Insurance

How US insurers can improve board effectiveness

For several years, mutual insurers and other traditional insurance firms in the United States have lagged other industries in building best-in-class boards of directors. Much of the reason for this stems from a prevailing culture that cleaves to the status quo, thereby preventing many insurers from revamping their boards to keep pace with change in the industry.

Now, in the context of a wide range of industry, technological, social, and regulatory disruptors, many insurance boards and CEOs are taking a fresh look at who is on their boards and how those boards operate. By focusing on the board refreshment process, composition and culture, and overall approach to assessing board effectiveness, insurers can work to ensure their boards effectively fulfill their obligations, meet their purpose, and provide the guidance their companies need to compete, grow, and thrive.

A growing disconnection

The insurance industry is currently confronting a range of changes that have arrived in quick succession. For one, M&A activity, with technology acquisition as a key driver of deals, is accelerating. According to one recent report, for example, M&A deal value in the first quarter of 2021 totaled nearly $21.2 billion for companies based in the United States or Bermuda; such deals added up to $19.4 billion for all of 2020, according to another report, and deals are continuing.1 At the same time, an evolving global and US insurance regulatory environment is allowing more room for change.

Meanwhile, fintech, insurtech, and other tech-driven and less regulated companies are entering the insurance market with competing offerings that often are faster, sleeker, and more convenient than traditional insurance products and services. And, catalyzed by the COVID-19 pandemic, digital insurance transactions are exploding—a change that likely is permanent and that will affect everything from the way in which customers are acquired to the way policies are underwritten to the way claims are processed.

Finally, a new generation of customers has new expectations about diversity, and the insurance industry, like many industries, has lagged at both the executive and board levels. For mutual insurers, that pressure is exacerbated by a strong culture of servant leadership, which has tended to mean that the board sees itself as reflective of the community of policy holders—but most insurance boards are now less reflective of that community than ever before.

Instead, boards at mutual insurers and other traditional insurance firms have remained largely traditional, focusing primarily on CEO succession, executive compensation, strategy oversight, compliance, and general risk. The CEO generally acts as the board chair. Board members are highly committed to the strong purpose of insurers in protecting people and communities, and they typically develop collegial cultures. That, however, means that honest feedback can be difficult to deliver, resulting at times in a lack of transparency and accountability. Furthermore, most of these boards have had low turnover due to an absence of term or age limits. And when board seats do open up, chairs significantly rely on their existing networks to fill them.

In short, the board management practices that had long served insurers well will not take them forward. The industry is changing, but boards have not kept pace. This dynamic has resulted in a disconnect between boards’ goals and what they are currently capable of providing. Most need to act more like public company boards with their term limits, clear definitions of the board’s role and competencies needed to meet it, and robust recruitment networks. Some boards are showing the way in updating their practices without losing sight of their core social purpose: protecting the community.

High-functioning boards can help companies improve foresight and agility to better anticipate and address opportunities and risks in a fast-changing environment, providing companies with a competitive edge that will be crucial to ongoing survival and growth. By taking a three-step approach to those goals, mutual insurer CEOs and boards can identify areas of improvement.

Three steps toward more effective boards

Step 1: Continuously update board composition and governance

There are a few basic steps insurers can take to upgrade their board refreshment process. First, they should assess the board’s role in the context of current and future strategic needs such as building digital dexterity, reaching new markets, or addressing industry consolidation. Next, they should determine the collective mix of capabilities and expertise the board will need to effectively oversee and support the company. For most boards, this will mean adding directors with more digital expertise, more expertise in public-company governance norms, and with greater gender and racial and ethnic diversity to ensure they are asking the right questions and offering the most constructive input. Boards will likely need to build new networks to find candidates who meet these criteria. This will require a significant shift in behavior for many chairs of these companies, who have tended to find new directors in their personal networks. Generally, chairs and nominating committees who look deeper into executive ranks (beyond traditional roles such as CEO and CFO) often build more knowledgeable boards faster.2 In another break with tradition, boards can also benefit from looking outside the insurance sector for new members who have the skills they are looking for without specific industry experience. Third, insurers should determine whether the size of the board is sufficient to provide the needed expertise. And finally, they should create a concrete plan for refreshing the board, starting with the ideal board and working out how to get there from the current state. Such a plan may include asking some directors to retire earlier than expected or creating temporary advisory committees in areas of immediate need. (For more on how boards can rethink their refreshment processes, see “Building the foundation for better board refreshment.”)

