Chief Executive Officer

Route to the Top 2025: The ascent redefined—detailed survey insights

Twenty-nine percent of CEOs and board members are very confident that their organization’s CEO succession strategy is positioning their organization well for the future, but only 11% are entirely confident in their overall executive attraction, development, and retention strategy.1 Yet 63% of CEOs are promoted from within the organization,2 so improving confidence in both processes is crucial—and companies vary widely in their attitudes related to preparing for leadership transitions. Our 2025 Route to the Top survey finds that companies overall take one of three approaches to CEO succession planning: continuous succession strategists, who see CEO succession planning as a top priority and act accordingly; as-needed succession traditionalists, who recognize its importance but allow other priorities to overshadow it; and reactive succession thinkers, who simply do not prioritize CEO succession.3 These differing mindsets have meaningful implications for organizational readiness, leadership confidence, and even financial performance. The article below offers detailed breakdowns by company size, ownership type, market, and sector, complementing our global report.

How CEO succession planning differs by market, ownership, and size

There are distinct differences in CEO succession planning by market and region. APAC markets, for example, contain the highest percentages of continuous succession strategists. Conversely, Latin American markets other than Brazil have the lowest percentage of continuous succession strategists, at 6%. The vast majority (88%) of respondents in Latin American markets identify as as-needed succession traditionalists. Across markets, the cultural influences and corporate governance norms indicate clear patterns that drive these succession planning approaches.

Company ownership and size also affect CEO succession planning strategies. As public companies increase in size, for example, the proportion of executives who strive to maintain a continuous strategy of succession also increases, from 26% at small public companies to 46% at medium public companies and 60% at large public companies. This last group is the largest group of continuous succession strategists for any particular cohort by a wide margin, with more than double the global percentage. This is likely due to the scrutiny and visibility that public companies face, as well as the resources they are able to utilize as they grow.

On the other hand, PE- and VC-backed companies have the lowest shares of continuous succession strategists (15% and 6%, respectively) and the most reactive succession thinkers (24% and 23%, respectively) proportionally. (Interestingly, this is the opposite of what we see in board refreshment approaches, where PE-backed companies tend to be more forward-thinking than public companies of any size, although larger public companies are more likely than smaller public companies to be strategic board refreshers. See our report on the 2025 Board Monitor survey for more information.)

A common thread in CEO succession planning

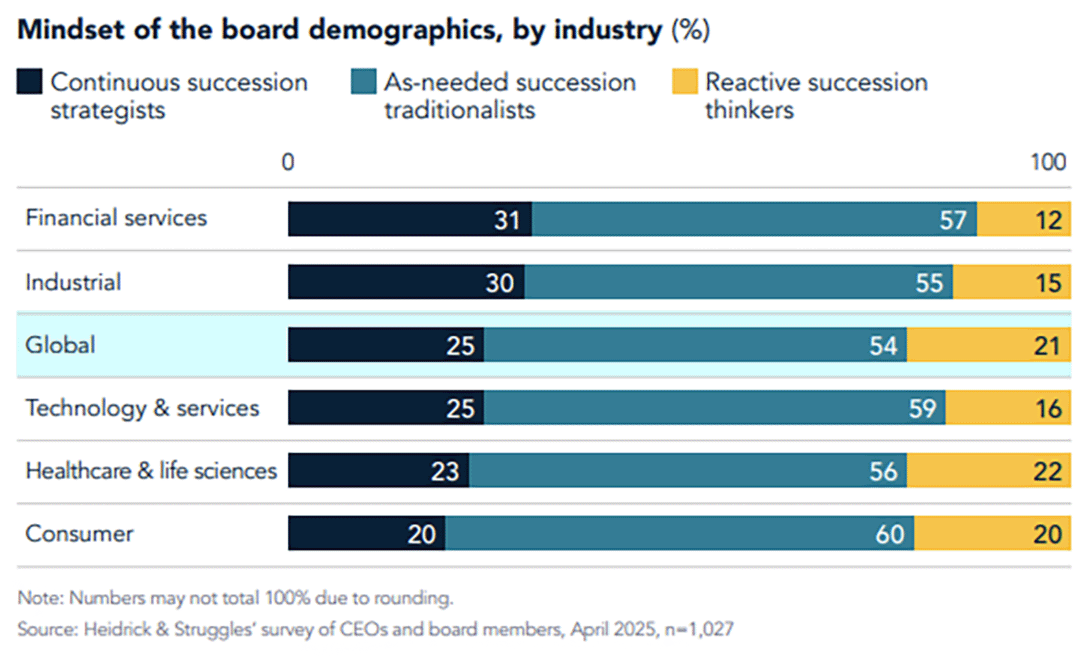

Despite the differences by region, company ownership, and size, there are some similarities in major companies across sectors: the distribution of succession planning strategies for each industry remains close to the global distribution, indicating that a company’s line of work does not have a large impact on CEO succession planning strategies.

