Private Equity

2022 North American Private Equity Operating Professional Compensation Survey

Welcome to our 2022 North American Private Equity Operating Professional Compensation Survey. Together with our survey of private equity investment professionals, this report provides a comprehensive picture of the compensation that North American private equity (PE) executives are currently receiving.

Deal activity is at record levels. With firms paying full price for their investments, the pressure is on operating professionals to ensure deals reach their full potential. We see in this report that in order to attract the right people, firms are raising compensation, providing increased job flexibility, and casting a wide net in their search for candidates.

We hope you enjoy reading the survey, which remains the only one of its kind. As always, suggestions are welcome.

Executive summary

This year’s survey includes a review of 2021 activity in North American private equity, our thoughts on the major hiring trends for operating professionals, and a deep dive into current compensation packages for operating professionals.

While this data is from 2021, we have observed a more dramatic increase in compensation than we have seen, even beyond these numbers. This trend is being reflected across all private equity positions.

Private equity: The big picture

- Private equity had a banner year in 2021. GPs closed 8,624 deals for a combined $1.2 trillion, over 50% above the previous annual record for deal value.1 The $1.2 trillion in deal value is 64% higher than the previous record from 2019.

- US PE exit activity shattered the previous annual records for both number of exits closed and their total value. In 2021, PE firms exited 1,731 US companies with an aggregate enterprise value of $854.3 billion.2

- Fundraising continues to be robust and bigger funds are leading to bigger deals—yet dry powder levels are substantial as well. 2021 was perhaps the best year yet to raise a fund, and 2022 may be even better. LPs continue to lift their private market allocations, a shift reinforced by the expectation of lower public equity returns beginning in 2022.

(See page 7 of the full report for the full breakdown.)

Operating professionals: Hiring trends

- Twenty-one percent of executives considered themselves to be industry generalists; the most common specialist categories were life sciences (17%) and industry (16%).

- Generalists also dominated the breakdown of functional expertise, at 22%, followed by focus areas in sales (17%) and marketing (15%).

- Twenty-eight percent had been management consultants in their immediate prior role, and 26% had been a CEO. Only 7% had been a PE operating executive, and only 27% had been previously employed by a portfolio company of their current GP or investment advisor.

(See page 8 of the full report for the full breakdown.)

Operating professionals: Cash compensation trends

- Cash compensation held steady at firms with $10.1 billion and more in firm AUM.

- By firm AUM, compensation was also strong in the mid-range of $3.1 billion to $10 billion.

- Looked at by fund AUM, cash compensation was slightly higher at those with $5.1 billion to $10 billion than those with more than $10 billion.