For example, one insurer we worked with recently hired its first non-family member as CEO. This new leader was just as committed as the other board members to preserving the organization’s purpose of protecting people. But he also provided a valuable outsider’s perspective that gave him a fresh view of the organization’s strengths and challenges with respect to its culture, strategy, and operations, which enabled him to see more clearly the new capabilities required at the company and on the board.

With the full support of the board, which had underscored its commitment to change by hiring the new CEO, he examined the industry dynamics, identified the strategic changes for digital transformation that needed to take place, and worked with the chair and nominating committee to assess the capabilities of the current board as a whole against what the company needed going forward.

Step 2: Assess board effectiveness

In addition to assessing their composition and governance, boards will benefit from considering what they, uniquely, can do to support the organization in fulfilling its purpose, and how they may alter their dynamics to become more effective.

- Purpose. Even in a time of significant change in the sector, the long-standing mission of protecting people and communities remains unchanged for most insurers. Likewise, the core mission of boards continues to be overseeing strategy and governance to ensure the organization continues to thrive. As the industry evolves, however, some boards are reassessing exactly what this mission means and how to best balance interests between policy holders and other stakeholders such as employees, vendors, and their communities.

- Dynamics. Boards can turn their culture of servant leadership to their advantage. Whereas boards in other industries sometimes find it difficult to encourage directors to retire earlier than planned in order to make room for new directors with fresh expertise, directors at insurers are more apt to acknowledge that change is needed and step aside as they see the member base and expectations changing. The shared purpose of most insurers’ boards is also conducive to onboarding new members, especially those coming in from outside the industry. These advantages are more important than ever now, as many boards are changing composition much more quickly and thoroughly than they were even five years ago. Boards can also benefit from separating the roles of CEO and chair to distribute power more evenly. Finally, boards will want to assess their traditional agendas and update them to ensure they are addressing the right topics at the right level for the current strategy. As the board composition and purpose shift, most boards will also want to assess the dynamics of the relationship between the board and the executive team in order to ensure roles and responsibilities are clear.