How rigorously boards assess leadership pipelines

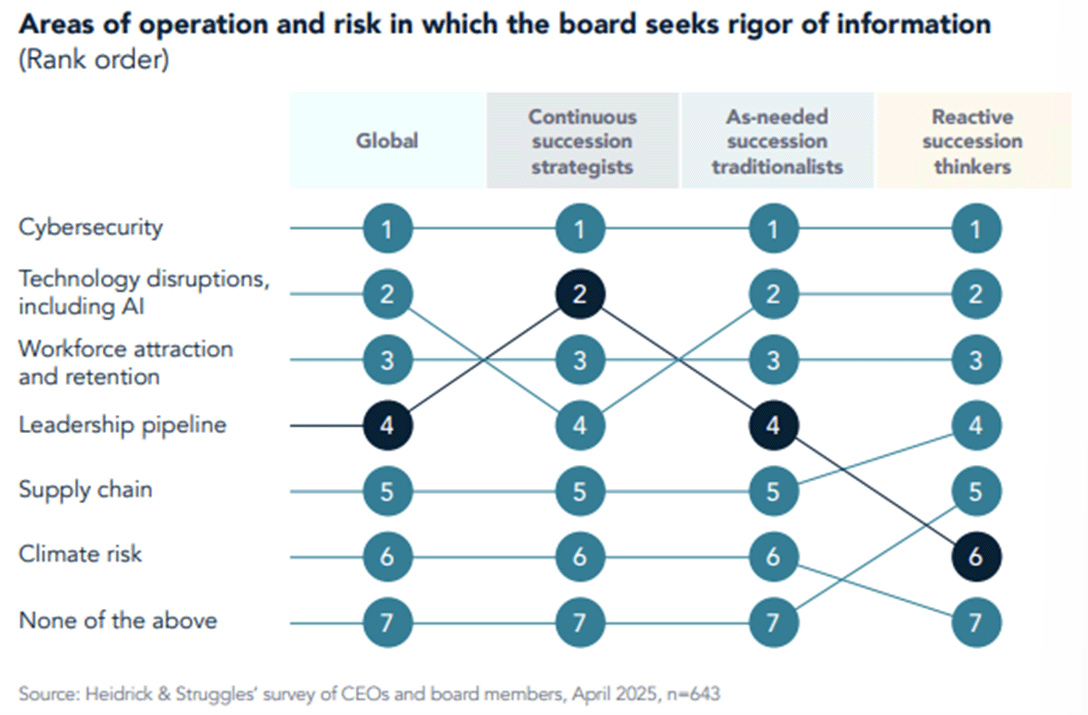

Survey respondents largely agree on the key operational and risk areas where boards seek rigorous information—except when it comes to leadership pipelines. As expected, the priority boards put on this area closely aligns with their approach to CEO succession planning. Continuous succession strategists rank leadership pipeline information as the second-most important area, just behind cybersecurity. As-needed succession traditionalists place it fourth, while reactive succession thinkers rank it even lower, at sixth.

Why it matters

This prioritization has real effects on the success of the company, respondents indicate: 90% of continuous succession strategists feel that their board’s approach to succession planning positions the organization well for the future, compared to 35% of reactive succession thinkers who feel the same. More concretely, 63% of continuous succession strategists feel very or entirely confident that their organization’s executive attraction, development, and retention strategy positions the organization well for the future, compared to 20% of reactive succession thinkers who feel the same.

That confidence translates to confidence in financial performance: 76% of respondents who are confident in both their organization’s CEO succession planning and executive pipeline planning report better financial performance than their peers. Put simply, organizations that proactively plan for future leadership succession perform better financially than those that make rushed, reactive decisions.

In summary, CEO succession planning is a critical indicator of organizational foresight and resilience. While approaches vary significantly by market, ownership structure, and company size, the data consistently shows that organizations with a continuous succession strategy are more confident in their leadership pipelines and more likely to report stronger financial performance. As boards and executives navigate increasing complexity and change, prioritizing proactive succession planning may be one of the most effective steps they can take to ensure long-term stability and success.

For more information about trends in CEO succession planning and how boards can improve their effectiveness, see the Heidrick & Struggles report on the Route to the Top 2025 survey.

References

1 “CEO and board confidence monitor 2025: Persistent concerns, pockets of increased confidence,” Heidrick & Struggles, February 5, 2025, heidrick.com.

2 “Route to the Top 2025: Explore global CEO backgrounds and trends,” Heidrick & Struggles, April 23, 2025, heidrick.com.

3 Route to the Top 2025: The Ascent Redefined: Charting More Effective Routes to the Summit, Heidrick & Struggles, July 23, 2025, heidrick.com.