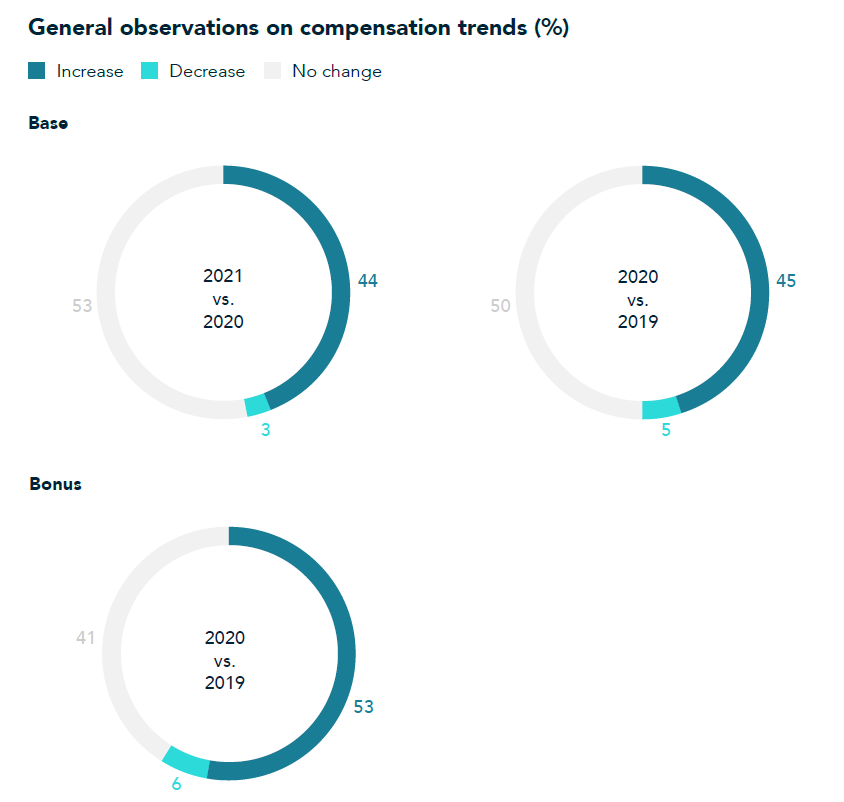

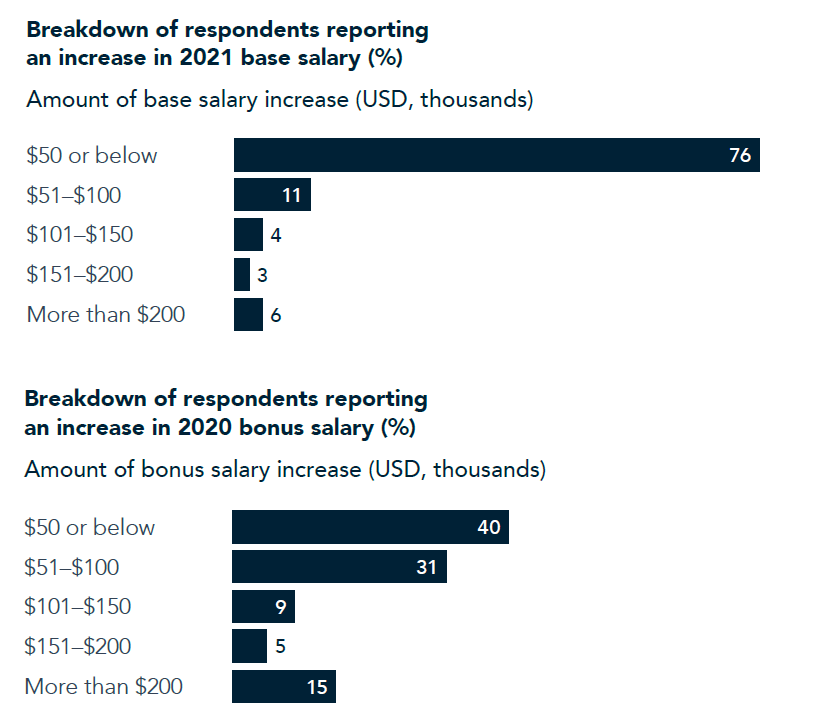

- Base salaries continued to increase, but the amount of increases reported was smaller in 2021 than in 2020.

(See page 12 of the full report for the full breakdown.)

Non-cash compensation

- The vast majority of respondents eligible for carried interest see it vest on a straight-line schedule.

- Most respondents are not eligible to receive warrants or options. However, 60% of senior or executive advisors and 35% of operating partners (those one step below general partnership) are eligible. Average warrant participation for these two groups is $3.9 million and $8.7 million, respectively.

- As with warrants or options, most respondents report not being eligible for direct equity participation. Among those who do, average cumulative direct equity participation is highest at the firm leader level ($28 million), far outpacing every other category.

- Solid majorities of respondents at almost all professional levels told us that they have co-investment rights. Whether co-investment rights are based on the performance of funds or individual deals varies by seniority, with the highest fund-based participation reported by firm leaders (73%) and those one step below general partnership level (69%). Most vice presidents, associates, and senior or executive advisors can co-invest based on individual deals.