Step 3: Routinely monitor board effectiveness

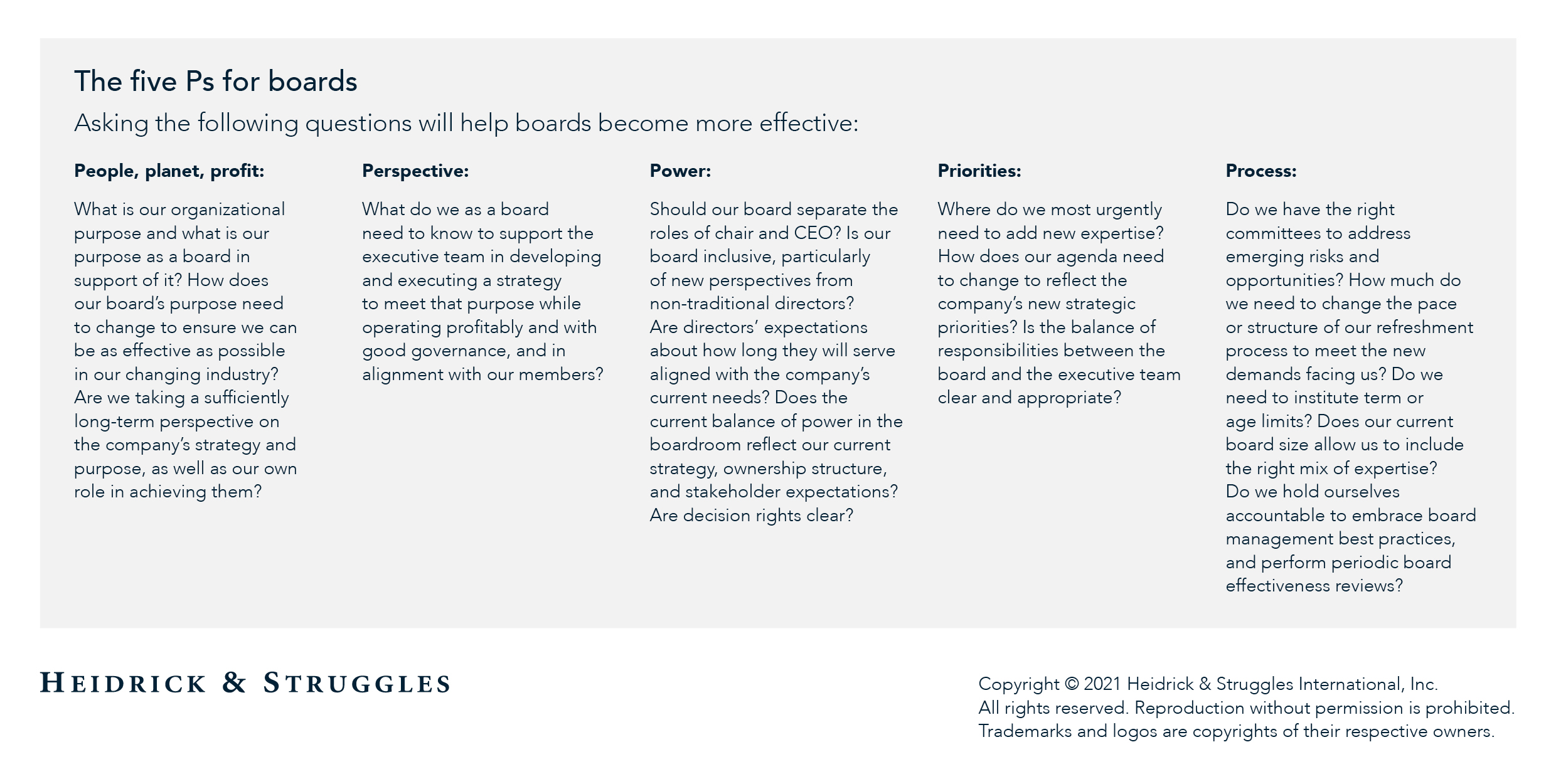

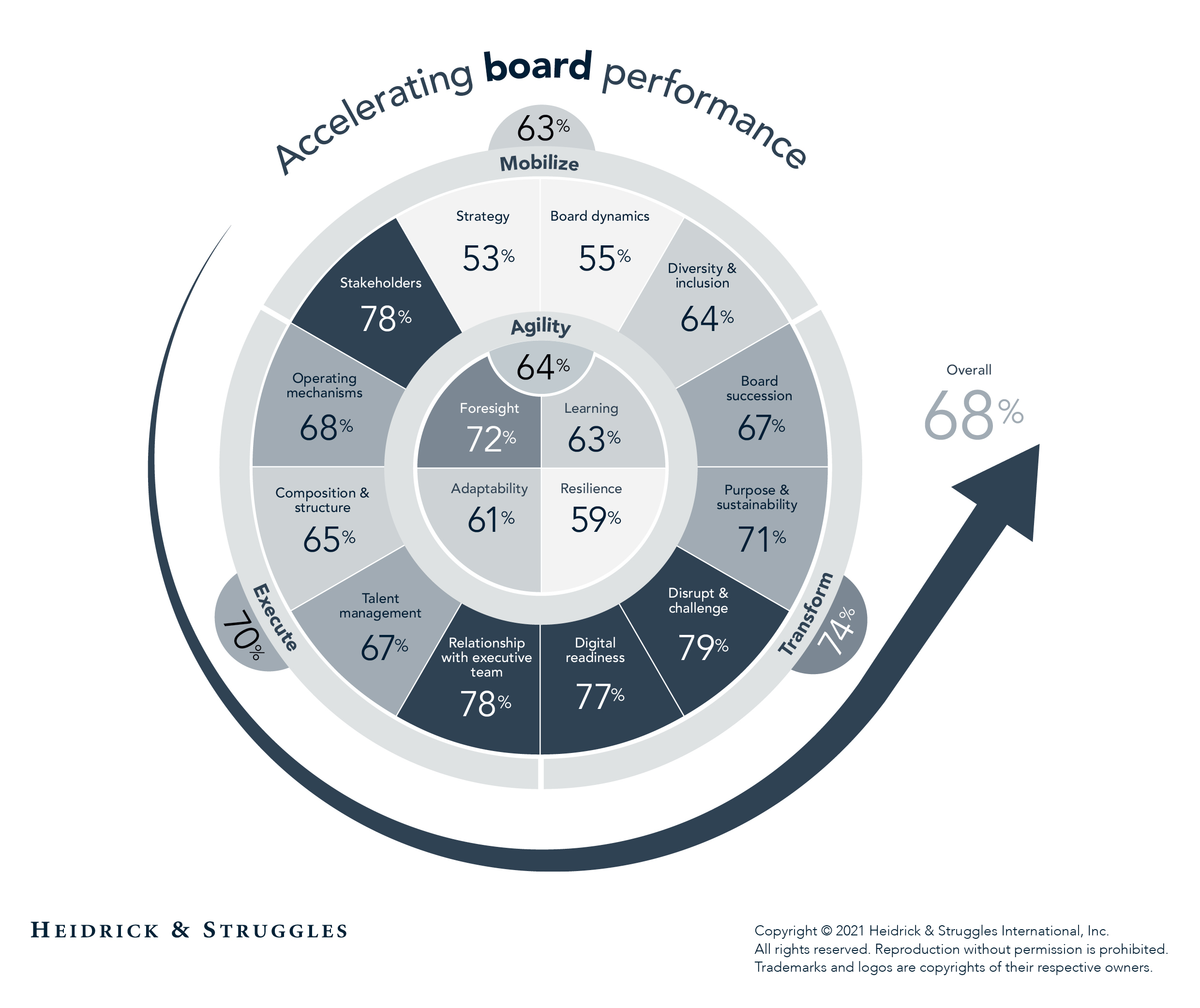

Boards that regularly assess the performance of the full board and individual directors can ensure ongoing effectiveness. For many boards in the sector, this will be a new exercise. We recommend boards assess themselves—typically with a board survey or series of interviews—against their ability to mobilize, execute, and transform with agility to lead most effectively. An example of what such assessment can look like is provided below. Though all areas matter, most insurers today are particularly focused on, and most challenged by, transforming with agility. (For more detail on board reviews and why these areas matter most, see “A board review that accelerates competitiveness.”)

Boards can then use a matrix (for an example of a matrix, see page 5 of the full article) that includes their predefined categories for capabilities, skills, and diversity mapped by members to provide an aggregate view of board composition and identify gaps that need to be filled. Assessments allow boards to prioritize where to address expertise in their refreshment strategies. Many boards are finding gaps in digital skills, cybersecurity, customer experience expertise, and deep insurance industry risk management expertise.

