Boards & Governance

Board Monitor South Africa 2022

Over the past few years, the world has experienced an unprecedented series of events, from the COVID-19 pandemic to racial and social justice movements, increased polarization, the sharpened focus on climate change, and geopolitical events such as the war in Ukraine, that have fundamentally changed both our communities and our organizations. One outcome of these experiences has been a greater focus on purpose, both individual and organizational. It is undeniable that all these events, taken together, have changed the very nature of a company’s license to operate—that is, the fundamental contract between organizations and the communities within which they do business. This sits at the center of the King IV Report on Corporate Governance for South Africa, consisting of a set of voluntary principles and leading practices with an “apply and explain” disclosure regime, which requires boards to set the tone by leading by example and behaving in an ethical and effective manner. The report further tasks boards with overseeing the implementation of ethical standards and disclosure processes in a bid to increase corporate transparency and build trust with their communities.

So, have boards moved the dial when it comes to changing their composition in order to tackle these new expectations and mitigate the risk of losing their license to operate?

Key findings

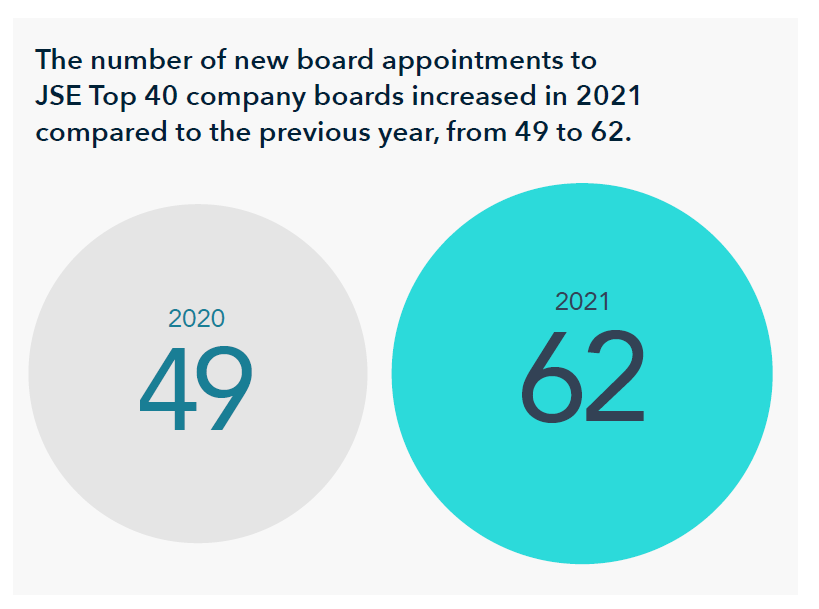

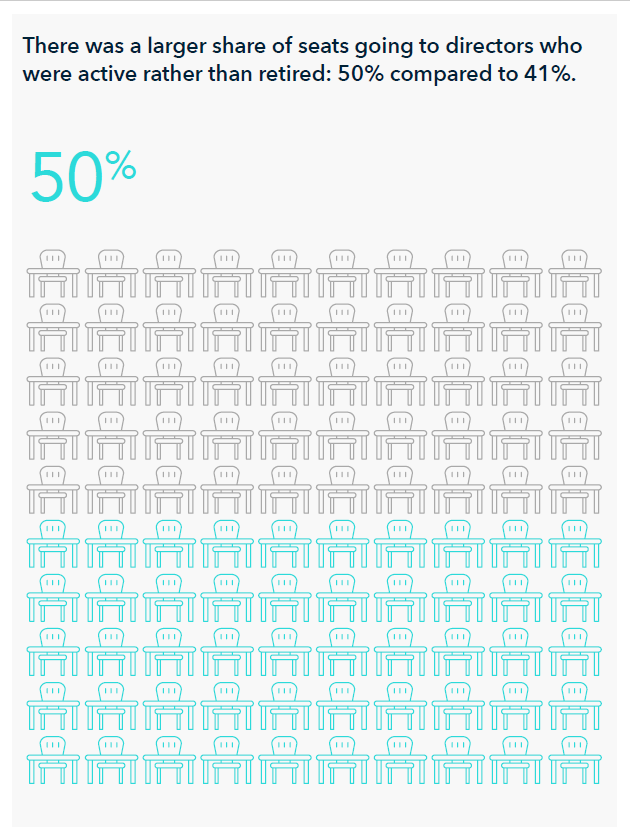

Indeed, there has been progress on broadening the spectrum of experience around boardroom tables in JSE Top 40 companies. That said, each company needs to make sure it is not only prepared for today’s challenges but is anticipating what type of directors it needs to appoint to future-proof its organization.

Acknowledgment

Thanks to Veronique Parkin for her contributions to this report.