(See page 12 of the full report for the full breakdown.)

In a fast-growing industry, firms are seeking—and paying for—a wider range of operating executives

PitchBook's 2021 report found In 2021, GPs closed 8,624 deals for a combined $1.2 trillion, over 50% above the previous annual record, set in 2019, for deal value.3 Markets are awash in liquidity and the possibility for a capital gains tax increase has been adding to the momentum to sell. In 2021, PE firms exited 1,731 US companies with an aggregate enterprise value of $854.3 billion.4 A majority of these exits are large, driven by the public–private multiple spread. To capitalize on the interest of corporates flush with balance sheet cash and higher valuations, general partners are stepping up their exit timetables. They have also turned to partial sales and recapitalizations, and have put high-quality assets into so-called continuation funds, as GP-led secondaries are now known.

Fundraising was robust in 2021—389 funds closed, for a combined $301.3 billion.5 GPs have been able to quickly put their capital to work and go back for more. Bigger funds and record levels of dry powder have led to bigger deals.

Given the state of the industry, demand for operating executives in North America continues to be very strong. Firms continue to recruit heavily for heads of talent, chief financial officers (CFO), and head of portfolio operations roles, and we are seeing substantial interest in bringing on operating executives with digital expertise. In terms of role structure, PE firms are making the operating executive role more integral than ever before; they are becoming more involved in investment decision making, developing deal themes and theses, and sourcing deals. Some clients even expect the number of operating professionals to match investment professionals over time.

As integral as the operating executive role is, private equity firms are offering more geographic flexibility. More firms that once wanted their operating partners located in the same office are now saying operating partners do not have to relocate as long as they're willing to travel.

In the past year, we have seen a slight shift in openness among our clients to C-level talent with P&L experience, even if they do not have prior PE exposure. Rather than solely considering professionals with previous operating executive experience, firms are now giving consideration to people who come out of industry and have simply had some exposure to private equity, even at the CEO level. It is, however, too early to tell if this is a lasting shift or driven by considerations specific to 2021’s conditions.

How best to compensate these executives remains a question firms wrestle with. LP–GP agreements are very strict about how firms can spend money or charge for expenses, and it can be hard to fit operating partners into that construct. Some firms run these expenses through their portfolio companies to pay operating executives, but that, too, can be difficult because it needs to be permitted through shareholder agreements or special permission. Even so, compensation for operating executives remains so strong that we are now seeing carry being awarded even to junior operating executives, which has traditionally been rare.

We are also seeing executives new to an operating executive role being compensated on par with those who have previous experience in this role. In addition to the need to pay competitively, this is also driven by the fact that executives new to the industry often leave behind equity compensation when they take new roles.

Looking ahead, since this survey was collected, we have observed an increase in compensation even beyond these numbers, which is being reflected across all PE positions. The role of the operating executive will be increasingly important as the strong competition for transactions compels private equity firms to pay higher multiples for their investments.

In addition, in our experience, private equity firms remain very interested in attracting diverse operating executives. The pool is larger than that of diverse candidates for investment professional positions because of the wider range of backgrounds operating executives come from. We hope to be able to report in more detail on diversity in this role in future reports.

About the authors

Jonathan Goldstein (jgoldstein@heidrick.com) is a partner in Heidrick & Struggles’ New York office and the regional leader of the Private Equity Practice for the Americas.

John Rubinetti (jrubinetti@heidrick.com) is a partner in the New York office and a member of the Private Equity Practice.

Acknowledgments

The authors wish to thank Mohd Arsalan and Akshat Singhal for their contributions to this report.

References

1 PitchBook, 2021 Annual US PE Breakdown, January 2022.

2 PitchBook, 2021 Annual US PE Breakdown, January 2022.

3 PitchBook, 2021 Annual US PE Breakdown, January 2022.

4 PitchBook, 2021 Annual US PE Breakdown, January 2022.

5 PitchBook, 2021 Annual US PE Breakdown, January 2022.