It is crucial that any board review produces concrete, actionable insights that the chair and board together address with respect and inclusivity. Many insurers could benefit from putting in place specific guidelines and requirements for annual reviews such as making a point to clearly explain to the board how the board’s level of effectiveness benefits the company; ensuring the balance of responsibilities between the executive team and the board are clear and remain appropriate; and ensuring board members rotate through committees to build their knowledge of the company’s full range of concerns.

About the authors

Alice Breeden (abreeden@heidrick.com) is the leader of CEO & Board and Team Acceleration for Heidrick Consulting; she is based in Heidrick & Struggles' London office.

Francois Kouroriez (fkouroriez@heidrick.com) is a partner in Heidrick & Struggles’ Boston office and is the global leader of the Insurance sector within the Financial Services Practice.

Tom Moran (tmoran@heidrick.com) is a partner in the Chicago office and a member of the Financial Services Practice.

Acknowledgments

The authors wish to thank Laura McCane for her contributions to this article.

References

1 “First Quarter Activity Signals Record Insurance Carrier M&A Deals Ahead in 2021: S&P,” Insurance Journal, April 6, 2021.

2 Other industries are similarly broadening their criteria: Heidrick & Struggles’ Board Monitor US 2021 report shows that Fortune 500 companies filled seats with the lowest share of people with CEO or CFO experience in the 12 years of the study, at just 51%.