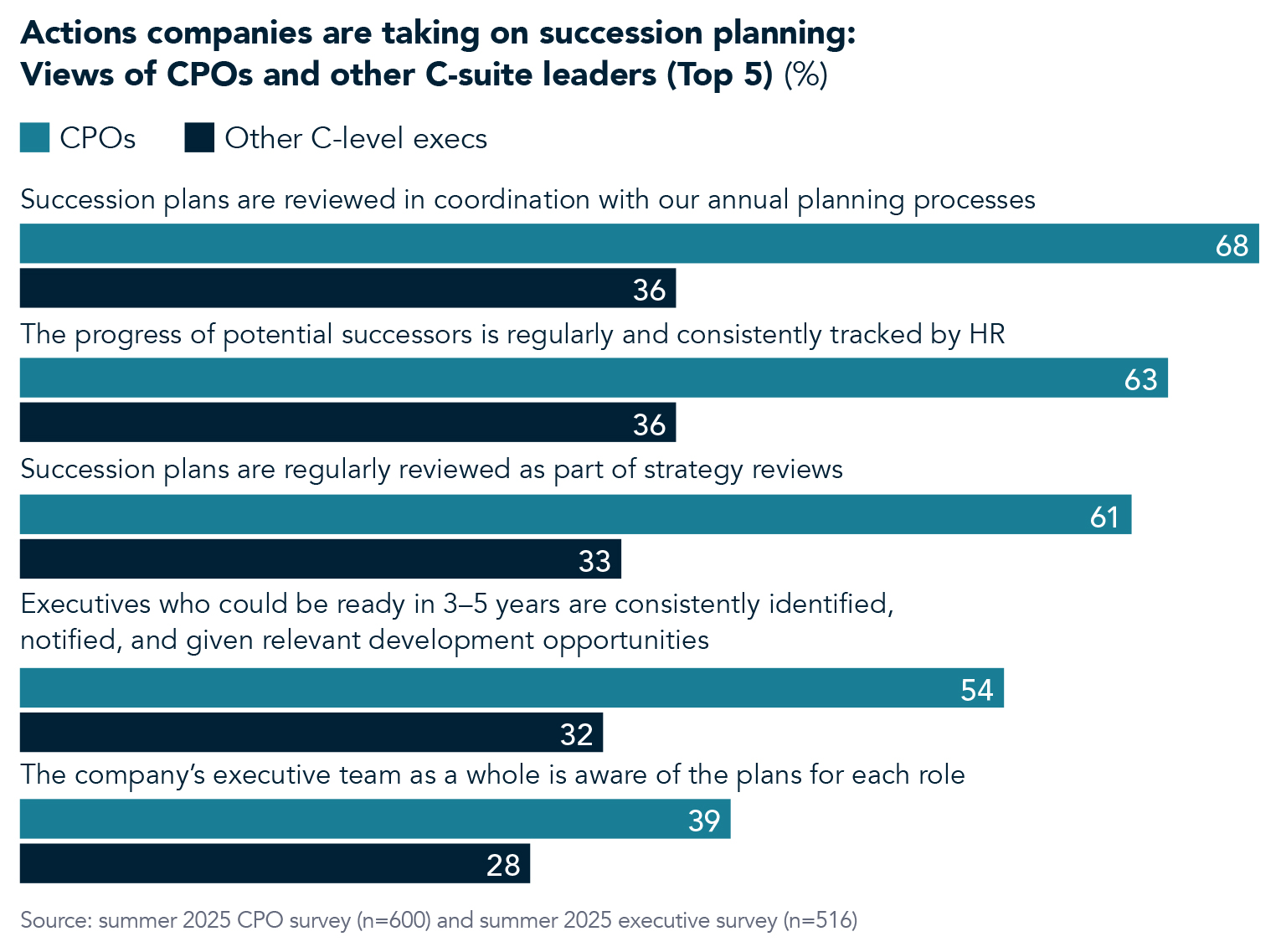

We have written extensively elsewhere about how to improve executive attraction, retention, development, and succession planning processes.4 Key tactics for improvement include greater alignment with business strategy and integrating these activities enterprise-wide rather than allowing them to remain siloed.

To get board buy-in and support for these efforts, CPOs need to start with the CEO, as we have noted. Then, CPOs can also work to find time with the board or individual board members to bring them relevant insights on human capital issues in the business and best practices beyond the kinds of immediate challenges we described above. For example, CPOs can share data to demonstrate that they’re proactive and thoughtful about succession planning in the context of specific business needs. If the CPO gets an opportunity to present to the board, this is an opportunity to talk about the executive pipeline, what they’re seeing, and what they plan to do to ensure the business will have the leaders it needs.

CEO succession planning and transition

In addition to CPOs’ significant role in CEO onboarding, they are also often more involved in CEO succession planning today than they have been traditionally. Having the skills and relationships to strategically engage with CEO succession can help CPOs strengthen their relationship with the board and may even be a factor in CPOs getting hired.

As the CEO leadership transition process accelerates, CPOs can serve as neutral moderators between the outgoing CEO and the board, helping both sides navigate the change while keeping the focus on leadership readiness. Supporting the personal and organizational aspects of transition while safeguarding governance boundaries is often complex; CPOs, with their deep knowledge of leadership and culture, provide critical guidance. When the situation is a founder transition, dual-class shareholding structures, or another particularly complicated context, CPOs’ input can be even more helpful to the board.

Strategy implementation—on the right foundation

As we have noted, CPOs also have a significant, and increasing, role to play in implementing strategy—everything from workforce planning, such as location and talent liquidity, to AI implementation to fostering resilience and agility. But to have a productive influence in these areas, CPOs first need to get the basics right, executing well on their core responsibilities and ensuring the organization is running smoothly. If they can show the board that they’re effective leaders in these areas, it can open the door to engaging more strategically—and, CPOs stress, if they falter in the traditional HR responsibilities, the board won’t take them seriously on other topics. More broadly, given that they have a pulse on the leadership team, they can help both other executives and the board think about the implications of change. In the case of acquisitions, CPOs can play a vocal role in setting the strategy and integrating new team members, as well as tying the effort back to commercial indices.